Nvidia shares reached an all-time high today, and their gains may still be just beginning, according to VanEck CEO Jan van Eck.

Van Eck, whose company runs the largest U.S. quasi-exchange-traded fund, points to his edge in the race to make artificial intelligence chips that could boost the performance of stocks including Nvidia.

“It's just that these companies have huge competitive advantages, almost near-monopolies,” he told CNBC's “ETF Edge” on Monday.

Nvidia shares are up 216% over the past year and 41% since Jan. 1, through Wednesday's close.

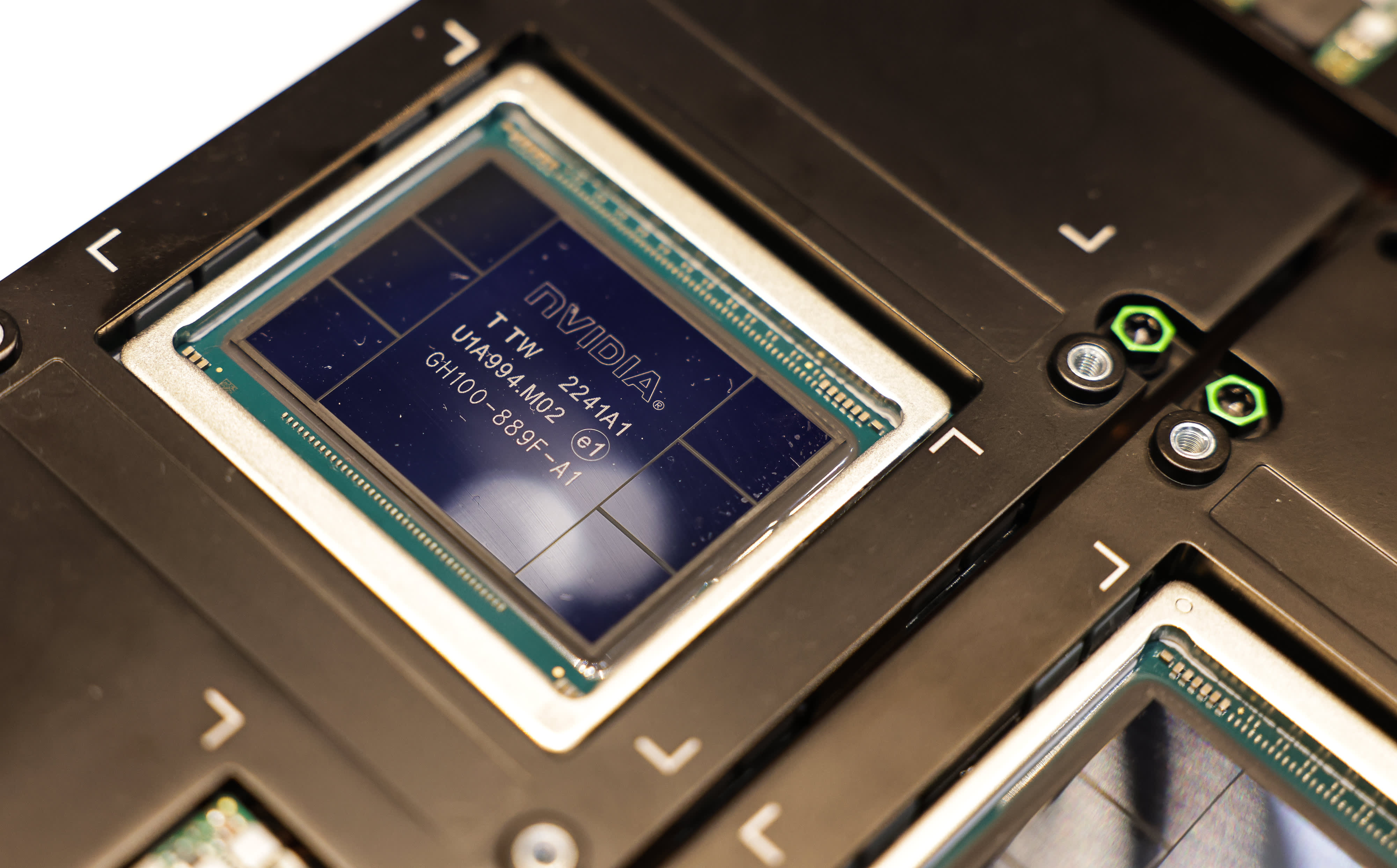

“Who competes with Nvidia on GPUs [graphics processing units]?” he asked. “They've got great pricing power. “They've got artificial intelligence.”

Nvidia is the leader of the VanEck Semiconductor ETF. The fund tracks 25 of the largest semiconductor companies weighted by market cap. According to FactSet, Nvidia accounts for nearly a quarter of the fund's assets.

“[Nvidia’s] “The bullets are very large,” Van Eck added. “The return on equity is huge.”

He suggests that as more competitors enter the AI graphics processing space, Nvidia's more advanced capabilities could mitigate the company's current status as the most valuable semiconductor stock.

“They're trying to build their moat by acquiring software services, and now they're building a cloud solution,” Van Eck said. “But who can really compete with them?”

The VanEck Semiconductor ETF's top holdings as of Wednesday are Nvidia, Taiwan Semiconductor and Broadcom. The ETF is up more than 12% this year.

Disclaimer

“Typical beer advocate. Future teen idol. Unapologetic tv practitioner. Music trailblazer.”

More Stories

JPMorgan expects the Fed to cut its benchmark interest rate by 100 basis points this year

NVDA Shares Drop After Earnings Beat Estimates

Shares of AI chip giant Nvidia fall despite record $30 billion in sales