The White House asked South Korea to urge chipmakers not to fill a market hole in China if Beijing bans Idaho-based Micron from selling chips, as it tries to rally allies to counter Chinese economic coercion.

The United States made the request as President Yoon Sok Yul prepares to travel Monday to Washington for a state visit, according to four people familiar with the talks between the White House and the presidential office in Seoul.

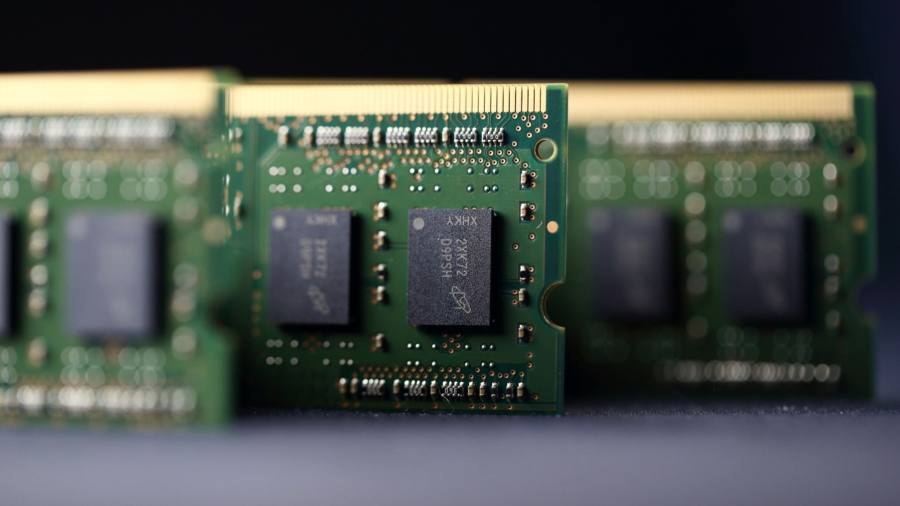

China this month launched a national security review into Micron, one of the three dominant players in the global DRam memory chip market, along with South Korea’s Samsung Electronics and SK Hynix.

It is unclear whether the Cyberspace Administration of China will take punitive measures after the investigation. But the stakes are high for Micron, as mainland China and Hong Kong generated 25 percent of its $30.8 billion in revenue last year.

US officials and businessmen believe the CAC investigation is Beijing’s retaliation against tough measures taken by President Joe Biden to help prevent China from acquiring or producing advanced semiconductors.

The Micron case has emerged as a crucial test of whether Beijing is willing to take coercive economic measures against a major US company for the first time.

The United States has asked Seoul to encourage Samsung Electronics and SK Hynix to back off increased sales to China if Micron is banned from selling as a result of the investigation, according to people familiar with the situation.

The White House request comes at a sensitive time, with Yoon arriving in Washington on Monday. While the United States worked with allies to counter China in the security domain in the Indo-Pacific, this was the first known occasion on which it asked an ally to enlist its companies to play a role.

The South Korean embassy in Washington and Samsung did not respond to requests for comment. SK Hynix said it had not received a request from the South Korean government. Micron declined to comment.

The White House would not comment on specifics, but said the Biden and John administrations had made “historic progress” to deepen cooperation on national and economic security issues, including efforts to protect “cutting edge technologies.”

“This includes efforts to coordinate investments in the semiconductor sector, secure critical technologies, and address economic coercion,” the US National Security Council said. “We expect the upcoming state visit to further enhance cooperation on all these fronts.”

It is unclear how Seoul responded. US and South Korean officials are putting the finishing touches on the visit. They discuss several issues, including how the United States can give South Korea more assurance over its “extended deterrence” — the US nuclear umbrella — while North Korea escalates tensions on the peninsula.

The Micron-related request puts Yoon in a complicated position. He took office last year on a platform widely seen as more hawkish on China than that of his left-leaning predecessor, Moon Jae-in. In making his position clear, he drew an angry response from Beijing last week by accusing China of trying to change the status quo on Taiwan “by force”.

But his administration is also exasperated by US efforts to rally allies behind its economic security agenda, amid concerns that the long-term competitiveness of Samsung and SK Hynix could be undermined by US export controls.

While Samsung and SK Hynix will not welcome efforts to reduce their business in China, the United States may have some leverage. When the US unveiled wide-ranging chip-related export controls on China last October, it gave South Korean companies with chip manufacturing facilities in China waivers to allow them to export from the country. These waivers must be renewed later this year. The Commerce Department said it had no status update.

Memory chip makers are already under pressure from an industry glut that in the first quarter of this year led to a 25 percent drop in the price of DRam chips, which are used in everything from TVs to phones.

Last week, Treasury Secretary Janet Yellen said Washington was concerned about “the recent rise in coercive measures targeting American companies.”

One person familiar with the situation said the request to Seoul reflected the fact that the Biden team was “eager to ensure that China would not be able to use microns as a tool to influence or influence US policy.”

The person said the United States could help thwart Chinese efforts at economic coercion by showing Beijing that it will work with allies and partners to undermine any such move against American or allied companies.

China has used economic coercion against Taiwan and other countries including Lithuania and Australia. But it refrained from taking major action against the United States even as Biden unveiled severe chip export restrictions and imposed sanctions on other Chinese companies.

One person who recently met with Chinese officials in Beijing said they were losing patience with what they saw as US efforts to suppress Chinese companies, suggesting it was considering retaliation.

Chinese foreign ministry spokesman Mao Ning on Monday criticized US export controls, accusing Washington of “flagrantly violating the principles of market economies and international trade” that “obstructed the stability of global supply chains.”

Mao added that CAC’s investigation into Micron was a “normal regulatory action.”

The US request to Seoul underscores how chips are at the heart of some of the deepest fault lines between Washington and Beijing.

In December, the US put Yangtze Memory Technologies Co., a memory chip maker that the White House has dubbed a “Chinese national hero,” on its “entity list.” That means companies are barred from exporting US technology to emerging competitor Micron without a hard-to-obtain license.

Additional reporting by Mikey Deng in Beijing

Follow on Twitter: Dimitri Sevastopoulou

“Typical beer advocate. Future teen idol. Unapologetic tv practitioner. Music trailblazer.”

More Stories

JPMorgan expects the Fed to cut its benchmark interest rate by 100 basis points this year

NVDA Shares Drop After Earnings Beat Estimates

Shares of AI chip giant Nvidia fall despite record $30 billion in sales