- Ethereum has trended within a range over the past 10 days.

- Futures traders continue to take long positions.

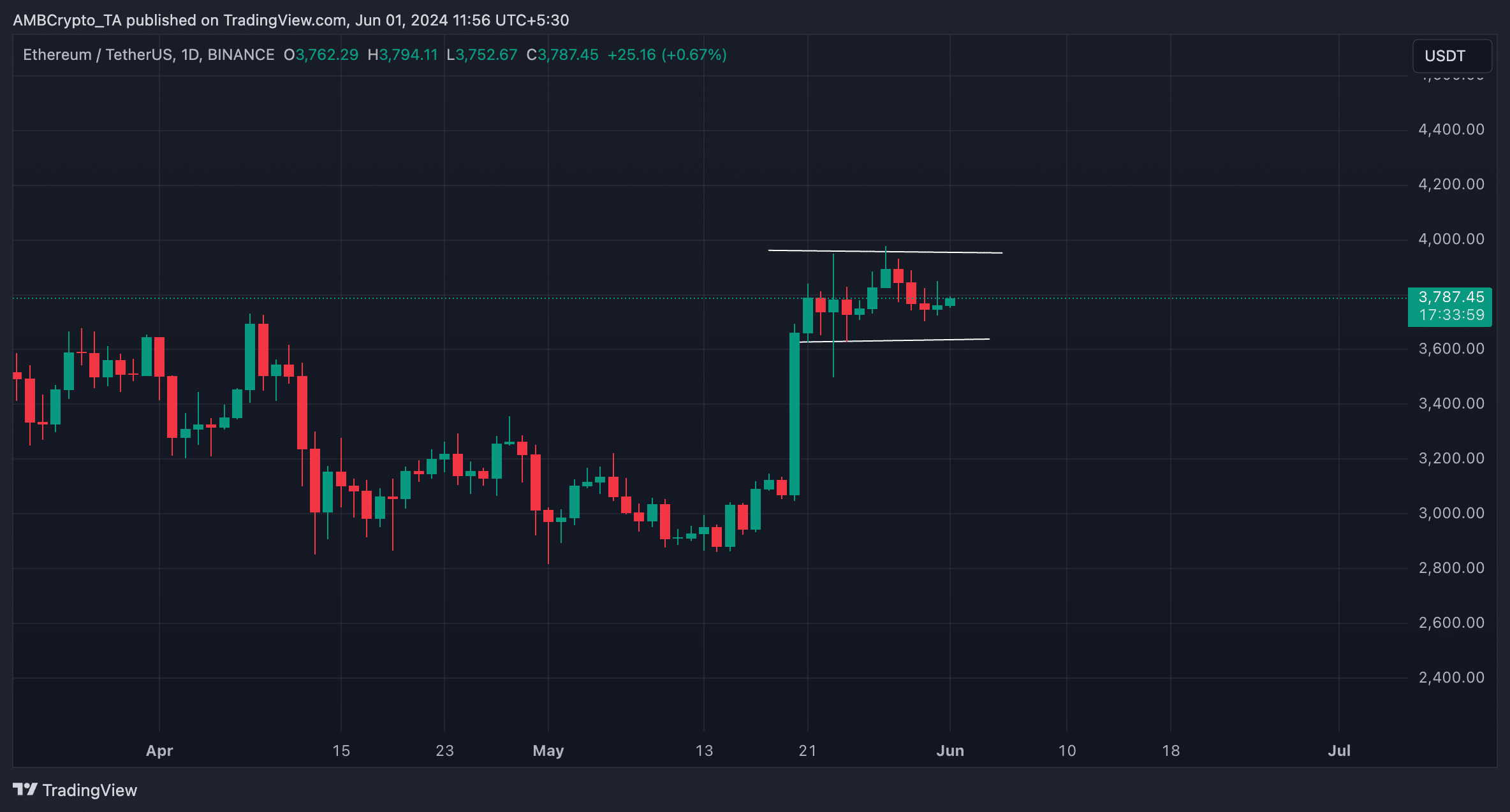

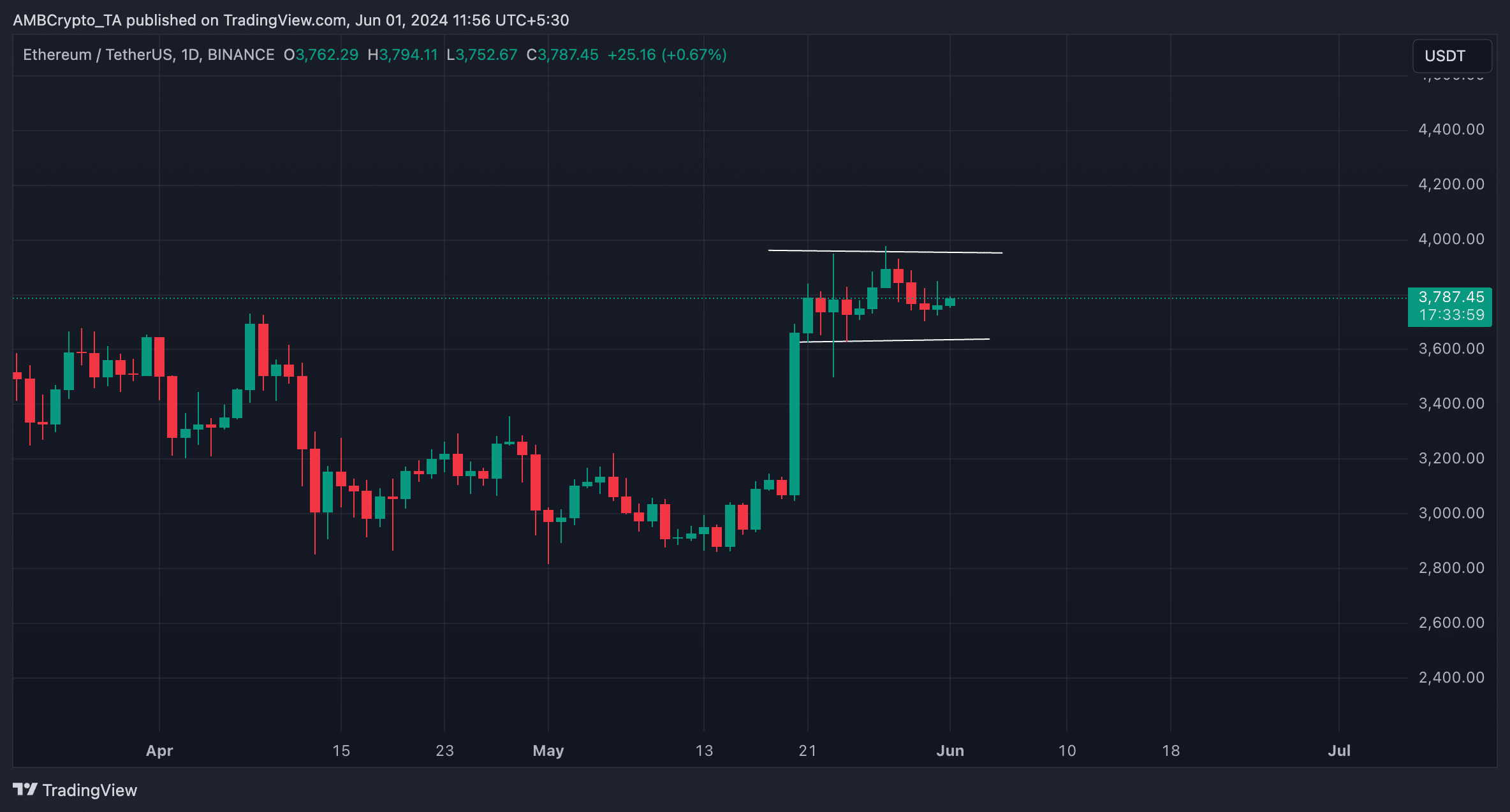

Analysis of Ethereum [ETH] The price forecast showed that ETH has been trending inside a horizontal channel since it closed above $3,650 on May 20.

A horizontal channel is formed when the price of an asset consolidates within a range for some time. This occurs when there is a relative balance between buying and selling pressures, preventing the asset price from trending strongly in either direction.

The upper line of this channel forms resistance, while the lower line forms support. As for ETH, it formed resistance at $3,962, while it found support at $3,638.

Source: ETH/USDT, TradingView

Ethereum price prediction shows bulls are here

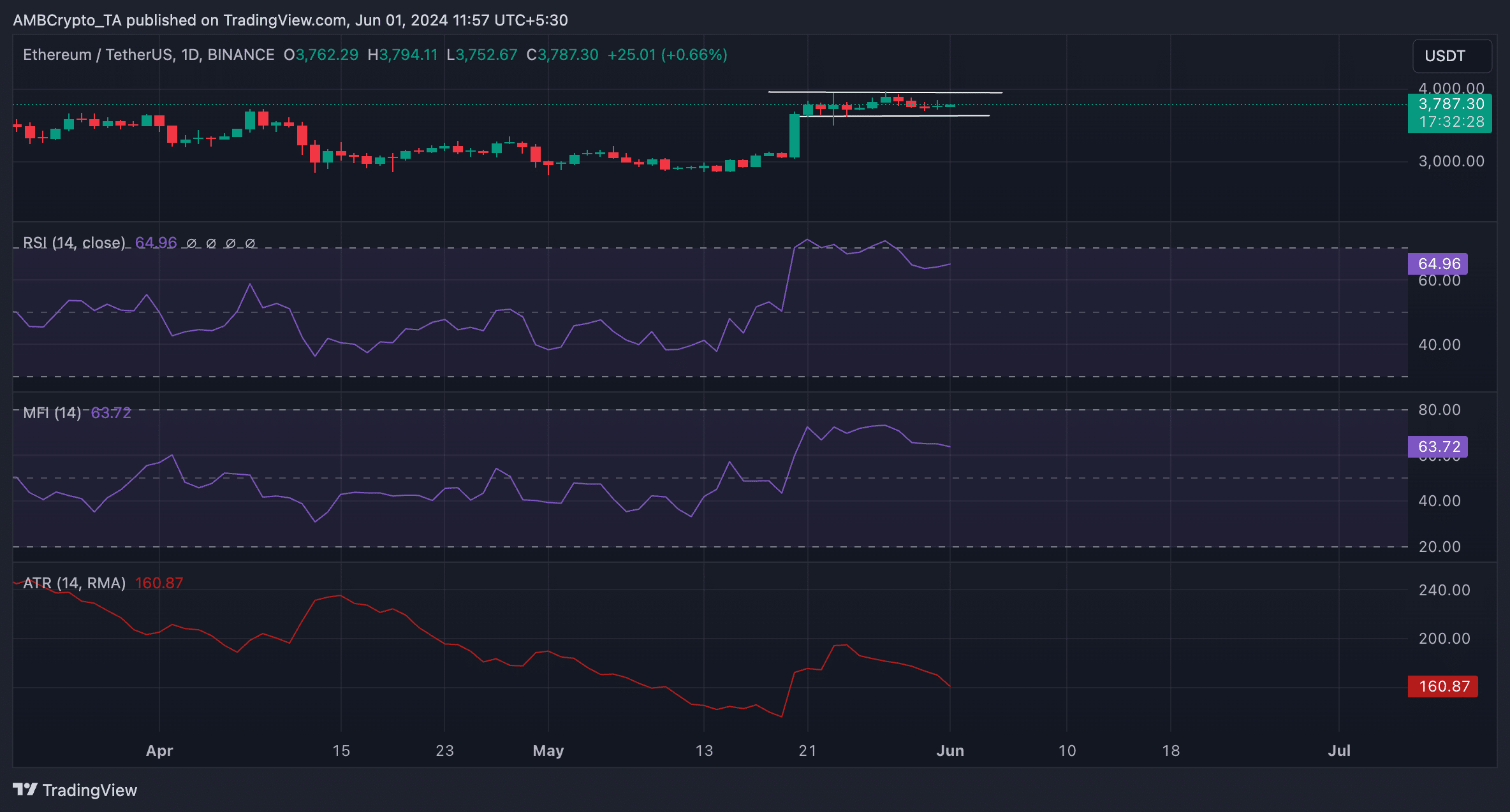

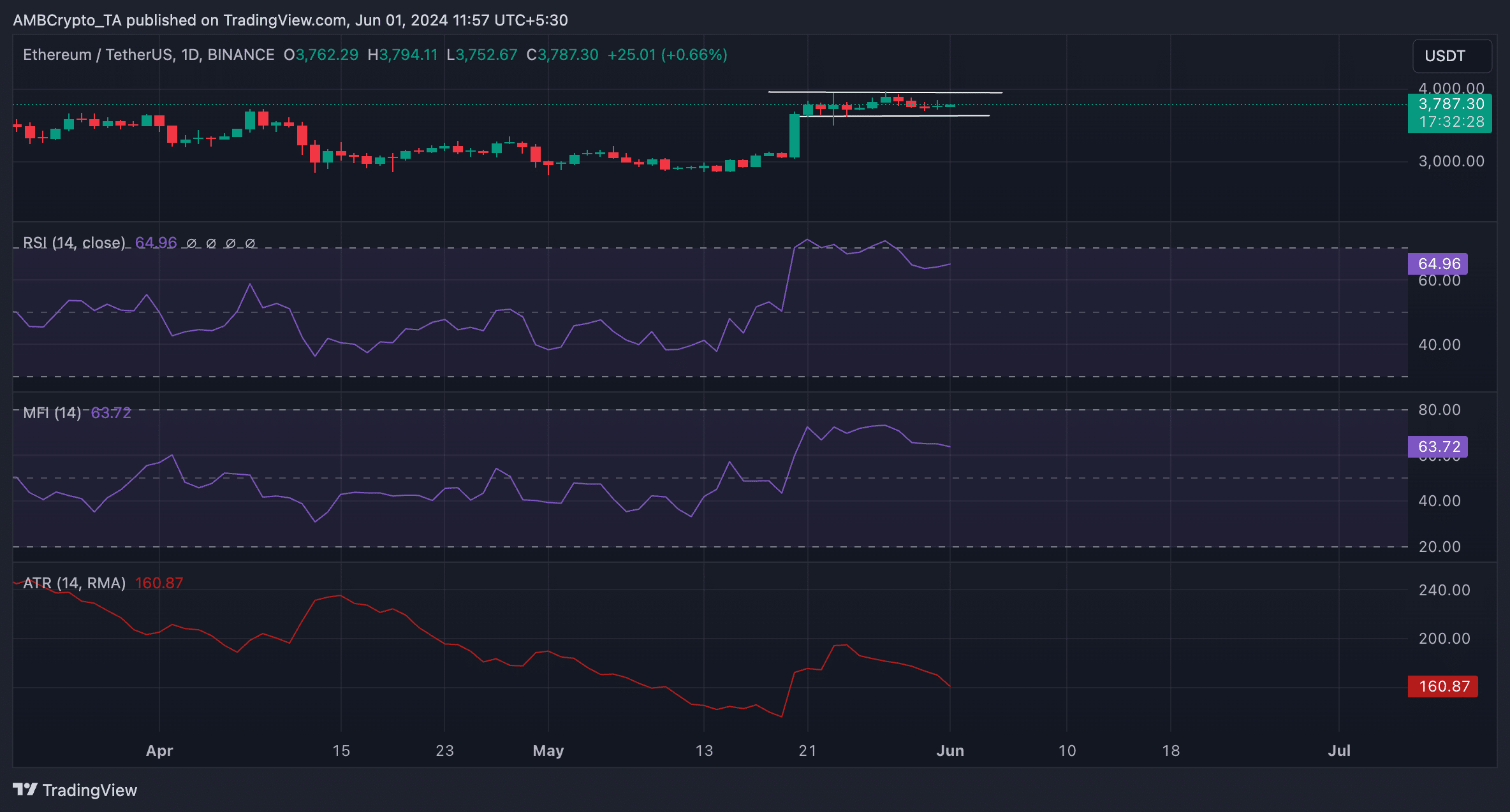

Observed readings from key momentum indicators for ETH confirmed that the market has been characterized by equal amounts of buying and selling activity in the past few days.

Although the Relative Strength Index (RSI) and Money Flow Index (MFI) for ETH are still above the 50 neutral point, they have been “stable” in the past few days.

These momentum indicators are said to be flat when they are trending in a seemingly straight line, with no significant swings up or down.

When they trend this way, it indicates there is no strong buying or strong selling pressure. Traders interpret this to mean that there is no clear signal for a breakout up or down.

As of this writing, ETH’s RSI is 64.92, while its MFI is 63.74.

Moreover, a decline in the average true range (ATR) of the currency confirmed the price consolidation. This indicator measures market volatility by averaging the range between high and low prices over a specified number of periods.

Source: ETH/USDT, TradingView

When the indicator decreases, it indicates decreased market volatility and indicates that the asset price is trending within a range without significant movements up or down.

Futures traders are unaffected

Despite ETH’s sideways price movements in the past few days, futures market activity has continued to grow. Since May 20, open interest in currency futures has increased by 42%.

Is your wallet green? Check out our Ethereum Profit Calculator

When the open interest of an asset’s futures contracts rises in this way, more traders enter the market to open new trading positions. At press time, open interest for ETH futures was $16.45 per Quinglass Data.

Regarding whether these traders are opening buy or sell positions, the positive funding rate for ETH across cryptocurrency exchanges has remained positive. This indicates that the demand for long positions was greater than the demand for short positions.

“Typical beer advocate. Future teen idol. Unapologetic tv practitioner. Music trailblazer.”

More Stories

JPMorgan expects the Fed to cut its benchmark interest rate by 100 basis points this year

NVDA Shares Drop After Earnings Beat Estimates

Shares of AI chip giant Nvidia fall despite record $30 billion in sales