- 21Shares has taken the lead with VanEck in pursuing the Spot Solana ETF

- An increase in Solana flows can be expected if the requests are approved.

Solana [SOL]Solana’s market performance over the past few years has caught the attention of many Wall Street institutions recently, so it’s no surprise that some of them are now keen on the idea of a Solana ETF.

21 stocks moving

In a move to capitalize on the growing interest in SOL, Swiss asset management firm 21Shares has filed to request To list the Solana ETF in the US. This filing closely follows a similar application filed by its competitor – VanEck.

21Shares’ filing is based on the altcoin’s legal classification. The filing assumes that Solana is not considered a security under U.S. law. This distinction is important because security ETFs face stricter regulations than standard ETFs.

If the SEC classifies them as securities, 21Shares may withdraw its application entirely. This potential withdrawal may stem from additional registration requirements that come with securities ETFs, which 21Shares may not be willing to meet.

How will SOL be affected?

The potential Solana ETF is expected to boost the price of Solana (SOL), similar to the way Bitcoin’s price rose after its spot ETF was approved.

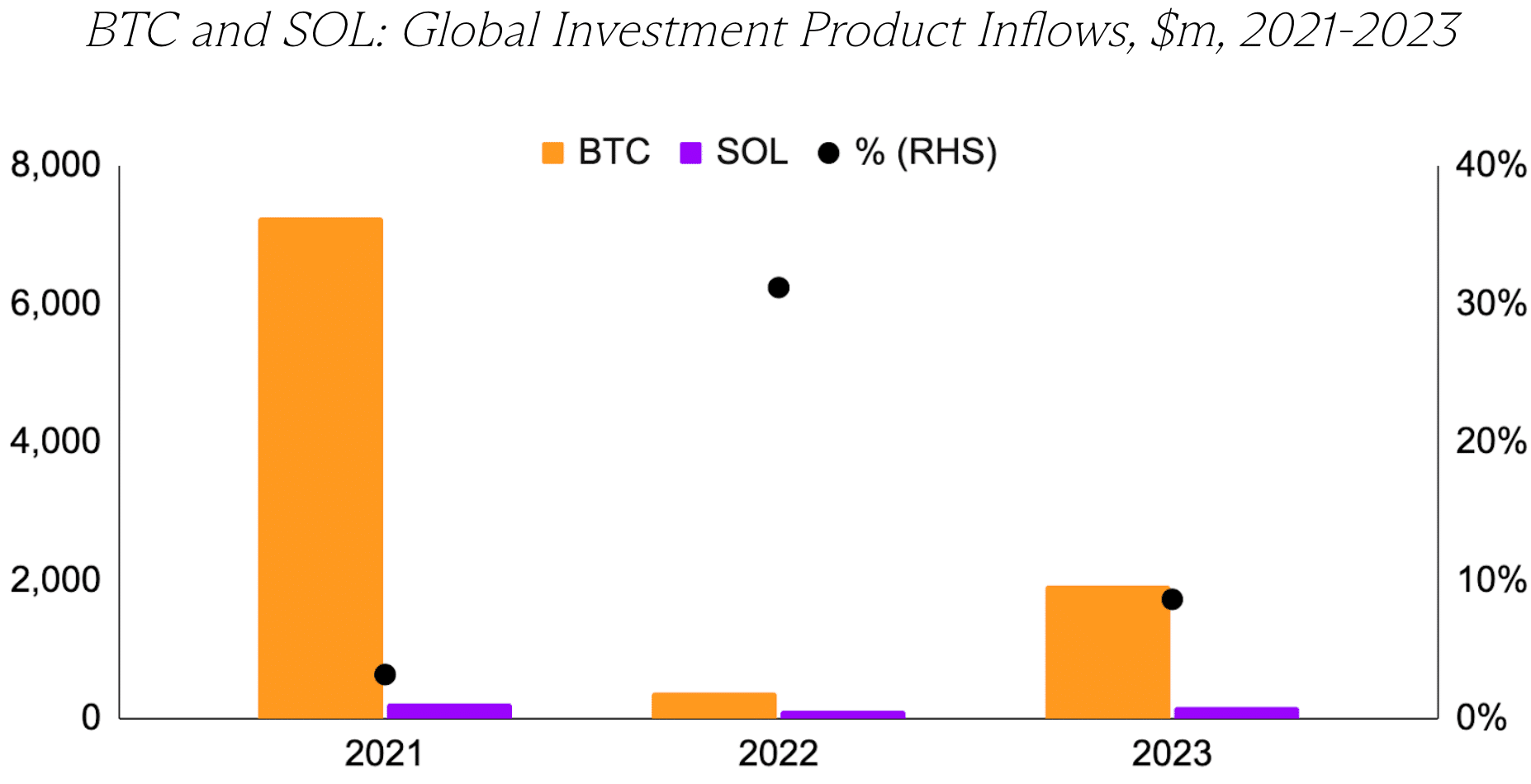

In fact, it happened recently analysis By GSR Markets actually used Bitcoin’s 2.3x price rise as a starting point. It’s worth noting that they acknowledged that Solana’s ETFs likely won’t attract the same level of investment. To account for this, GSR instead explored three scenarios based on potential investment flows, comparable to Bitcoin ETFs.

In the case of the bears, they assumed a 2% increase in inflows to Sol. This assumes a low level of interest in Solana ETFs, with only 2% inflows compared to Bitcoin.

Next comes the base scenario, which would result in 5% more inflows than Bitcoin. This would be a more moderate scenario based on actual investment activity in Solana products from 2021 to 2023, excluding 2024 to avoid the impact of Bitcoin ETFs.

In the most optimistic and bullish scenario, GSR took into account relatively higher inflows to SOL in 2022 and 2023. It estimated that the altcoin could attract 14% of inflows, compared to Bitcoin on average.

Source: GSR

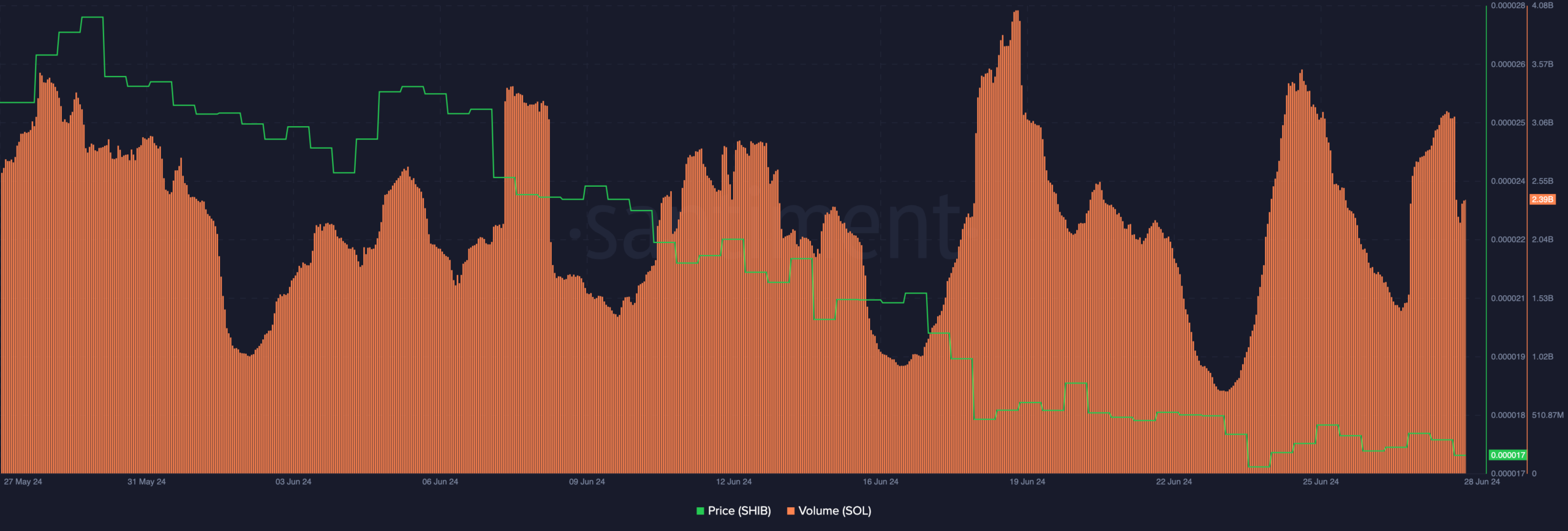

At the time of publishing this report, SOL price was trading at $141.80, having dropped by 2.53% in the last 24 hours. In fact, its trading volume during the above mentioned period decreased by 33.23% on the charts as well.

Is your investment portfolio green? Check out SOL’s earnings calculator

Source: Santiment

“Typical beer advocate. Future teen idol. Unapologetic tv practitioner. Music trailblazer.”

More Stories

JPMorgan expects the Fed to cut its benchmark interest rate by 100 basis points this year

NVDA Shares Drop After Earnings Beat Estimates

Shares of AI chip giant Nvidia fall despite record $30 billion in sales