A closely watched crypto strategist believes that Bitcoin (BTC) looks poised for a quick explosion to the upside.

Pseudonymous analyst Kaleo tells his 553,400 Twitter followers that crypto Bitcoin could be preparing for a short squeeze.

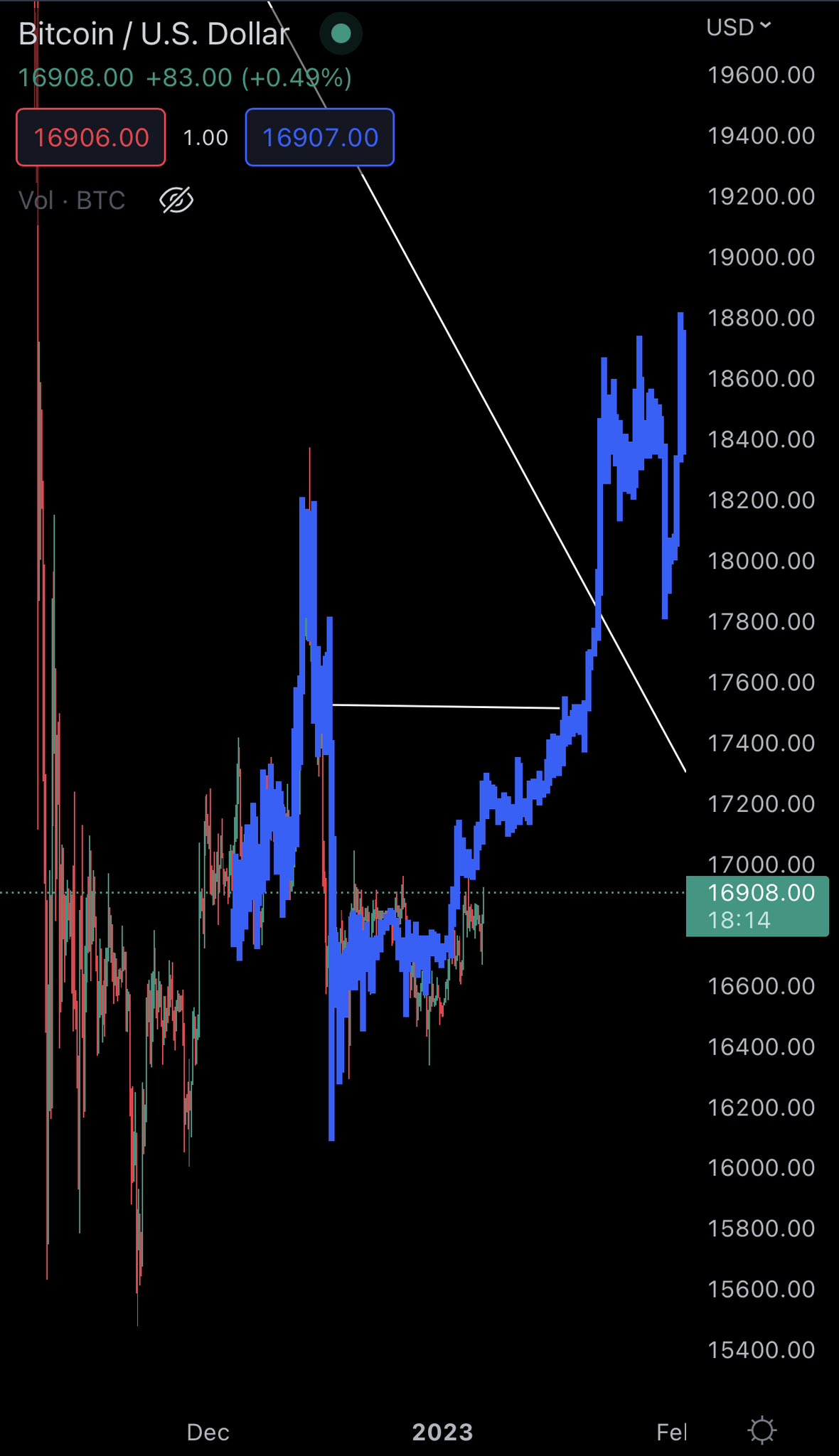

“Finally, BTC looks ready to break out of the $16,000-$17,000 base range that has been stuck for the past several weeks. Start the squeeze.”

A short squeeze occurs when traders who borrow an asset at a certain price in hopes of selling at a lower price to pocket the (short) spread are forced to buy back while the trade moves against them.

Looking at the Kaleo chart, it appears that he thinks Bitcoin could rally to $18,800. At the time of writing, Bitcoin is trading at $16,930, which indicates an upside of around 10% for the crypto-king if it reaches the analyst target.

for Ethereum (ETH), the cryptocurrency strategist also believes that the top smart contract platform is poised to rally.

“Ethereum/ETH finally looks set for the next move in the ~$1400 range.

We should see some pullback and consolidation there before continuing higher.”

At the time of writing, Ethereum is worth $1,261.

The crypto strategist also keeps a close eye on the S&P 500 (SPX). According to Kaleo, the SPX appears poised to take out its resistance at 3,900 points.

Again, when SPX broke 3900 [points]Fasten seat belts. “

Traders are watching the SPX as the cryptocurrency markets tend to mirror the movements of the stock market index.

At the time of writing, SPX is trading at $3,895.

Don’t miss out – Subscription Get encrypted email alerts delivered straight to your inbox

check price action

Follow us TwitterAnd Facebook And cable

browse Daily Huddle Mix

& nbsp

Disclaimer: The opinions expressed on The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in bitcoin, cryptocurrency, or digital assets. Please be aware that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend buying or selling any cryptocurrency or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl engages in affiliate marketing.

Featured image: Shutterstock/TadashiArt/Sensvector

“Typical beer advocate. Future teen idol. Unapologetic tv practitioner. Music trailblazer.”

More Stories

JPMorgan expects the Fed to cut its benchmark interest rate by 100 basis points this year

NVDA Shares Drop After Earnings Beat Estimates

Shares of AI chip giant Nvidia fall despite record $30 billion in sales