(Bloomberg) — The pulse of U.S. inflation will likely continue to slow at the start of the year, helping fuel expectations that the Federal Reserve will find interest rate cuts more palatable in the coming months.

Most read from Bloomberg

The core CPI, a measure that excludes food and fuel to get a better picture of core inflation, is expected to rise 3.7% in January from a year earlier.

That would represent the smallest year-over-year advance since April 2021, and highlights the successes of Fed Chair Jerome Powell and his colleagues in beating inflation. The overall CPI will likely rise less than 3% for the first time in nearly two years, economists expected Tuesday's report to show.

Despite acknowledging this progress, policymakers have not accepted the possibility of lowering interest rates as soon as next month.

Read more: Fed officials add to easing hopes for interest rate cuts soon

Their patience has roots in an economy that turns on green lights, the largest of which is the job market. Permanent employment growth has kept consumer spending afloat. A separate report on Thursday is expected to reveal another increase in retail sales, excluding automobiles and gasoline.

Slowing inflation, coupled with expectations that borrowing costs will fall this year, explain the recent improvement in consumer confidence. A University of Michigan poll scheduled for release Friday is expected to show the sentiment index remains near the highest level since July 2021.

Investors will also be watching Fed officials' comments in the days following the CPI data, to gauge the timing of any future rate cuts. Among those on the schedule are regional bank presidents Raphael Bostic of Atlanta and Mary Daly of San Francisco, both of whom are voting on policy this year.

What Bloomberg Economics says:

“To decide when to start cutting interest rates, the Fed will have to reconcile the data it has available — which shows inflation on a fast track toward the 2% target — with the risks that inflation could flare up again or that the labor market could weaken more sharply. Data Next week she will consider that decision, but will not give a definitive answer.

—Anna Wong, Stuart Ball, Elisa Wenger, and Estelle Au, economists. For the full analysis, click here

Heading north, Canadian home sales will reveal whether the market continues to improve ahead of expected interest rate cuts mid-year. Housing and manufacturing starts data will also be released.

Highlights of global events this week include Japan's GDP, UK inflation and wages, and testimony from the head of the eurozone's central bank.

Click here to see what happened last week. Below is a summary of what will happen in the global economy.

Asia

The Japanese economy is expected to rebound from its poor performance over the summer, providing another signal for the Bank of Japan as it prepares to end its negative interest rate policy.

Thursday's figures are also set to confirm that Japan has fallen to the world's fourth-largest economy, behind the United States, China and Germany.

China markets will be closed due to Lunar New Year celebrations, and no major releases are scheduled.

RBI Governor Shaktikanta Das, who maintained a hawkish stance at Thursday's interest rate meeting, may see some progress in his battle against inflation at the start of the week with consumer prices expected to grow at a slower pace in January. However, that probably won't be slow enough to spur talk of a pivot.

The Philippine central bank is expected to keep interest rates steady on Thursday after prices continued to weaken there as well.

Australian jobs numbers earlier today show a return to growth after losses in December.

Singapore will revise its GDP numbers ahead of trade data the next day.

Reserve Bank of New Zealand Governor Adrian Orr set out his latest stance on policy and 2% inflation in a speech on Friday morning, as Malaysia's GDP numbers close out this week.

Europe, Middle East, Africa

UK data will take the spotlight. On Tuesday, pay figures could show the weakest pressure on wages since 2022, cheering Bank of England officials who – like their global peers – are moving towards lower interest rates.

Policymakers will also examine the expected rise in headline inflation, the core measure that excludes volatile items such as energy, in data due on Wednesday.

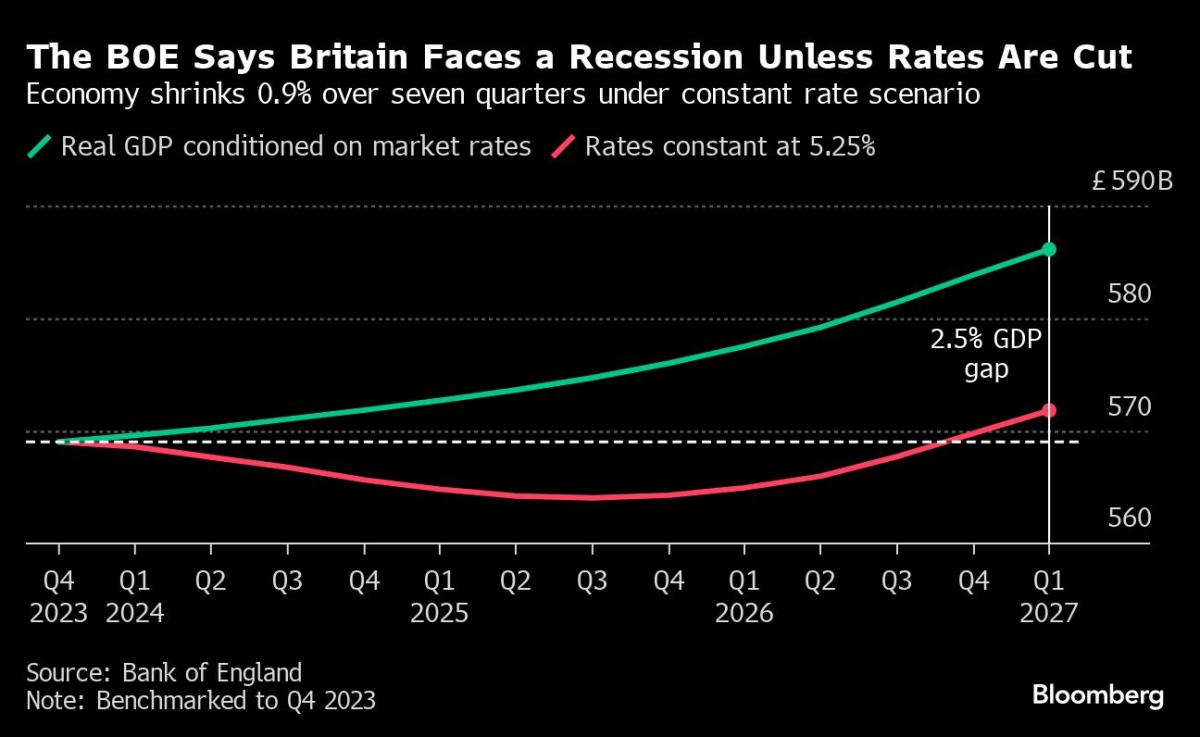

The next day, GDP will indicate how BoE tightening will affect growth. Economists believe the UK is experiencing a recession in the fourth quarter, and is narrowly avoiding one at the moment.

January inflation data will also be released across the region this week:

-

Consumer price growth in Switzerland may slow to 1.6%, while Denmark will release similar numbers.

-

In Eastern Europe, inflation is expected to decline significantly in Poland and the Czech Republic, while rising in Romania.

-

In Ghana, the rate likely fell from 23.2% the previous month, while in Nigeria the reading may have accelerated from 28.9% amid currency weakness.

-

In Israel, inflation is expected to slow to 2.7%.

A series of fourth-quarter GDP figures are also due to be released, with growth in the Eastern European and Norwegian economies likely to remain weak.

Euro zone industrial production on Thursday was a highlight in the currency zone, with a fourth monthly decline in December cited by economists amid falling factory output in economies including Germany.

The emergence of policymakers will attract attention. European Central Bank President Christine Lagarde will testify before lawmakers on Thursday, while several events featuring her colleagues are also scheduled to take place.

Speaking this weekend, ECB Governing Council member Fabio Panetta said that “the time to reverse the monetary policy stance is fast approaching,” warning against a long wait on interest rate cuts.

In Norway, Governor Ida Wolden Bache will deliver her annual speech to the Supervisory Board of Norges Bank.

There are a few pricing decisions on the calendar across the wider region:

-

In Romania on Tuesday, the central bank is likely to keep interest rates at 7% as investors watch for any signs of potential cuts.

-

Zambian officials are preparing to raise borrowing costs on Wednesday to support the struggling currency and limit mounting price pressures.

-

On the same day, Namibia's policymakers are likely to leave borrowing costs unchanged in line with South Africa's pause last month.

-

On Friday, Russia's central bank may remain on hold after its governor, Elvira Nabiullina, signaled in December that its key interest rate would remain high for an extended period to address inflation that is nearly double the 4% target.

latin america

The Carnival holiday marks a quiet start to the week, but Argentina returns on Wednesday to publish its January inflation report.

Consumer prices likely rose 21.9% last month, according to economists surveyed by the central bank, down from 25% in December. These forecasts indicate an annual rate of more than 250%, up from 211% at the end of 2023.

Inflation rose following President Javier Miley's decision to devalue the peso by 54% and remove price controls on hundreds of everyday consumer products.

Colombia publishes a wealth of data, highlighting a sharp slowdown in what was one of Latin America's bright lights post-pandemic.

Industrial production, manufacturing and retail sales have been negative since March, while fourth-quarter output likely contracted from the previous three months. Full-year GDP growth may exceed just 1%, well below the 2021 and 2022 readings of 11% and 7.5%.

Brazil publishes December GDP figures ahead of the quarterly and full-year reports due on March 1, while Peru publishes December economic activity data along with January unemployment in Lima, the capital. And the largest city.

Finally, the Central Bank of Chile is recording the minutes of its January decision to cut interest rates by 100 basis points, to 7.25%. Economists surveyed by the central bank see it reaching 4.75% by the end of the year with inflation returning to 3%.

–With assistance from Piotr Skolimowski, Robert Jameson, Monique Vanek, Brian Fowler, Abeer Abu Omar, Tony Halpin, and Laura Dillon Kane.

(Updates with Panetta in EMEA section)

Most read from Bloomberg Businessweek

©2024 Bloomberg L.P

“Typical beer advocate. Future teen idol. Unapologetic tv practitioner. Music trailblazer.”

More Stories

JPMorgan expects the Fed to cut its benchmark interest rate by 100 basis points this year

NVDA Shares Drop After Earnings Beat Estimates

Shares of AI chip giant Nvidia fall despite record $30 billion in sales