- Banks are turning to Bitcoin investments, indicating a change in views.

- The US House of Representatives approves a bill that relaxes SEC guidelines, showing acceptance of cryptocurrencies

In new Submit Form F13JPMorgan has disclosed a $731,246 investment in a Bitcoin exchange-traded fund on behalf of its clients.

They allocated the majority, $477,425, to BlackRock’s IBIT, along with investments in Bitwise’s BITB, Fidelity’s FBTC, and Grayscale’s GBTC.

US banking giant Wells Fargo, which owns 2,245 GBTC shares worth $121,207, joined the fray.

At the time of writing, BTC is trading at $60,864 having seen a 3.34% decline but there is still a noticeable shift among investors.

More banks are joining

In early April, it was the second largest bank in Europe, Banque Nationale de Paris Paribas, purchased 1,030 shares of IBIT stock for $41,684.10. In the first quarter of 2024, their price was $40.47 each, far less than the current value of a single bitcoin.

Interestingly, just like Dimon, Sandro Peri, head of fund management group BNP Paribas Asset Management, refuted BTC’s potential in September 2022 and said:

“We are not involved in cryptocurrencies and do not want to be involved in them.”

These developments indicate a marked shift in the attitude of many banks, indicating a growing interest and openness towards Bitcoin as an investment vehicle.

The tides are turning

In January, the CEO of JP Morgan said: Jamie Damon Take a bold stance against Bitcoin [BTC] During a conversation on “Squawk Box”. He said,

“There are cryptocurrencies that do something, that might have value. Then there’s one that does nothing, I call it the ‘pet rock.’ Bitcoin, or something like that.

However, he noted,

“It has some use cases. Everything else is people trading among themselves.

Bitcoin: What do the metrics say?

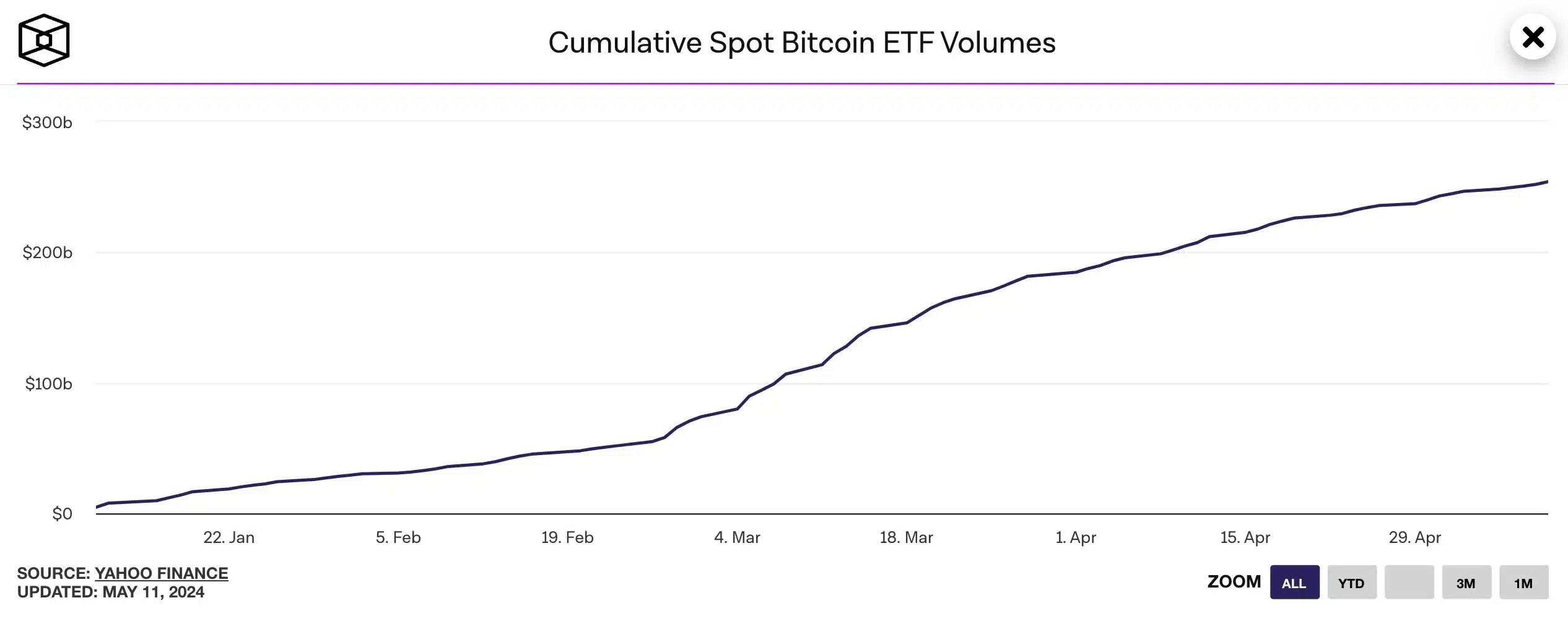

The increase in cumulative spot Bitcoin ETF volumes reinforced this assertion, representing the total trading activities of spot Bitcoin ETFs within a given time frame.

Source: Cluster

The US House of Representatives approved a invoice To ease SEC guidelines, signaling growing acceptance of cryptocurrencies despite banks’ historical resistance to digital assets.

Speaking of the same, the Biden administration Pledge To veto legislation if approved by the Senate.

“Unduly restricting the SEC’s ability to ensure appropriate guardrails and address future issues related to crypto assets including financial stability.”

“Typical beer advocate. Future teen idol. Unapologetic tv practitioner. Music trailblazer.”

More Stories

JPMorgan expects the Fed to cut its benchmark interest rate by 100 basis points this year

NVDA Shares Drop After Earnings Beat Estimates

Shares of AI chip giant Nvidia fall despite record $30 billion in sales