- ETH price rose more than 5% on May 3

- This contributed to the increase in the number of liquidated short positions

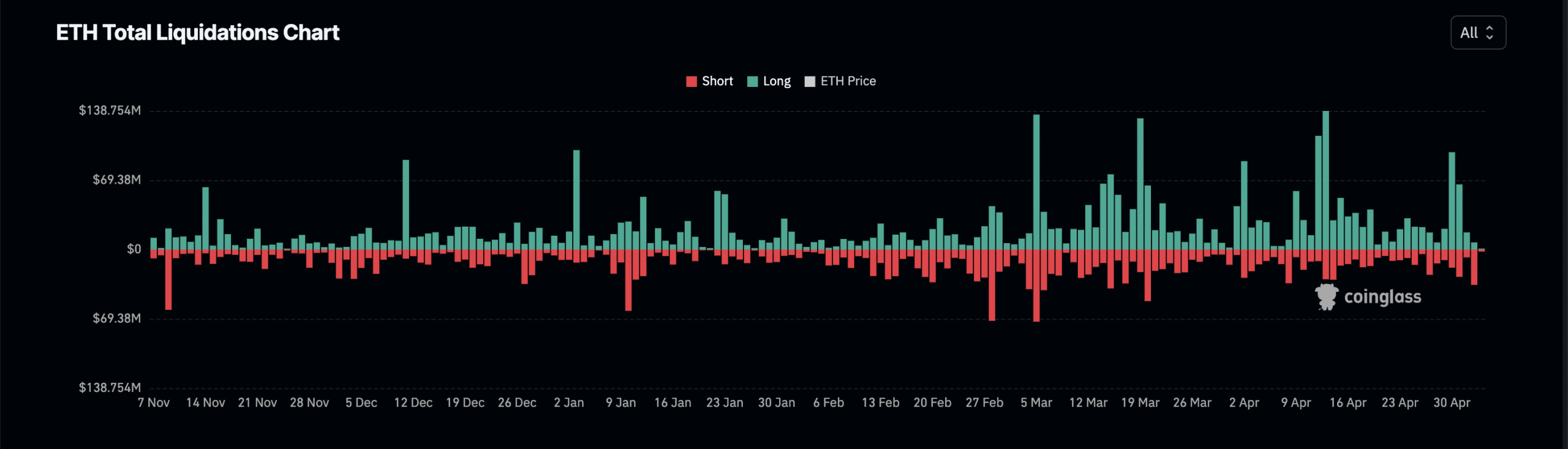

Ethereum [ETH] A 7% price rise during the intraday trading session on May 3 sent short liquidations in the derivatives market to a two-month high, according to Quinglass.

In fact, the on-chain data provider went on to reveal that on that day, $35 million worth of ETH short positions were liquidated. By comparison, long liquidations totaled just $7.16 million.

Source: Coinglas

Liquidations occur in the asset derivatives market when a trader’s position is forcibly closed due to insufficient funds to maintain it. Short liquidations occur when the value of an asset suddenly rises, and traders who have open positions in favor of falling prices are forced to exit their positions.

according to Santiment According to the data, on May 3 the altcoin closed above $3,000 after trading below this price level since the beginning of the month.

Derivatives market traders remain in position

Ethereum’s price is still gaining ground at press time, rising more than 5% over the past 24 hours. At the time of writing, the market-leading altcoin is valued at $3,104.

Here, it is worth noting that Coinglass data also indicates that the price rise did not stimulate any significant activity in the ETH derivatives market. In fact, trading volume in this market increased by only 2%.

Read about Ethereum [ETH] Price forecasts 2024-25

Likewise, open interest for currency futures registered a slight increase of 3% during the same period. Open interest for ETH futures was $10.68 billion at press time. Furthermore, ETH options volume fell by more than 50% during the period under review.

Options trading gives participants the right to buy or sell an asset on a specific date. In general, when ETH sees a decrease in its options volume, it means there is less speculation about future price movements as market participants wait to see which direction the coin market might go next.

The combined reading of a slight increase in ETH futures trading volume and a decline in options volume suggests that crypto derivatives market participants have adopted a “wait and see” approach. Simply put, they are not placing large bets on where its price might go next.

“Typical beer advocate. Future teen idol. Unapologetic tv practitioner. Music trailblazer.”

More Stories

JPMorgan expects the Fed to cut its benchmark interest rate by 100 basis points this year

NVDA Shares Drop After Earnings Beat Estimates

Shares of AI chip giant Nvidia fall despite record $30 billion in sales