(Bloomberg) — U.S. inflation figures next week are expected to confirm that long-awaited interest-rate cuts are coming soon, while a reading on consumer spending suggests the central bank has succeeded in keeping the expansion intact.

Most Read from Bloomberg

Economists expect the core personal consumption expenditures price index, excluding food and energy, the Fed’s preferred measure of core inflation, to rise 0.2% in July for the second straight month. That would bring the three-month annual core inflation rate down to 2.1%, just above the central bank’s 2% target.

Economists surveyed by Bloomberg also expect consumer spending, not adjusted for price changes, to rise 0.5% — the strongest advance in four months — in Friday’s report.

Speaking at the Jackson Hole Symposium, Federal Reserve Chairman Jerome Powell acknowledged the recent progress in inflation, saying he had gained confidence that it was on track to return to 2% and that “it is time to adjust policy.”

Friday’s comments marked a major turning point in the Fed’s two-year battle against price pressures, and underscored how the focus has shifted to risks in the labor market — the other part of the central bank’s dual mandate. Job growth has helped keep consumers spending — the key to ensuring the economy expands.

The government will release its first revision of second-quarter gross domestic product data on Thursday. Economists expect annual growth of 2.8%, unchanged from the previous reading.

Other U.S. data due next week includes durable goods orders for July on Monday and separate consumer confidence indicators on Tuesday and Friday.

San Francisco Fed President Mary Daly, a 2024 FOMC voter, will appear on Bloomberg TV on Monday. Another voter, Atlanta Fed President Raphael Boucek, will speak about the economic outlook on Wednesday.

What Bloomberg Economics says:

“Powell’s very dovish speech at Jackson Hole was music to the ears of market players. He pledged that the Fed would do “everything it can” to support a strong labor market and provide a floor for the economy. We think a little reality check is in order.”

— Anna Wong, Stuart Paul, Eliza Winger, Estelle O. For the full analysis, click here.

In the north, Canada’s second-quarter GDP data will be the last major economic release before the central bank cuts interest rates for a third straight time on September 4.

Preliminary data pointed to annual growth of 2.2% quarter-on-quarter – above the central bank’s forecast of 1.5% – reinforcing its efforts to engineer a soft landing while continuing to lower borrowing costs.

Investors will also be watching for the latest developments in the resolution of a Canadian rail dispute that has disrupted supply chains in North America.

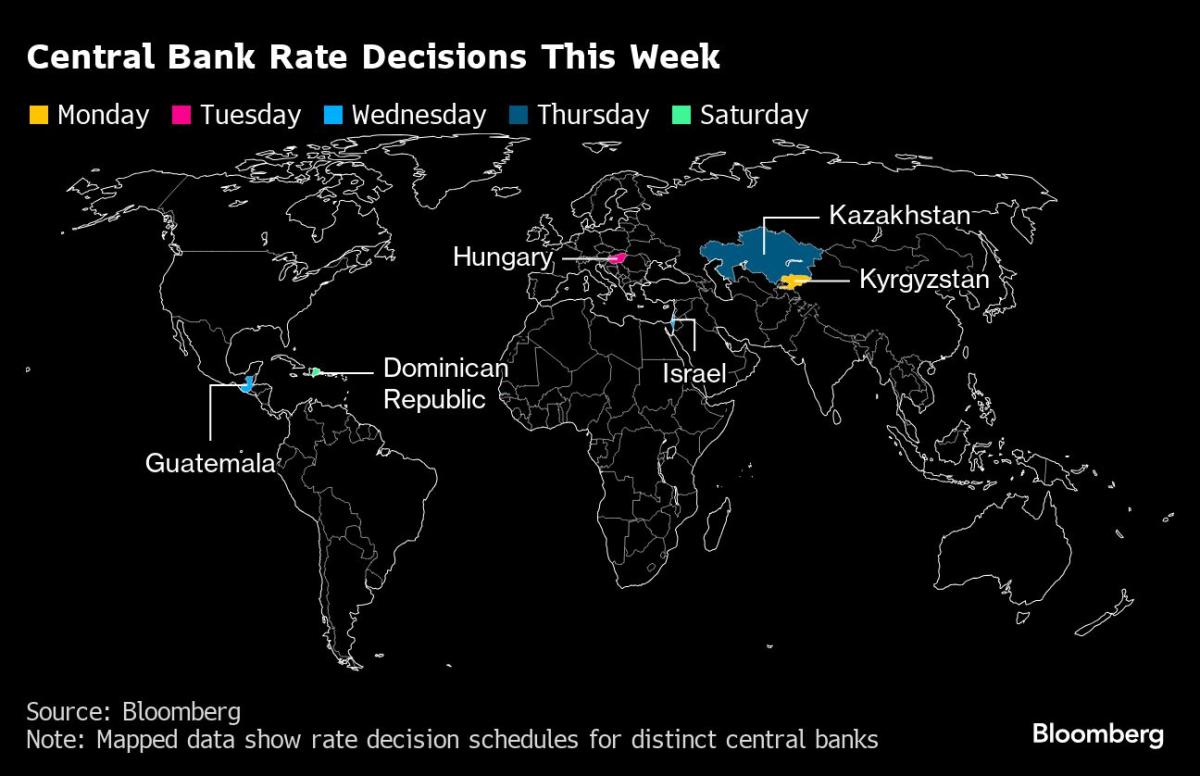

Elsewhere, the eurozone will release inflation data for August less than two weeks before the European Central Bank makes its next policy decision, while China’s central bank sets its annual lending rates. Interest rate decisions include Hungary and Israel.

Click here to see what happened last week, and here’s our summary of what’s coming in the global economy.

Asia

The week begins with renewed focus on China’s new monetary framework, as the People’s Bank of China sets its benchmark interest rate for annual lending. After a surprise cut in July, authorities are expected to keep the rate steady at 2.3%.

Monday’s decision comes after the People’s Bank of China signaled this month that it was downplaying the role of the medium-term lending facility as a policy tool, while raising the seven-day reverse repo rate to greater prominence.

A day later, China gets industrial profit figures that could spark calls for more policy steps to boost the economy, and Beijing also sees official PMI figures on Saturday.

Elsewhere, prices will be a major topic.

Australia’s lower average inflation gauge for July is expected to give the central bank fresh evidence to assess as it considers whether to maintain its hawkish rhetoric.

Japan will also get an update on consumer inflation in the capital, a leading indicator of national trends. Data on Friday could show India’s annual economic growth slowed slightly in the second quarter, and trade figures are due in the week from Thailand, Sri Lanka and Hong Kong. Kazakhstan’s central bank meets on Thursday to decide whether to cut its key interest rate for a third straight meeting.

Europe, Middle East and Africa

Inflation data will also be in focus in Europe, with August figures due from the region’s major economies – Germany, France, Italy and Spain – along with a reading for the 20-nation eurozone as a whole.

Eurozone growth is expected to slow from 2.6% in July, paving the way for the European Central Bank to cut interest rates for the second time this cycle when it meets in September.

The outlook has been bolstered by the continent’s economic malaise. While the August PMI received an unexpected boost from the Paris Olympics, underlying weakness is likely to persist after this temporary uptick. Updates on output and sentiment in Germany – the region’s current weak spot – will be released early in the week.

Speakers likely to comment on monetary policy and recent shifts in the economy include ECB Governing Council members Joachim Nagel and Klaas Knot, as well as Executive Board member Isabel Schnabel.

In Eastern Europe, Hungary is expected to keep interest rates at 6.75%. The same is true in the Middle East, where the Bank of Israel is expected to keep its benchmark interest rate at 4.5%.

In Africa, August inflation readings from Kenya and Uganda are due, along with second-quarter GDP figures from Nigeria.

latin america

Brazil’s central bank publishes its weekly survey of economists on Monday. Bank President Roberto Campos Neto said this month that inflation expectations were unstable and that officials were ready to tighten monetary policy if necessary.

Brazil’s mid-month inflation data on Tuesday could show a slight dip from July’s 4.45%, still well above the 3% target. Analysts are raising their interest rate forecasts while traders are pricing in a hike next month.

The fiscal slide has put Brazil’s budget data under the spotlight – July figures are due out next week. Economists polled by the central bank see no nominal or primary annual budget surpluses through the projected 2027 horizon.

The main event in Mexico will be the central bank’s quarterly inflation report. New forecasts are unlikely to emerge soon after the bank revised its August 8 statement after the decision, but policymakers may revise their GDP estimates.

Chile’s retail sales figures for June are likely to show a positive reading for the seventh straight year after nearly two years of decline.

–With assistance from Robert Jameson, Laura DeHillon Kane, Zoe Schnoes, Paul Richardson, and Brian Fowler.

(Updates with Fed spokespeople in paragraph 8.)

Most Read from Bloomberg Businessweek

©2024 Bloomberg LP

“Typical beer advocate. Future teen idol. Unapologetic tv practitioner. Music trailblazer.”

More Stories

JPMorgan expects the Fed to cut its benchmark interest rate by 100 basis points this year

NVDA Shares Drop After Earnings Beat Estimates

Shares of AI chip giant Nvidia fall despite record $30 billion in sales