Warren Buffett offered a staunch defense of stock buybacks in his annual letter to Berkshire Hathaway shareholders on Saturday, saying stock purchases by Berkshire and the dozens of publicly traded companies it owns are a boon for investors.

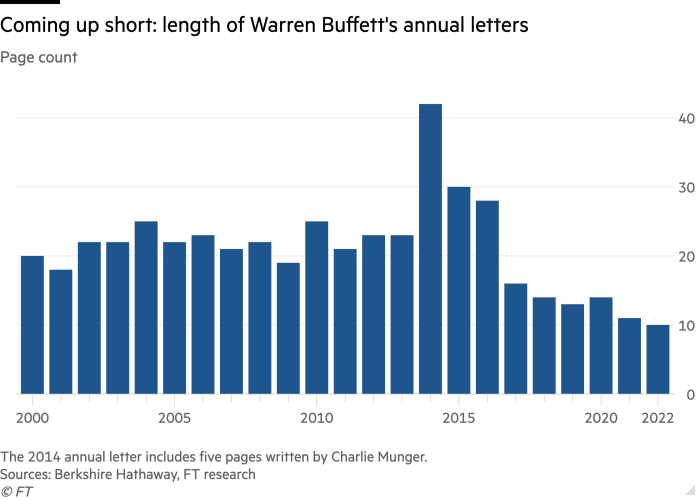

The 92-year-old investor’s comments came in The shortest annual speech It was published decades ago and accompanied results showing that Berkshire suffered a loss of $22.8 billion last year, driven by a decline in the value of its stock portfolio.

Buffett’s defense comes weeks after a new tax on stock buybacks took effect in the United States. The tax was one of the few revenue-raising measures that found unanimous support among Senate Democrats when they passed the Inflation Reduction Act, President Joe Biden’s sweeping climate and tax bill.

Proponents of the tax argued that buybacks do little to support the underlying economy and can be spent on capital expenditures or returned to workers in the form of better wages. Others, including Buffett, argue that buybacks can provide a prudent way to deploy capital.

“When you are told that all buybacks are harmful to shareholders or the country, or particularly beneficial to CEOs, you are listening either to an economic illiterate person or a demagogue (personalities that are not mutually exclusive),” Buffett wrote.

The Berkshire CEO said that when buybacks took place at “cumulative value prices” it benefited all shareholders, referring to the investments his company made in American Express and Coca-Cola in the 1990s.

While Berkshire stopped buying new stock in those companies, the buybacks completed by American Express and Coca-Cola cemented the sprawling conglomerate’s ownership in the two companies and made Berkshire its largest investor.

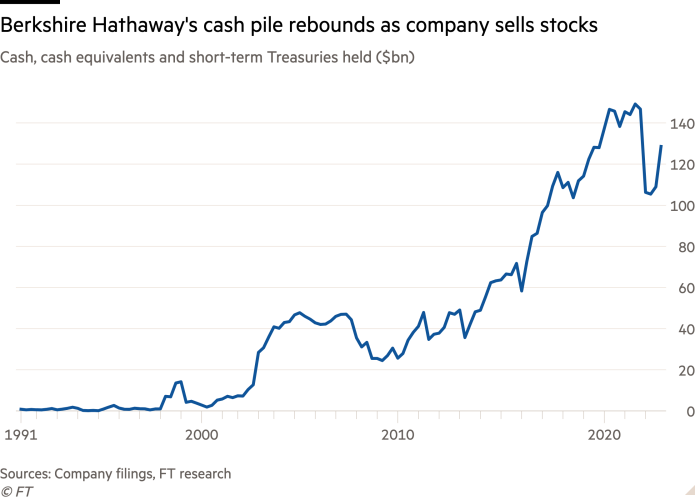

Berkshire has ramped up its stock purchases in recent years, particularly at times when Buffett was finding few attractive investment alternatives. The company spent $7.9 billion in 2022 to buy its shares.

This year’s buybacks will be taxed for the first time, with officials projecting that stock buybacks could generate $74 billion in revenue for the US Treasury over the next decade. That number could rise further if US policymakers increase the tax rate of 1 percent.

Buffett told shareholders on Saturday that he expects Berkshire to pay more taxes over the coming years as the sprawling conglomerate grows, calculating that the company has paid $32 billion in taxes over the past decade.

“We owe the country no less: the dynamism of America has made a great contribution to all of Berkshire’s success – a contribution that Berkshire will always need,” he wrote. “We depend on American Tailwind, and although it has been toned down from time to time, its momentum has always returned.”

Buffett offered little nuggets of wisdom in an annual speech usually poured in by the public for his thoughts on investing and the world.

The letter was 10 pages short, about half the length of his letters since 2000, and included nearly a page of quotes from his longtime partner Charlie Munger. His letters only got shorter as he got older; However, the hundreds of pages he has written for shareholders since the 1970s mean that investors only have to look through his archives to find his opinions.

Buffett struck an optimistic tone when he delivered on some of his greatest successes: “Effective markets are only in textbooks,” the critical importance of “the power of compounding,” and “avoiding behavior that might produce any inconvenient monetary needs at inconvenient times.”

“The lesson for investors: Weeds wither as flowers bloom. Over time, it only takes a few winners to work wonders. And yes, it pays to start early and live into your 90s, too.”

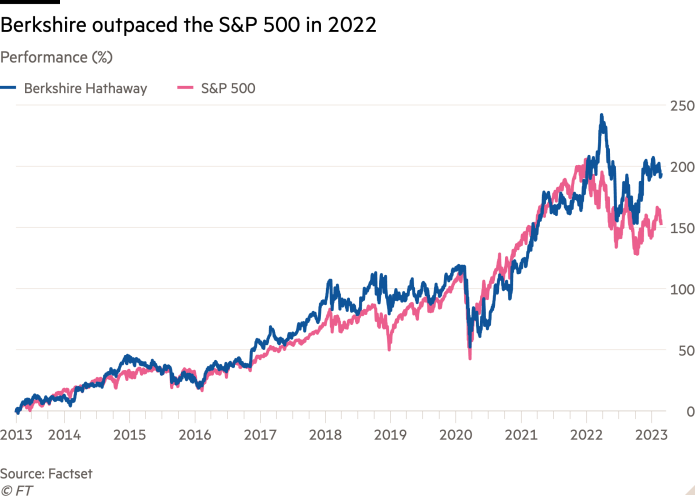

Berkshire reported profits of $18.2 billion in the fourth quarter of 2022, down more than 50 percent from the previous year. For the full year, the company turned in a net loss of $22.8 billion, from a profit of $89.8 billion in 2021.

However, these numbers were significantly affected by the decline in the prices of Berkshire’s stock portfolio of $ 309 billion, which fell along with a widespread sell-off in the financial markets. Accounting rules require Berkshire to report those unrealized gains and losses each quarter in its results.

Buffett said that measurement was “100 percent misleading when presented quarterly or even annually.”

The company’s core business, which includes the BNSF rail line and ice cream supplier Dairy Queen, posted a profit of $6.7 billion in the last three months of the year, down 8 percent from a year earlier.

Buffett said that full-year operating profit of $30.8 billion was a record for Berkshire.

The company’s cash pile swelled to $128.6bn at the end of the year from $109bn in September. Berkshire last quarter sold more than $16 billion worth of stock, and dumped shares of chip maker Taiwan Semiconductor Manufacturing, U.S. regional bank Bancorp and Bank of New York Mellon.

Despite not adding any new stocks to his portfolio last quarter, Buffett has found other places to spread Berkshire’s money. Earlier in the year it spent tens of billions of dollars buying shares in oil majors Occidental Petroleum and Chevron, and in the fourth quarter Berkshire’s acquisition of rival Ghanaian insurer was completed.

The company revealed on Saturday that it had bought a 41.4 percent stake in the Pilot Flying J truck-stop chain for $8.2 billion in January, giving it a majority stake in the company. Berkshire first bought a stake in the company in 2017 but did not disclose financial details of the deal until this weekend.

Its annual report also showed that Berkshire increased capital expenditures in both its power and rail units.

But the report, looking at Berkshire’s vast business empire with more than 380,000 employees, provided more evidence of the disparity in the US economy.

The company said its apparel business, which includes the Fruit of the Loom brand, was downsizing as retailers struggled with high inventories and slowing sales. “A slowdown in new orders was observed in almost all regions in the fourth quarter,” TTI, which distributes electronic components, said.

High interest rates sharply affected Berkshire’s building and construction units. Clayton Homes, a maker of modular homes, said its backlog has decreased sharply and that it expects new home sales to remain challenging.

One of Berkshire’s crown jewels – auto insurance unit Geico – posted its sixth consecutive quarterly underwriting loss. Berkshire revealed that it has secured the support of some US states to increase the insurance premiums it charges customers, given the high claims it has had to pay in recent years.

“As a result, we currently expect Geico to generate an underwriting profit in 2023,” Berkshire said.

“Typical beer advocate. Future teen idol. Unapologetic tv practitioner. Music trailblazer.”

More Stories

JPMorgan expects the Fed to cut its benchmark interest rate by 100 basis points this year

NVDA Shares Drop After Earnings Beat Estimates

Shares of AI chip giant Nvidia fall despite record $30 billion in sales