This $1.3 trillion came and went in the space of a month, and people didn’t really notice – which is amazing.

By Wolf Richter for Wolf Street Journal.

The week was marked by continued tech selloffs and the fading of the much-touted “rotation” in small-cap companies: the S&P 500 fell 2.0%, the Nasdaq Composite dropped 3.6%, the Nasdaq 100 fell 4.0%, and the Magnificent 7 dropped 4.7%.

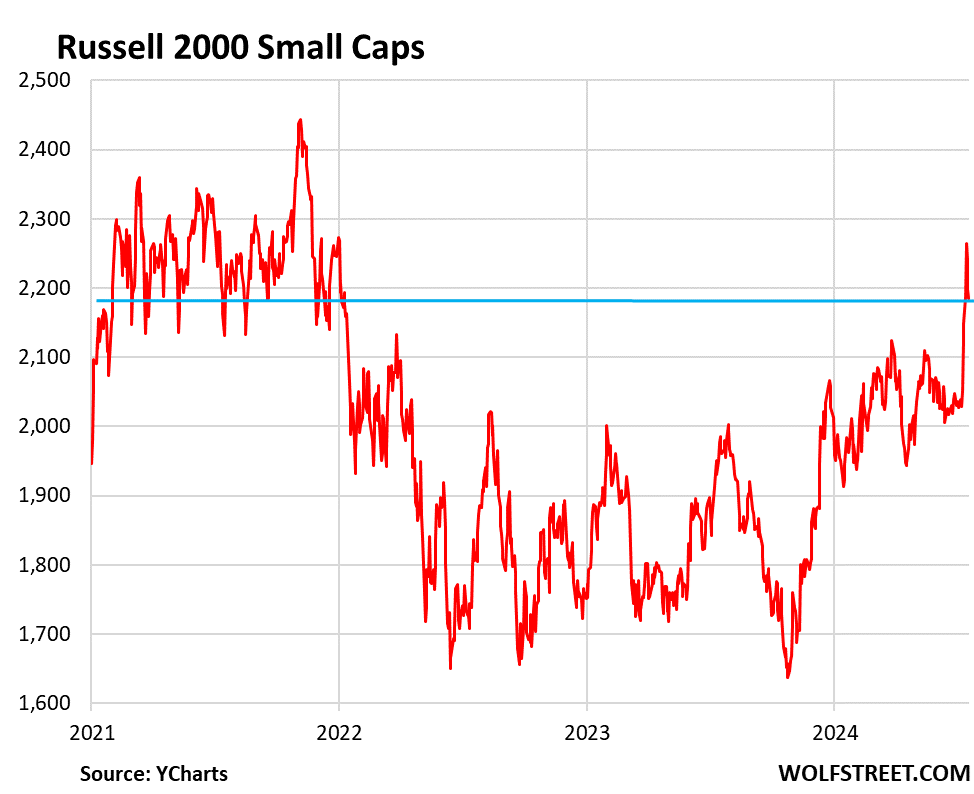

But the Russell 2000, which tracks about 2,000 small-cap stocks, rose 5.3% over the first two days of the week, as part of a “shift” to small-cap stocks, then fell 3.5% over the remaining three days of the week, ending the week up 1.7%, back to where it was in February 2021.

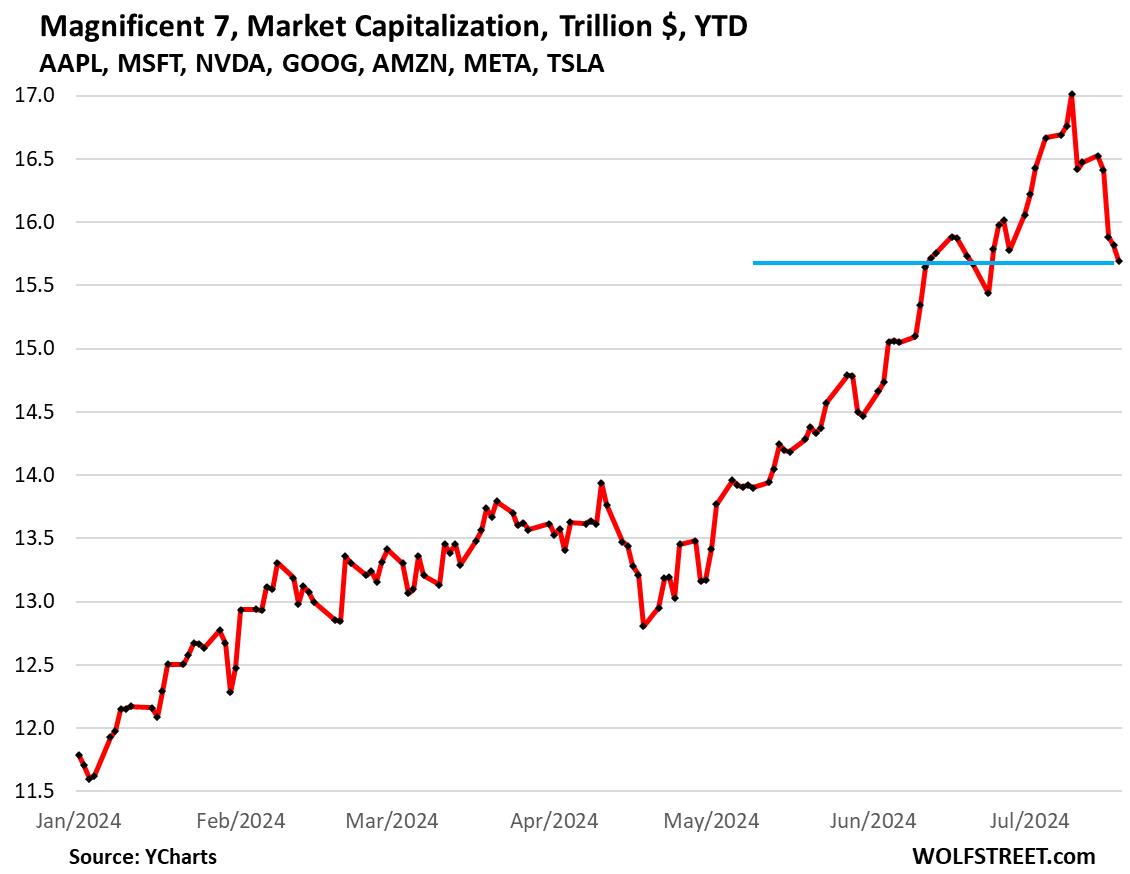

Magazine 7 Amazon lost another $113 billion in market value on Friday, bringing the total decline from its July 10 peak to $1.32 trillion (-7.7%). That $1.32 trillion came and went in about a month, spanning just seven stocks, and people didn’t really notice — which is amazing when you think about it. It was a lot of money back then.

The combined market cap of the seven largest companies has now fallen to $15.69 trillion, from more than $17 trillion on July 10. The seven largest companies are now back to where they were on June 13. That $1.32 trillion drop has surpassed the $1.13 trillion drop in the dollar in April. But the 7.7% drop is still less than the 8.1% drop in April.

Individual stock declines in the MAG 7 index, from its peak on July 10 (Nvidia shares rose on Thursday but rebounded again on Friday):

- apple [AAPL]:-3.6% ($-129 billion)

- Microsoft [MSFT]: -6.3% ($-217 billion)

- the alphabet [GOOG]:-6.9% ($-164 billion)

- Amazon [AMZN]: -8.3% ($-173 billion)

- Tesla [TSLA]: -9.2% ($-78 billion)

- Meta [META]: -10.8% ($-146 billion)

- Nvidia [NVDA]: -12.3% ($-410 billion).

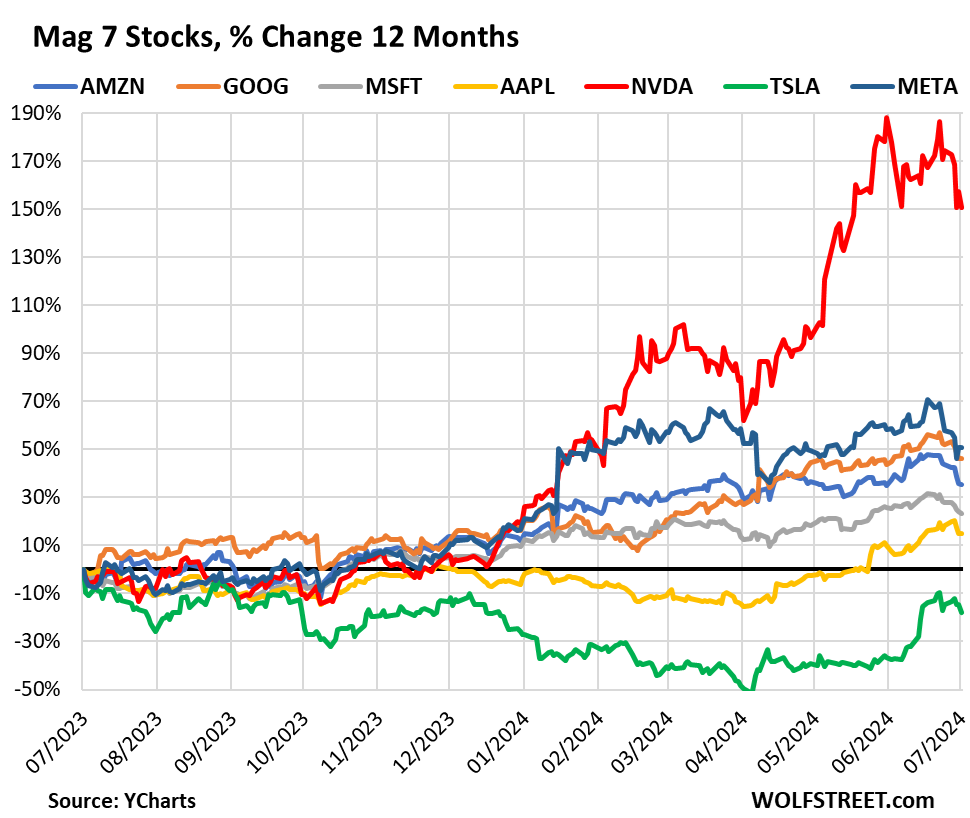

Over the past twelve months, in percentage terms, two Mag 7 companies have stood out:

- Nvidia, which is still up 150% in 12 months, despite the recent decline (red line in the chart below)

- Tesla, which is still down 18% in 12 months, and down 42% from its all-time high in February 2021 (in green).

The gains of the remaining five magazines over the past 12 months pale in comparison to Nvidia’s 150% gain, though they are still steep despite recent declines:

- Meta: +50.9%

- Alphabet: +46.1%

- Amazon: +35.3%

- Microsoft: +23.1%

- Apple: +15.0%.

small stocks It collapsed on Wednesday, July 17, after its sudden bout of glory during which the entire market was supposed to “spin” towards it, or something else.

The Russell 2000 had gained 11.5% over the five trading days between July 9 and July 16. On Wednesday, the index began to decline, and on Friday, it closed 3.5% below its Tuesday high. But thanks to a 5.3% gain over the first two days of the week, the index remained up 1.7% for the week.

The Russell 2000, at 2,184, is back to the same level it was in February 2021. This kind of sudden ups and downs certainly doesn’t calm our anxiety.

Nasdaq 100 IndexThe Nasdaq 100 index of the largest non-financial companies on the Nasdaq, dominated by big technology and social media stocks, fell 4.0% for the week, and is down 5.6% from its peak on July 10.

So far, the index is up 16% for the year, despite two major sell-offs. The first ended in April with a 6.2% decline.

Since the start of 2021, the index is still up 51.5%, with a massive bottom in the middle. It has risen 88% from the December 2022 low. This incredible move to such dizzying heights does not at all assuage our fears:

S&P 500 Index U.S. stocks are starting to show the first signs of the tech drama. Sell-offs have been minimal so far. The index is down 2% for the week, and down 2.9% from Tuesday’s high.

Since the start of 2021, the index has risen 47%. Since its lows in October 2022, the index has risen 53%. These are huge rapid gains on top of already very high valuations, and the decline so far has been almost negligible:

Do you enjoy reading WOLF STREET and want to support it? You can donate. I would greatly appreciate it. Click on the beer and iced tea mug to learn how:

Would you like to be notified by email when WOLF STREET publishes a new article? Sign up here.

“Typical beer advocate. Future teen idol. Unapologetic tv practitioner. Music trailblazer.”

More Stories

JPMorgan expects the Fed to cut its benchmark interest rate by 100 basis points this year

NVDA Shares Drop After Earnings Beat Estimates

Shares of AI chip giant Nvidia fall despite record $30 billion in sales