Stay informed with free updates

Simply sign up US inflation myFT Digest – delivered straight to your inbox.

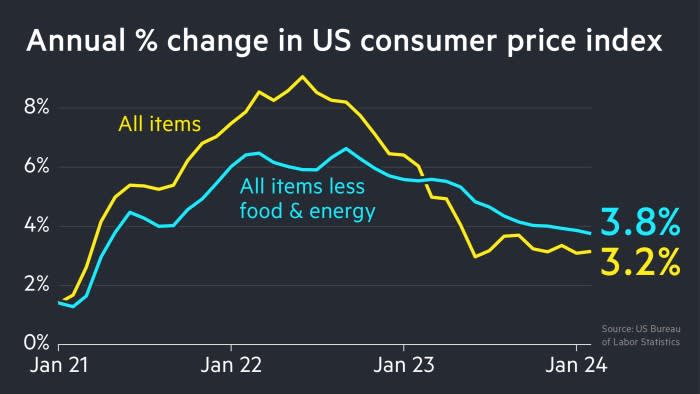

US inflation rose unexpectedly to 3.2 percent last month, highlighting the challenge the Federal Reserve faces in the “last mile” of its battle against rising prices.

Economists surveyed by Bloomberg expected annual consumer price inflation to remain unchanged from January's rate of 3.1 percent.

But Tuesday's rate rise, fueled largely by services such as auto and health insurance, prompted warnings that the Fed may have to wait longer than previously expected before cutting interest rates from their current 23-year highs.

“These inflation numbers herald a more difficult period for the Fed,” said Eswar Prasad, a professor at Cornell University.

“Although the US economy has held up well so far, there is a risk that persistent inflation and the Fed’s response to it could turn a soft landing scenario into a soft stagflation.”

Tuesday's numbers will play an important role in the Fed's thinking when it publishes new forecasts next week on the number of cuts it expects for 2024. The March 20 meeting is also expected to keep interest rates at between 5.25 and 5.5 percent.

Diane Swonk, chief economist at KPMG US, suggested that the inflation data would strengthen the resolve of central bank hawks who want to keep interest rates high for longer to bring inflation back to its 2 percent target.

“The March meeting will be very hot,” she said.

At present, the central bank plans to cut interest rates three times this year. Markets expect three or four cuts this year, starting in June or July.

“The Fed is likely still on track to cut rates in June,” Citi economist Andrew Hollenhorst said, adding that “inflation data in the last two months shows the difficulty of getting inflation back on target.”

Movements in interest rates and inflation are a major concern for President Joe Biden, who is seeking to make his management of the economy the centerpiece of his campaign against Donald Trump, whom he is trailing in opinion polls ahead of the November election.

On Tuesday, the president attacked Republicans for not having a “plan to cut costs,” highlighting his promise to address corporate price gouging.

Government bond prices fell slightly as investors adjusted their bets on when the Federal Reserve will cut interest rates. Two-year Treasury yields, which often track interest rate expectations and move inversely with prices, rose 0.06 percentage point to 4.59 percent.

The 10-year benchmark yield also added 0.06 percentage point to 4.16 percent.

The index, which tracks the dollar against a basket of six other currencies, rose 0.2 percent during the day.

US stocks rose in volatile trading after the release of the report, but continued to rise, leaving the Standard & Poor's 500 index on Wall Street up 0.9 percent during mid-afternoon trading in New York. The Nasdaq Composite Index, which is dominated by technology stocks, rose 1.1 percent.

“It's surprising we haven't seen more negative feedback,” said Tim Murray, of T. Rowe Price Asset Management. “That last mile of inflation — from 3 percent to 2 percent — is going to be really difficult. Much harder than getting 9 to 3 percent.”

He added that the market's hope of lowering interest rates “is constantly declining… You have to wonder even how many cuts we will get in the end.”

But Willie Tollett, chief investment officer at Franklin Templeton Investment Solutions, said Tuesday's inflation reading was “almost perfect for keeping the market higher, as it's not too hot.” [and] “And not too cold.”

Core inflation, which excludes changes in food and energy costs, was 3.8 percent, compared to 3.9 percent in January, Consumer Price Index numbers from the Bureau of Labor Statistics showed. Economists had expected the measure, seen as a better measure of underlying price pressures, to fall to 3.7 percent.

The headline figure rose on a monthly basis from 0.3 percent in January to 0.4 percent last month.

The Fed is targeting an alternative measure of inflation – personal consumption expenditures. However, with the February PCE figure not released until after the vote on March 20, the CPI data is expected to influence rate setters' deliberations.

“Typical beer advocate. Future teen idol. Unapologetic tv practitioner. Music trailblazer.”

More Stories

JPMorgan expects the Fed to cut its benchmark interest rate by 100 basis points this year

NVDA Shares Drop After Earnings Beat Estimates

Shares of AI chip giant Nvidia fall despite record $30 billion in sales