ESG is a tool that seeks to extend the traditional analysis of company value by including environmental, social and governance metrics. This approach recognizes that ESG factors, although called “non-financial” in traditional accounting terminology, may still be critical to a company’s bottom line.

For nearly twenty years, investors have found that companies with better management of ESG factors Tends to match or outperform (Opens in a new tab) peers, especially in the long term. In other words, companies that anticipate market pressures or opportunities related to sustainability – such as increasing water scarcity – will be in a better position to thrive in that future environment. Since then, investing in ESG has flourished in a multi-trillion dollar industry that relies on many different approaches.

Subscribe to Kiplinger’s free e-newsletters

Earn and thrive with Kiplinger’s best expert advice on investing, taxes, retirement, personal finance and more – straight to your email.

Win and thrive with Kiplinger’s expert advice – straight to your email.

What does ESG mean?

Investing in ESG breaks these risks and opportunities down into environmental, social, and governance metrics. I do not want?

- environmental. The company’s environmental analysis will assess the extent to which the company has an impact on the environment and how well it is managing that impact. A beverage company, for example, may come under more scrutiny because its business consumes large amounts of water, but it can earn points if it manages its water use efficiently. The degree of environment of a mining company or industrial company is generally more important than that of a software company or bank for example.

- social. This category covers issues related to employees, supply chain employment, and the customers and communities affected by the company’s operations. Some of these categories are particularly important in a particular industry. Product safety, for example, is critical to the value of a pharmaceutical company, but it is less important to a publishing company. Good employee relations are of global importance to maintaining and protecting a company’s reputation.

- judgment. Good governance is based on sound ethics and transparency. ESG investors are looking for companies with a proven track record of clean accounting, reasonable executive compensation (bonuses tied to long-term company results, for example), and direct and timely communication with shareholders.

Each piece of ESG information is typically grouped into the scores assigned by the ESG rating companies. This way, investors can compare companies across industries or geographies.

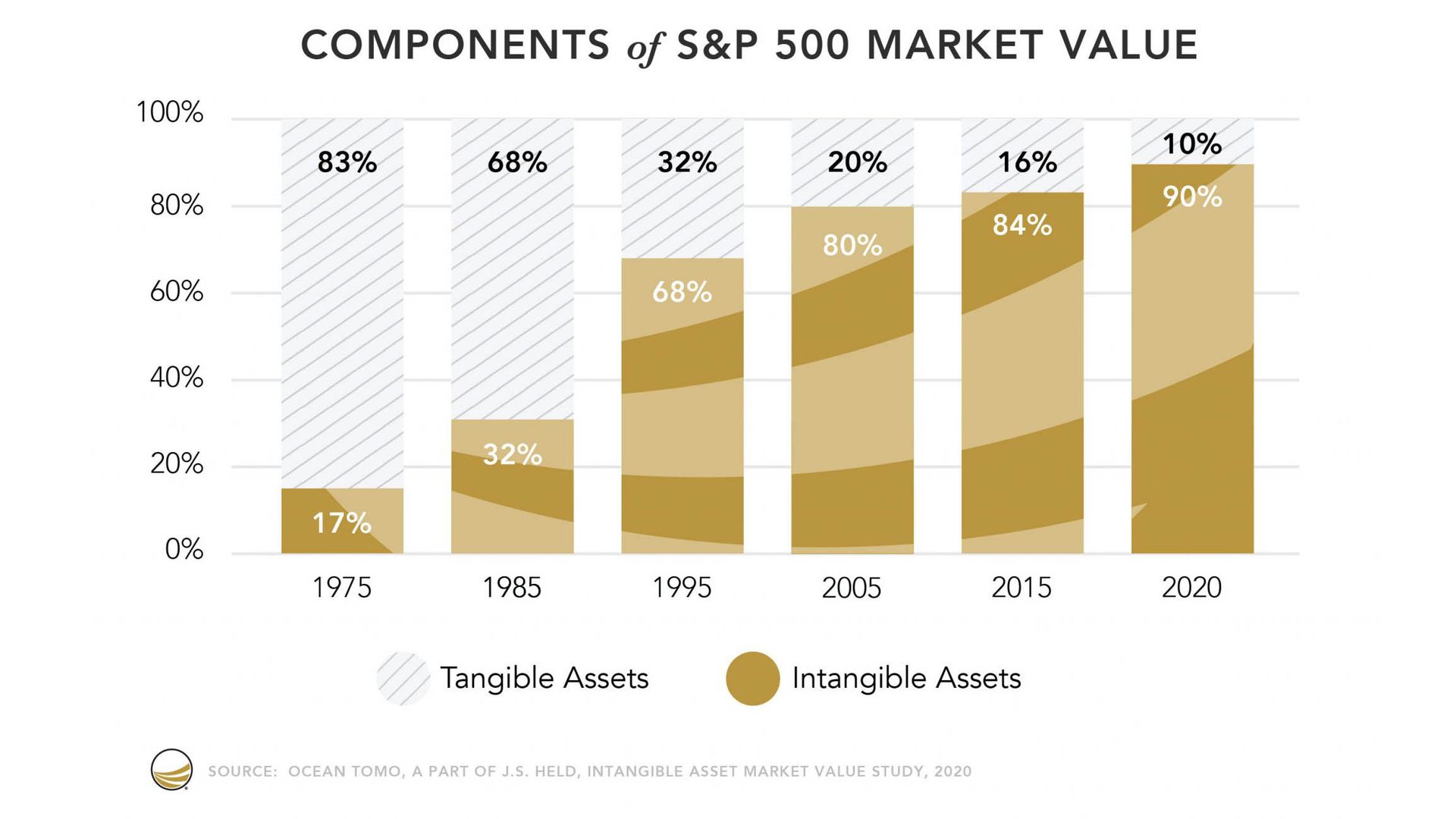

The gold standard for company valuation is based largely on the concept of ‘tangible assets’, which include equipment, land, raw materials, finished products and other tangible goods with a fixed monetary value. In 1975, most of the companies owned in the S&P 500 were considered valuable because of these tangible assets. Only about 17% of a company’s value is derived from “intangible assets” such as brand value and human capital – including many attributes captured by ESG metrics.

With the boom of information technology and corporate transparency, intangible assets have emerged as a greater driver of company value. As the chart below shows, intangible assets accounted for 90% of the company’s value on the S&P 500 Index by 2020. This change represents an extraordinary shift in the economy.

(Image credit: Ocean Tomo, part of JS Held, Intangible Asset Market Value Study 2020)

To understand how the rise of intangible value and ESG are intertwined, consider how important employee relations are now compared to the past. “The bargaining power has fluctuated from employer to employee, and as a result turnover and wages have gone up very, very high,” Peter Essele says (Opens in a new tab) Commonwealth Financial Network. Essele explains: “Companies are now implementing unique strategies to attract and retain the best talent, because in any industry increasing employee turnover is costly.”

Is ESG Just Greenwashing?

Is investing in ESG a marketing scam, engaging in “greenwashing”, or promising better environmental or social outcomes than it does? Unfortunately, consumers cannot always know the answer to this question because there is no standard definition of ESG. Remember that ESG was not originally designed to change the world, but to create institutional value that the market overlooked. If good things came from this investment strategy, this was seen as a bonus, but not the primary goal.

European governments Strict action against companies offering ESG funds (Opens in a new tab)and ensuring that their purpose is clear to investors. Similar efforts are in full swing in the United States (Opens in a new tab) In the meantime, investors whose impact is the highest priority should look for products offered by companies in US Sustainable Investment Forum (Opens in a new tab) (USSIF). These companies are likely to engage directly with companies to address ESG problems and to collaborate with nonprofit groups on corporate defense.

“Unapologetic tv specialist. Hardcore zombie trailblazer. Infuriatingly humble problem solver.”

More Stories

Stand News editors convicted in sedition case

Latest Baysail sinking: Mike Lynch’s wife ‘didn’t want to leave boat without family’ as crew investigated

WFP halts Gaza operations after repeated shooting at aid vehicle