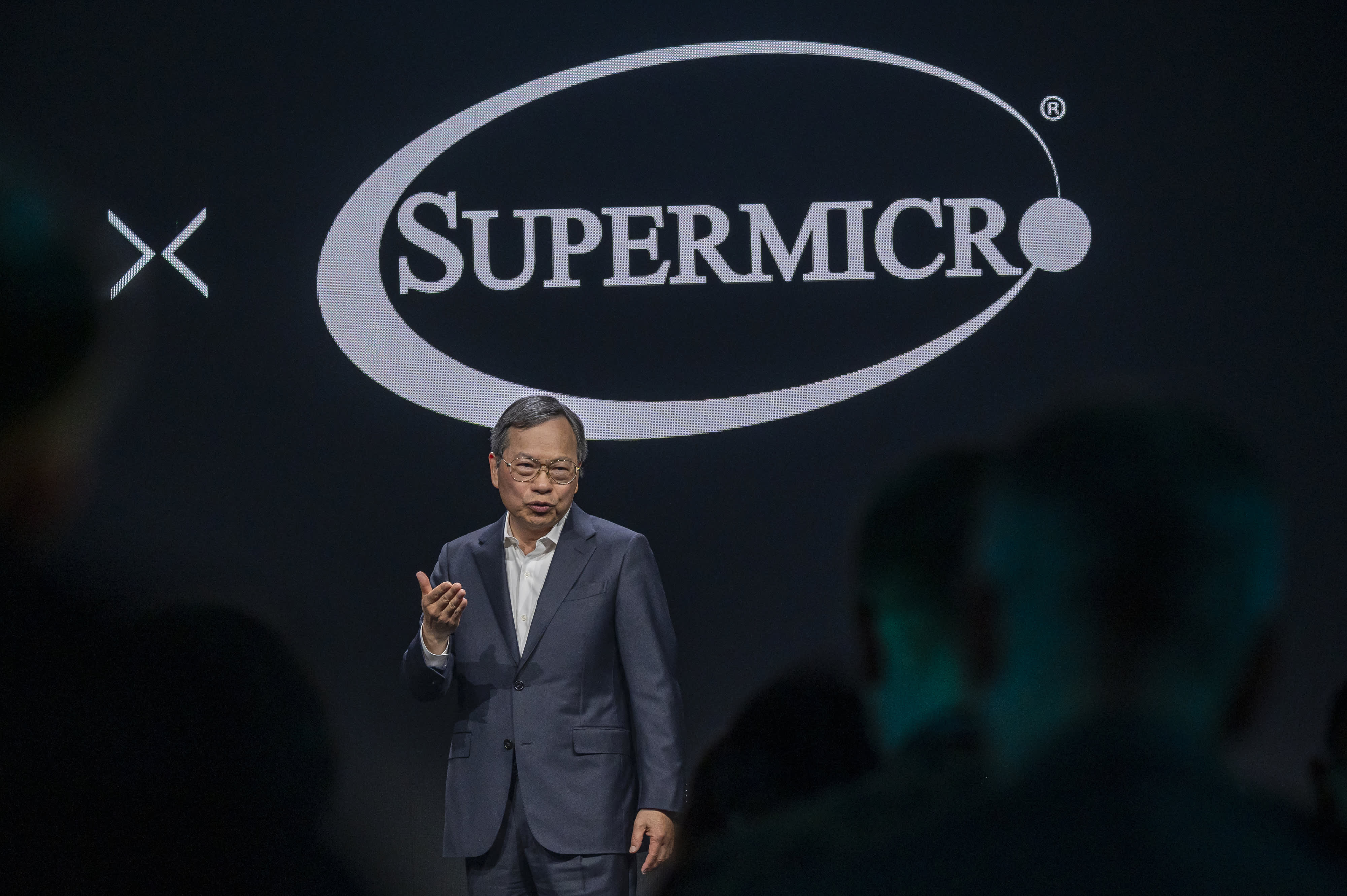

David Paul Morris | Bloomberg | Getty Images

Super Micro Computer joins the S&P 500 after a historic stock rally that pushed the company's market value past $50 billion.

Shares, up more than 20-fold in the past two years and more than 200% since the start of 2024, were up another 8% in extended trading on Friday.

Super Micro replaces Whirlpool, according to a press release. Deckers Outdoor also joins the S&P 500, replacing Zions Bancorporation.

Stocks added to the benchmark index often rise in value because funds tracking the S&P 500 will add them to their portfolios. The average market capitalization of companies included in the Standard & Poor's 500 index is $33.7 billion.

Super Micro has been a major beneficiary of the AI boom sweeping the technology industry. The company makes servers and other computer infrastructure, and is one of the primary suppliers for building Nvidia-based server “clusters” for training and deploying AI models.

In the quarter ended December, Super Micro's revenue more than doubled to $3.66 billion. Analysts expect sales in the current quarter to more than triple.

“We see Nvidia's results as a positive data point for SMCI which is one of the leading partners that designs and manufactures servers to wrap around GPUs and customize racks to the specific needs of the customer,” Bank of America analyst Ruplu Bhattacharya wrote in a note last month. He has a Buy rating on the stock.

He watches: Super Micro is definitely a meme stock

Don't miss these stories from CNBC PRO:

“Typical beer advocate. Future teen idol. Unapologetic tv practitioner. Music trailblazer.”

More Stories

JPMorgan expects the Fed to cut its benchmark interest rate by 100 basis points this year

NVDA Shares Drop After Earnings Beat Estimates

Shares of AI chip giant Nvidia fall despite record $30 billion in sales