- The increase in Coinbase Premium Gap indicates an increase in the price of ETH.

- However, the price of ETH may not reach $4000.

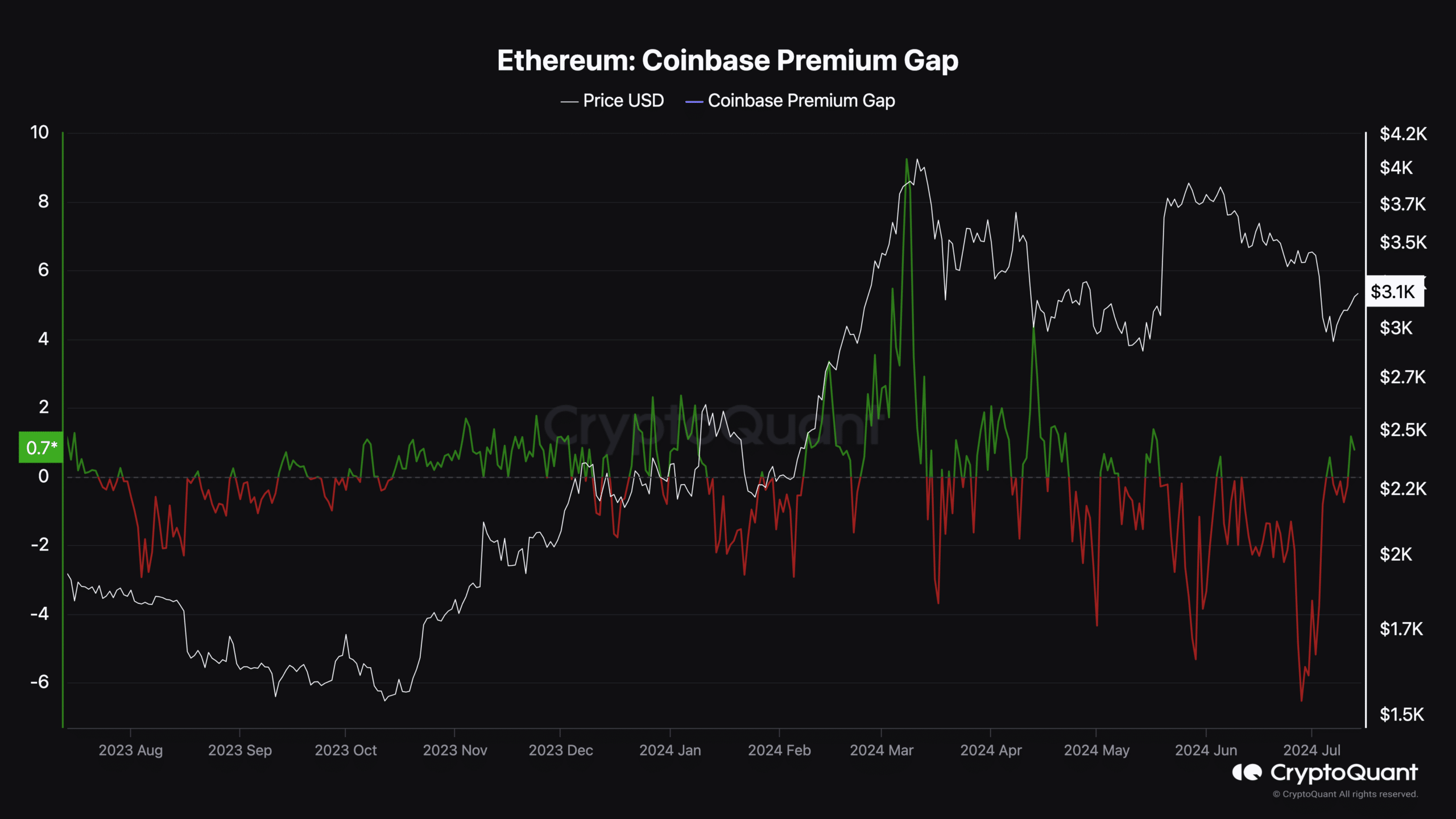

According to data from CryptoQuant, cryptocurrency investors have been buying Ethereum [ETH] In large numbers. This was evident from the Coinbase Premium Gap trend.

This metric measures the difference between the price of ETH on Coinbase and the price on Binance. When it falls, it means that investors from the US are selling ETH or refraining from buying.

Americans now trust altcoins

But higher values, such as its recent high of 0.78, indicate strong buying pressure from the U.S. According to AMBCrypto’s findings, the increased exposure to Ethereum could be linked to the launch of an Ethereum exchange-traded fund.

But apart from that, it He provides The price of the altcoin has a higher potential to rise. For example, in March 2023, Coinbase Premium gapped to its lowest point ever.

Source: CryptoQuant

This caused the price of ETH to drop below $1400. In March 2024, the same metric reached its highest point. At that time, the price of ETH jumped to $4065.

At the time of writing, ETH’s market cap is $3,194. This represents a 34.70% drop from its all-time high. However, if buying pressure continues to improve in the US and other regions globally, we may see the price erase some of this decline.

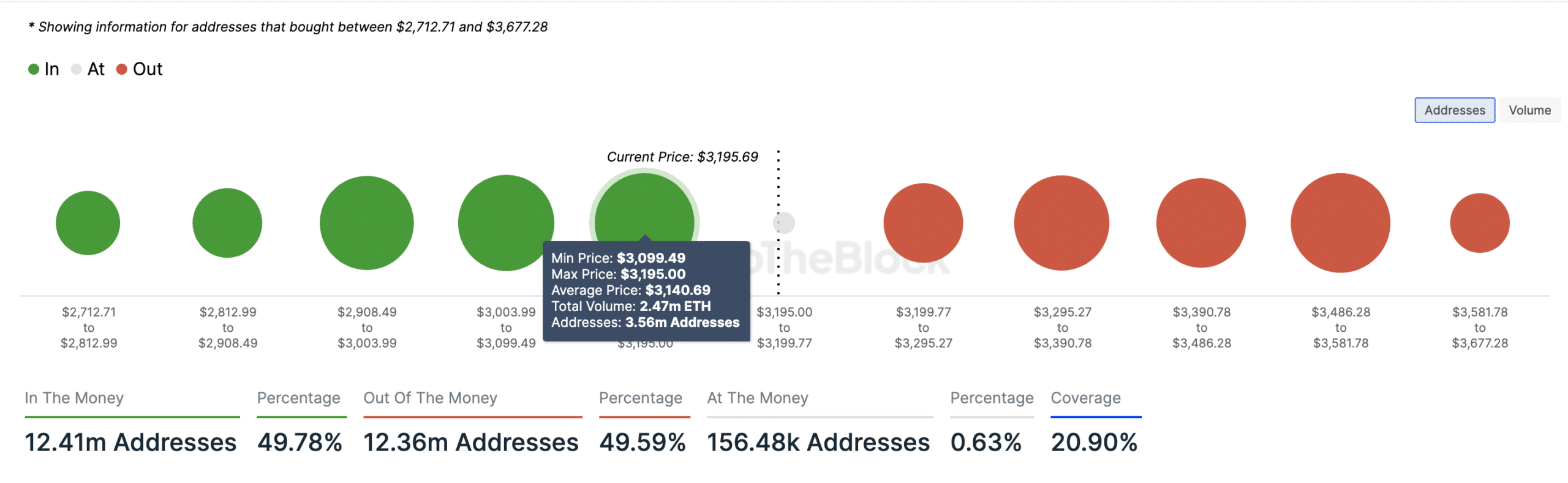

Furthermore, the data tracked by IntoTheBlock provides context for where Ethereum’s price could go if the accumulation intensifies. The specific metric AMBCrypto looked at was IOMAP.

ETH on the verge of retesting $3437 despite neutral sentiment

IOMAP stands for In/Out of Money around Price. Additionally, this indicator identifies buying and selling areas that are supposed to act as support or resistance.

Titles are ranked based on those that make money, those that break even, and those that don’t.

The larger the pool of addresses in a price range, the stronger the support or resistance levels it provides. As of this writing, 3.56 million Ethereum addresses are in a good position and have purchased 2.47 million ETH at an average price of $3,140.

On the right, 2.02 million addresses bought 4.01 million ETH worth $3,242 and are out of the money. Looking at Bigger titles in moneyThere is a possibility that ETH will break the resistance level at $3242.

Source: IntoTheBlock

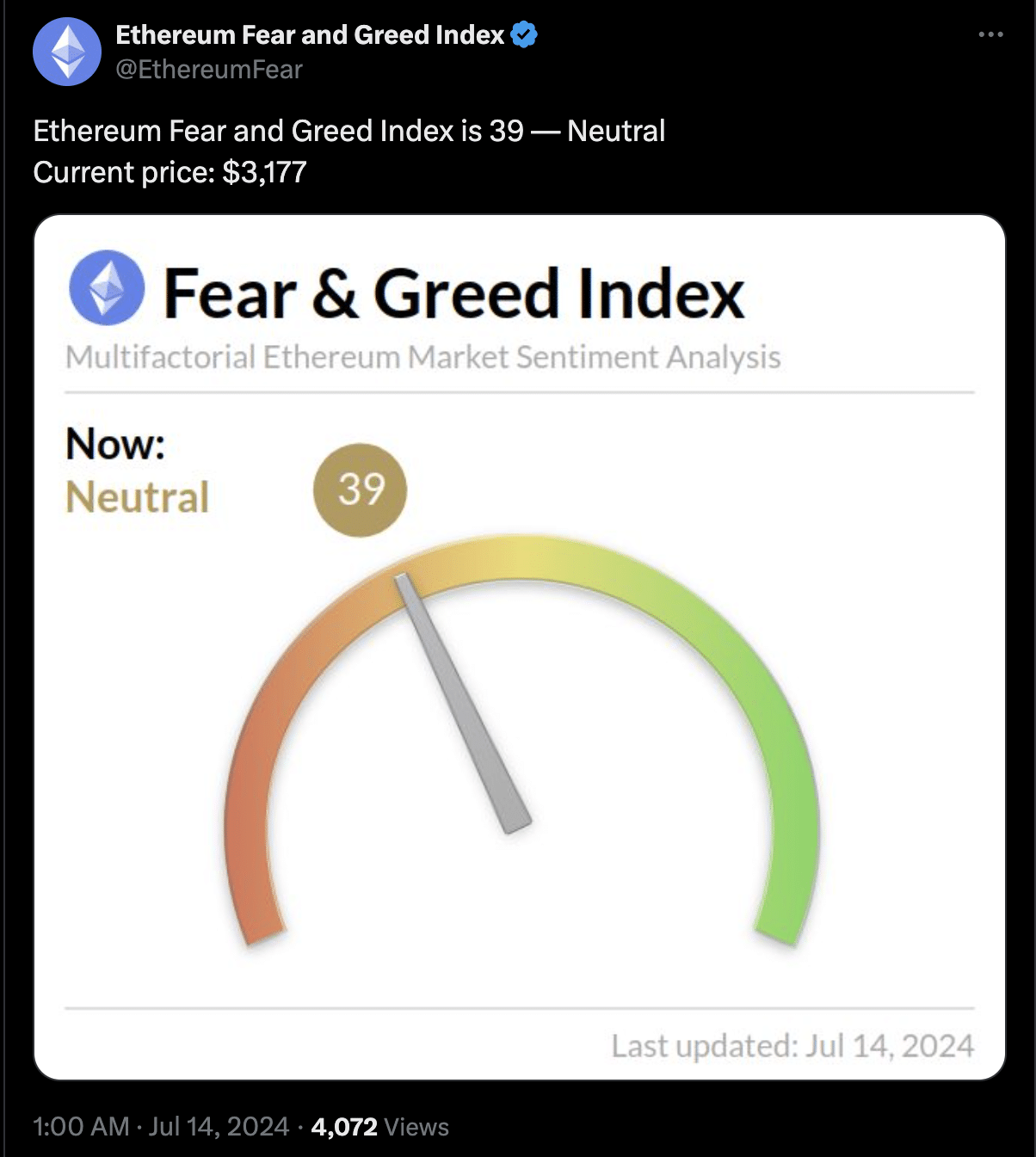

If so, the next area the cryptocurrency could reach could be $3,347. AMBCrypto checked the Ethereum Fear and Greed Index to see if it’s a good time to buy ETH.

Furthermore, this index ranges from 0 to 100. Values close to 0 indicate fear, and values close to 100 indicate greed. As of this writing, the index was 39, meaning there was neither extreme fear nor greed.

Source:X

Read about Ethereum [ETH] Price forecast 2024-2025

However, the reading provides an opportunity to buy the altcoin especially since the launch of the ETF looks like a bullish event.

While the price of ETH appears to be heading higher, the decline in overall interest may invalidate this prediction.

“Typical beer advocate. Future teen idol. Unapologetic tv practitioner. Music trailblazer.”

More Stories

JPMorgan expects the Fed to cut its benchmark interest rate by 100 basis points this year

NVDA Shares Drop After Earnings Beat Estimates

Shares of AI chip giant Nvidia fall despite record $30 billion in sales