The method of calculating the annual social security ceiling on wages depends on the size of the ceiling, which is reassessed according to changes in pay.

The social security ceiling has not changed in 2022 but the BOSS is bringing many clarifications and changes.

Keep in mind that old age insurance contributions are calculated each month, within the monthly value of the Social Security ceiling, in the number of calendar days. The same rules apply to additional pension contributions and differ significantly from previous calculation methods.

This monthly calculation does not change the progressive regularization of contributions due to the old age insurance of the basic plan.

A one-time rate is paid to employees who are paid for every month (every two weeks or every quarter).

The BOSS has made a number of clarifications and changes and allows employees working less than 218 days per year from January 1, 2021, to increase the Social Security ceiling according to the number of days..

In the absence of continuous fixed-term contracts, the amount of the ceiling will not be contracted out, and the first employment contract will formalize the ceiling taking into account the amounts paid from the date of hiring. This measure should be used from January 1, 2022.

Finally, the reduced ceiling for part-time employees is calculated in full-time employee-related hours.

Rules for monthly calculation of basic old age insurance contributions

For example, the calculation of old age insurance contributions is monthly for some employees who are paid fifteen or weekly. This will be the same for all other salaries annually.

Thus, old age insurance contributions, the basic pension plan for employees and the limited contributions for additional pension plans are calculated monthly on calendar days, in line with the Social Security ceiling.

Contributions calculated within the annual ceiling are regularized each month.

|

Monthly cap = |

(Monthly value of Social Security ceiling) x (Number of employment periods) Number of calendar days in the month |

Proportional adjustment of the ceiling for sales representatives and monthly salaries

Under the provisions of the Labor Code, non-monthly salary is paid at least twice a month.

Sales representatives or travelers, Usher representatives will be paid at least once every three months.

The monthly Social Security ceiling (PMSS) is reassessed each year and is calculated on a pro rata basis according to the frequency of pay.. This is the maximum amount set by Article D242-17 of the Social Security Code.

Exceptionally, employees who are stripped from the adjusted ceiling benefit from 50% of the monthly social security ceiling..

|

Ceiling of the month = |

(Monthly value of pay period Social Security cap) x (Number of days in employment period) Number of calendar days |

Example of calculating the Social Security ceiling for a monthly salary

The monthly salary is paid on the 15th day of the month and on the last day of the month covering 28 calendar days. Its ceiling is equal to:

3,428 x 15/28 = 1,836 rounds for first pay.

3,428 x (28 – 15) / 28 = 1,592 round for the second pay.

As a reminder, in a leap year, the number 28 will be replaced by 29.

Reduction of Social Security ceiling for part-time employees

The ceiling value used for part-time employees is related to the number of hours provided in the contract, the number of overtime hours, the legal working hours or the period of time specified by the branch contract. Applicable term work in a company or organization.

|

Ceiling = |

(Monthly value of Social Security ceiling) x (contract work time + overtime) Legal period of work |

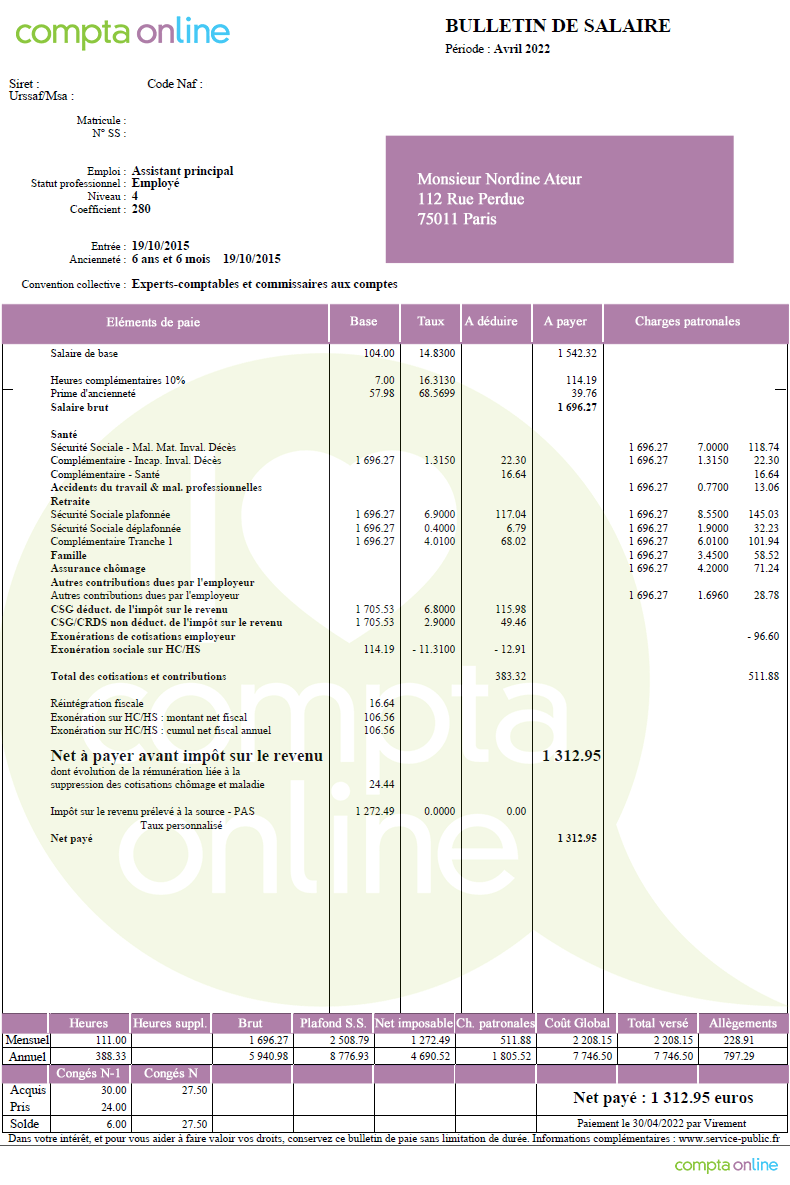

Example of calculating the PMSS of a part-time employee

An employee works 24 hours a week. In April, he worked an additional 7 hours. The ceiling value is calculated as follows:

24 * 52/12 + 7 = 104 contract time + 7 = 111 hours

3,428 * 111 / 151.67 = 2,508.79

The full-time pay that operates based on the rate of the Social Security ceiling is no longer available.

Social Security ceiling calculation in case of entry or exit during the month

The Social Security ceiling is calculated on a pro rata basis, based on the total number of days in the month when the employee is hired or the employment contract ends during the month. For the 30-day month, the Social Security ceiling is calculated at 30 and at 31 months for the 31-day month.

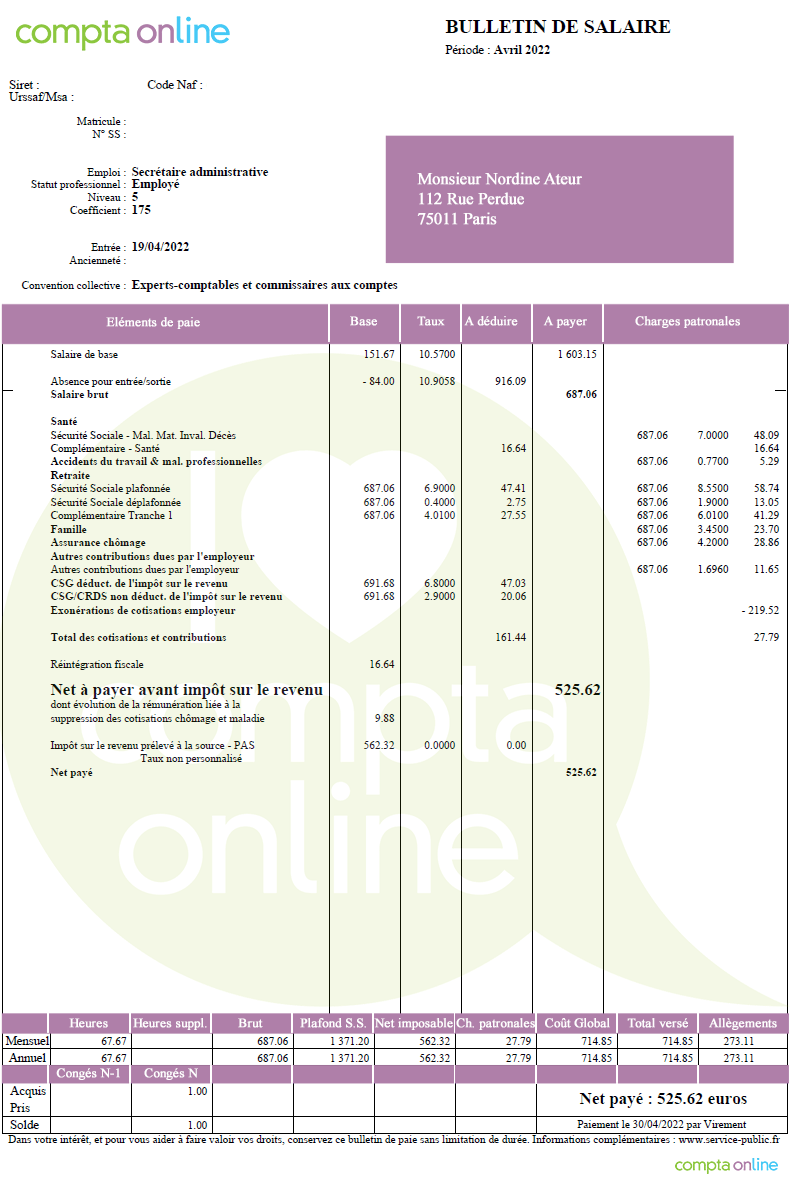

Example of calculating the PMSS of an employee hired during the month

An employee was hired on April 19th. There are 30 days in this month and the employee will be on the 12 calendar days of the working month from April 19th to 30th.

The ceiling value will be calculated on his pay slip as follows:

3,428 * 12/30 = 1,371.20

Reduction of Social Security ceiling if employment contract is suspended: Disease …

The Social Security ceiling is calculated at short intervals (Daily Social Security benefits or sickness with or without unpaid leave). Lack of pay is taken into account.

Protestation will be mandatory One or two days sick or unpaid leave and the number of days is done. The monthly Social Security ceiling is lowered to take into account the days of the unpaid period.

The following formula applies:

|

Monthly cap = |

(Monthly limit value) x (Number of paid days during employment) Number of calendar days in the month |

The number of paid days in the working period corresponds to the number of calendar days that are deducted from the days that do not lead to the maintenance of pay.

BOSS states that there is no reduction in the ceiling in the absence of hours or half days.

Maybe Salary maintenanceThe ceiling is only lowered according to the waiting days.

Therefore, even the partial pay for the absence of BOSS (compensation subject to social security contributions, types of benefits, increase in time savings account) will not be reduced. The same rule applies if an employee is given a bonus or another element of pay that cannot be linked to previous work.

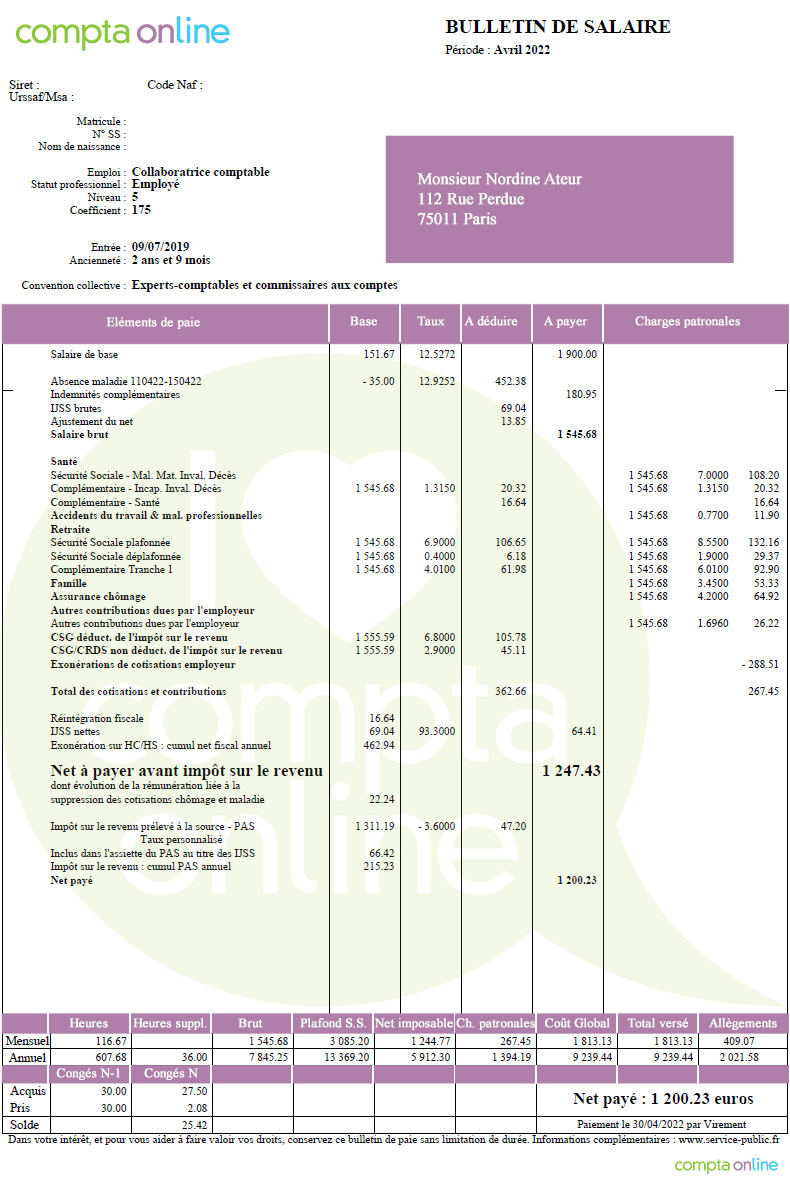

Example of calculating the PMSS of an employee on sick leave with continuous pay

An employee is on sick leave from April 11 to 15, i.e. 5 calendar days. The collective agreement provides for salary maintenance beyond the 3 day waiting period.

Number of days taken into account in ceiling calculation:

There are 30 calendar days in April, with a waiting period of 3 days with continuous pay beyond 3 days, i.e.:

30 days – 3 days wait = 27 days

The value of the Social Security ceiling will be calculated on his pay slip as follows:

3,428 * 27/30 days = 3,085.20

For bonuses and other components of compensation, action must be taken with the possibility of applying in advance from January 1, 2022..

On the other hand, IJSS is reduced only when refunded (without additional compensation).

These rules do not apply in the event of partial operation subject to contributions (the ceiling will be reduced) with additional compensation.

Social Security ceiling and employee leave

There is no rate calculation for the Social Security ceilingWhen employees take national holidays, Because his employer is expected to maintain his salary during this period.

There is one exception: the country’s vacation fund. When the branch of activity contributes to the leave fund of a particular country, the social security ceiling is calculated with the number of working days.

The employee on leave receives:

- From his employer: Wages deducted for lack of paid leave;

- From the country’s vacation fund: Compensation for the same period.

Country leave funds are available in the following fields:

- Construction and public works;

- Port and dock handling;

- Entertainment sector;

- Non-stop workers in transport.

“Beeraholic. Friend of animals everywhere. Evil web scholar. Zombie maven.”

More Stories

What are the 5 most spoken languages in the world?

Master the Art of Applying Acrylic Nails at Home: A Complete Guide

Tortoises as Family Pets: Teaching Responsibility and Care