- XRP trading volume has fallen by 53%, but the market remains indecisive.

- XRP’s continued stability leaves analysts optimistic that it can rise to $20.

With Bitcoin [BTC] Altcoins have fallen by 5.4% to trade at $61,881 in the past seven days, with altcoins being the hardest hit. In fact, this period has seen high volatility in the cryptocurrency markets.

However, XRP has seen a sustained consolidation phase without significant gains or losses. However, the altcoin has not escaped the market’s decline, with trading volume down 53% in the past 24 hours.

Despite the low trading volume, analysts are expecting further gains and upward movement. For example, Perform encryption Expect a rise to $20. In a post shared on X (formerly Twitter), he stated,

“Next target: Fibonacci 0.5! Flip the price with confidence, then we fly to Fibonacci 1.618 ($6.4).”

he added,

“First target is $6.4, next target is $20?”

Market sentiment

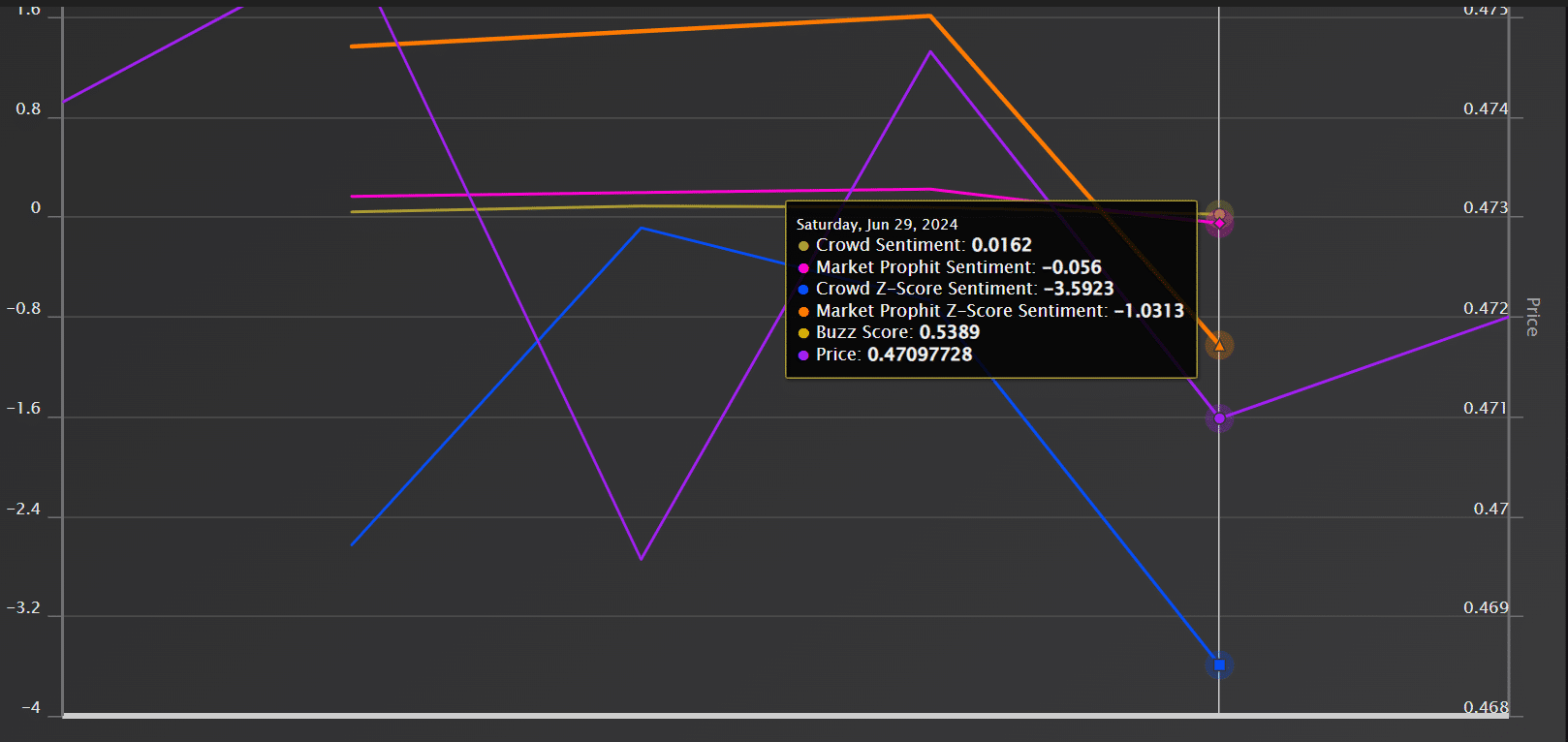

Source: Market Prophit

AMBCrypto analysis showed that XRP has been consolidating over the past seven days. The trends indicated equal strength between buying and selling pressure, with no certainty of direction.

Our analysis showed mixed market sentiment at press time. Fan sentiment was slightly positive, while market expectations were slightly negative, with both reporting a negative Z-score.

What the price charts indicate

At press time, the Money Flow Index (MFI), an index that measures the strength of money flows, was at 45.

This MFI showed a balanced market; relatively stable between buying and selling pressures without either side dominating, which indicates a consolidation phase.

Source: TradingView

The simple moving average (SMA) also touched the price, which showed the market was balanced. Based on the Simple Moving Average (SMA), there has been stability in the market with a narrow price range.

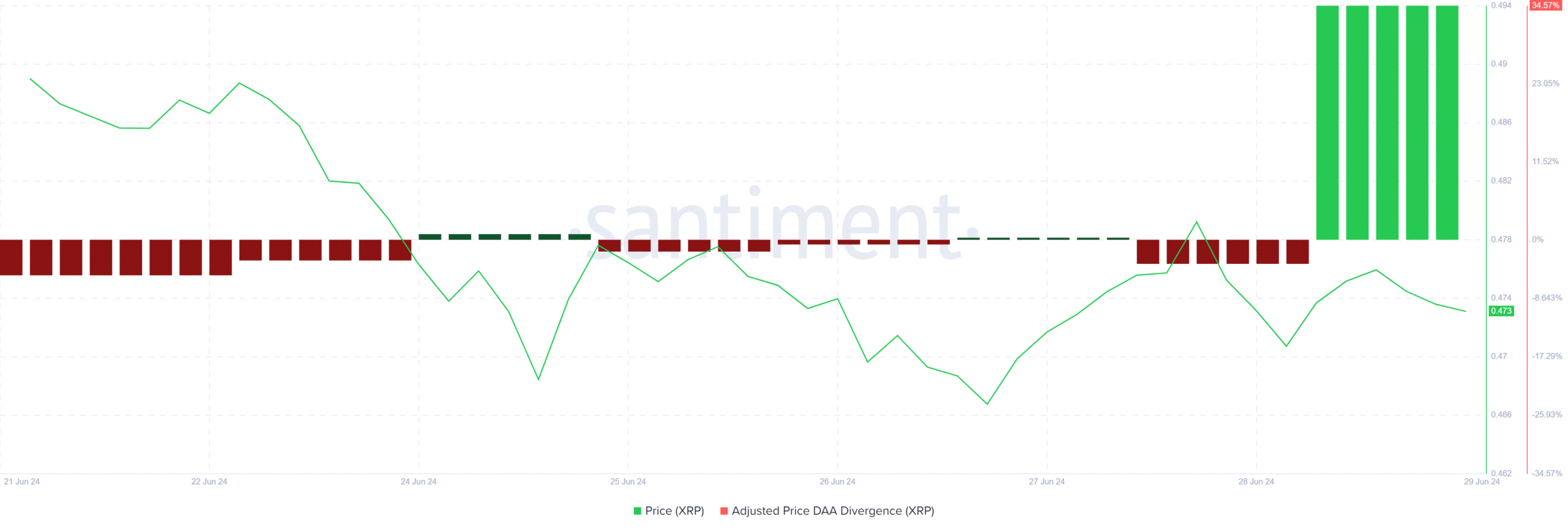

Source: Santiment

Additionally, the adjusted price divergence of XRP on DAA is 34.57%. This indicates a moderate gap between the price rise and the daily active address.

Higher DAA divergence indicates that prices were rising due to speculative buying. Therefore, moderate DAA divergence showed little difference between daily activity and price increases.

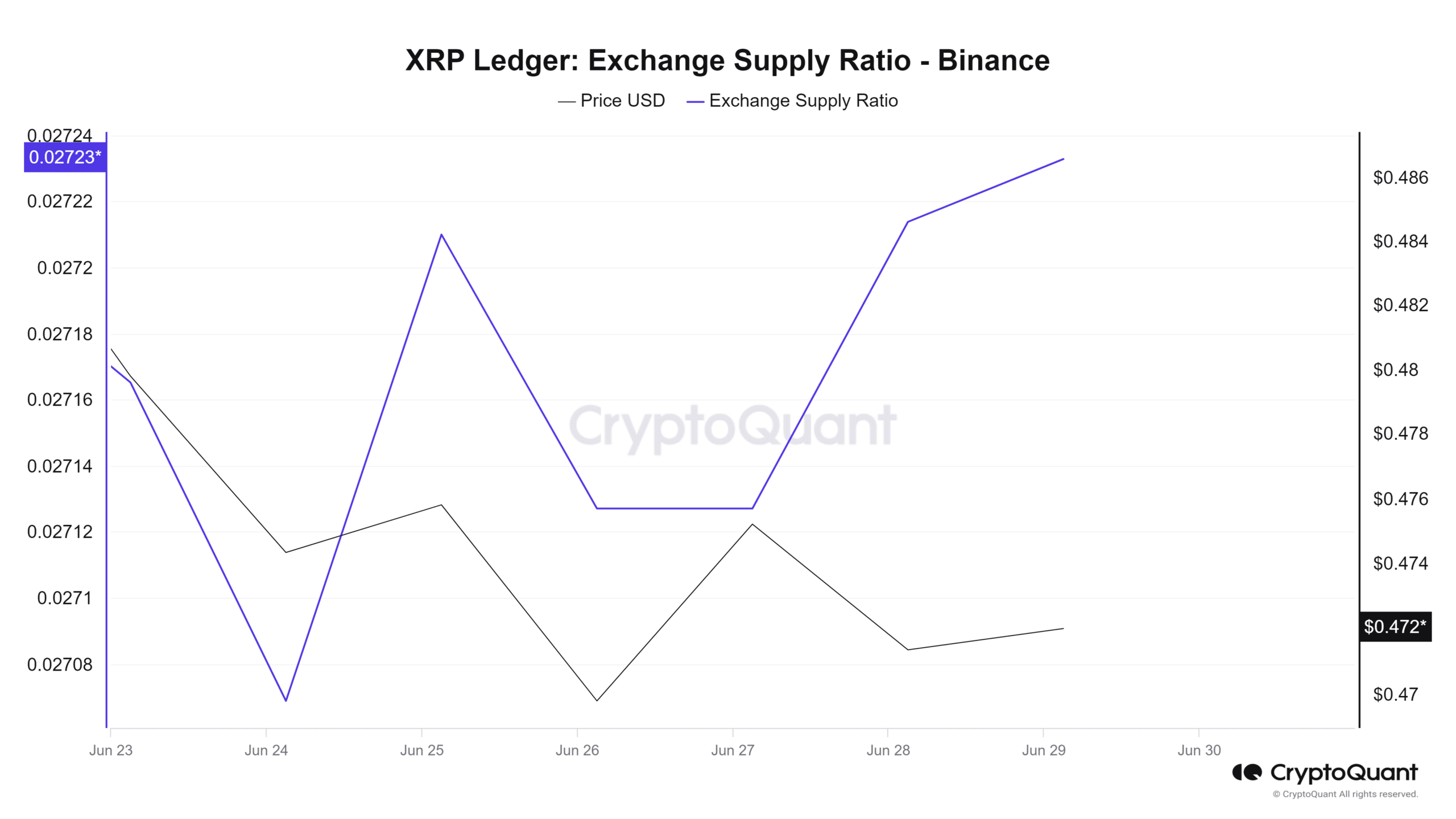

Source: CryptoQuant

Finally, AMBCrypto’s analysis of CryptoQuant shows a slight increase in the exchange supply ratio over the past few days. During this period, the exchange supply ratio rose slightly from 0.0270 to 0.0272.

The exchange supply ratio remained in balance with the supply and demand for the altcoin stable.

XRP at a Crossroads

It is worth noting that the consolidation stages always precede the breakout. XRP was trading at $0.4721 at press time, down 0.75% in 24 hours.

Is Your Wallet Green? Check Out Our XRP Earnings Calculator

Sellers broke the critical support level around $0.466, and $0.47 remained throughout the entire month as a support level, indicating prevailing demand and selling pressure.

Thus, if the bulls win the battle, a minor bullish reversal would push prices to the next important level, at around $0.499. However, a slight break below this critical level would trigger a massive sell-off, pushing prices to $0.43.

“Typical beer advocate. Future teen idol. Unapologetic tv practitioner. Music trailblazer.”

More Stories

JPMorgan expects the Fed to cut its benchmark interest rate by 100 basis points this year

NVDA Shares Drop After Earnings Beat Estimates

Shares of AI chip giant Nvidia fall despite record $30 billion in sales