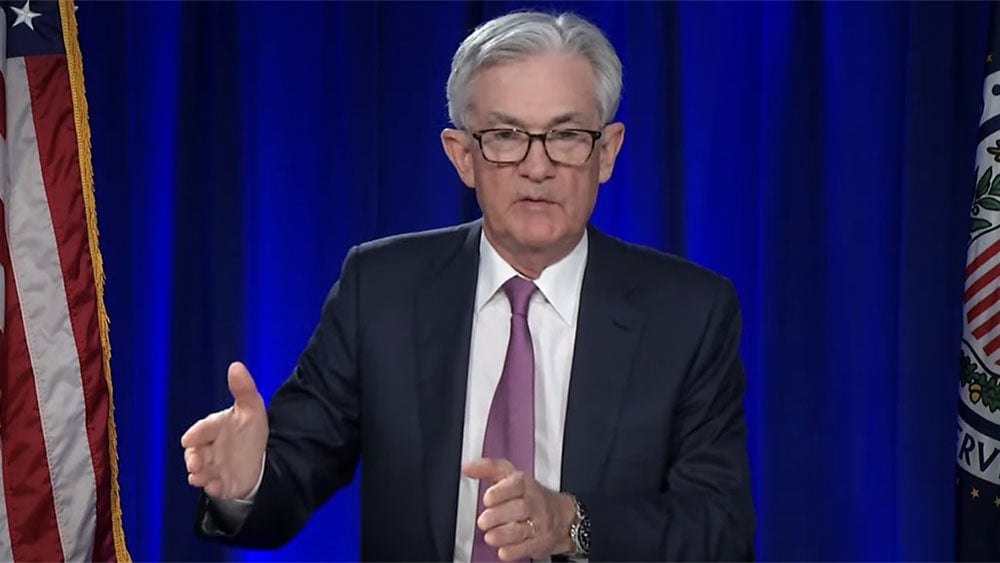

Dow futures rose ahead of Tuesday’s open after the Dow Jones Industrial Average sold off nearly 500 points on Monday. Investors will soon turn their attention to Fed Chair Jerome Powell’s speech on Wednesday, while key inflation data is due on Thursday.

X

Monday’s stock market weakness was due to a combination of the spread of Covid-19 protests in major cities in China and St. Louis Federal Reserve President Jim Bullard’s comments on interest rates.

in Webcast interview with MarketWatchAsked how long he expects the federal funds rate to stay in the 5% to 7% range, Bullard said, “I think we’re going to have to stay there all through 2023 and into 2024.”

Bullard believes that markets are still underestimating the degree to which the Fed will need to keep its policy tightening in order to rein in inflation. Traders are putting a 72% chance of a 50 basis point rate hike, down from 80% a week ago, at the next central bank meeting, according to the FedWatch CME.

This week’s earnings reports include: CrowdStrike (CRWD), dollar general (DJ) And the gut instinct (INTU). Dow Jones stock is also included sales force (CRM), along with snowflake (snow), Ulta Beauty (Ulta) And the a work day (day).

stock market today

On Monday, the Dow Jones Industrial Average lost 1.45%, or 497 points, and the S&P 500 fell 1.5%. The tech-heavy Nasdaq Composite sold 1.6%. within Exchange money tradedNasdaq 100 Invesco QQQ Trust Tracker (QQQ(down 1.5% and the SPDR S&P 500 Index)spy) fell 1.6%.

Solar shares sold off sharply on Monday, with an analyst downgrading the rating First Solar (FSLR) affected the rest of the industry. FSLR stock fell 3.4% after JPMorgan downgraded the rating from overweight to neutral due to the stock’s strong performance in recent weeks. Matrix techniques (I see) And the Scholes Technologies (SHLS) 7.1% and 6.4%, respectively. Array Technologies gave up a recent buy point, while SHLS stock fell back into a buy range above 28.57 buy points.

electric car giant Tesla (TSLAMonday traded with a higher breakout ratio. within Dow Jones stockAnd the apple (AAPL) decreased by 2.6% and Microsoft (MSFT) decreased by 2.3% in stock market today.

Underwriting leader matrix technologies, IBD Leaderboard stock Arista Networks (Network), Celsius (CELH) And the Chubb (Cb) – as well as the names of the Dow Jones Boeing (BA), Larva (cat) And the chevron (CVX) – among the top stocks to buy and watch.

Arista Networks is IBD Leaderboard It was fresh stock from IBD Stock today. Boeing is IBD SwingTrader Stocks He was one of the four leaders Featured In this week Arrows near the buy zone column. was a percentage Pick Monday stocks from the IBD 50 to watch.

4 growth stocks to buy and watch in Cursstock market rally

Dow futures today: treasury yields, oil prices

Before the opening bell on Tuesday, Dow Jones futures were up 0.1%, while the S&P 500 was up 0.15%. The Nasdaq 100 Heavy Technology Futures rose 0.2% against fair value. Remember to work in overnight Dow Jones futures contracts and elsewhere that does not necessarily translate into actual trading in the next regular session Stock market session.

The 10-year Treasury yield rose to 3.7% on Monday, holding near recent lows. On Friday, the 10-year Treasury yield closed at 3.69%, its lowest close since Oct. 4. Meanwhile, US oil prices reversed higher after touching their lowest level since December 2021. West Texas Intermediate futures traded around $77 a barrel.

What to do in the stock market

Now is an important time to read IBD’s The Big Picture column With the stock market trend back to a “confirmed uptrend”.

While it is a good idea to put money to work in the current stock market, keep your exposure on the conservative side with small positions to start. Just because the stock market is in a definite uptrend doesn’t mean you have to be a 100% investor. And don’t be afraid to take a 10% profit if you get it, given the volatile nature of the market.

(paying off IBD inventory listings Like the defect 50 And the Stocks near the buy zonefor additional inventory ideas.)

Five Dow Jones stocks to buy and watch now

Dow Jones stocks to buy and watch: Boeing, Caterpillar, Chevron

Aircraft maker Boeing fell 3.7 percent on Monday, falling 173.95 points under Buy of Cup Base. Look for a decisive recovery of this entry before considering buying Boeing stock.

Dow Jones member Caterpillar Corp. is close to recovering 238 of its cup bases Point purchaseAnd the to me IBD MarketSmith Pattern Recognition, and less than 2% less than the entrance. CAT stock, with heavy exposure to China, fell 1.4% on Monday.

CAT stock It boasts an impressive average of 96 out of 99 IBD Perfect Composite Rating, per IBD stock check.

Energy giant Chevron fell 2.9% on Monday, giving up a 182.50 buy point on a consolidation base.

Top stocks to buy and watch: Array, Arista, Celsius, and Chubb

Array Technologies, a leader in solar energy and IPO stocks, gave up 22.40 buy points in a cup with handle during Monday’s tumble, to me IBD MarketSmith Pattern Recognition. The stock is about 3% below the entry. More vulnerability would result 7%-8% losing sell base.

IBD Leaderboard Arista Networks stock remains in a buy range above 132.97 for a choppy base Point purchase Despite Monday’s loss of 1.5%.

Energy drink maker Celsius fell 1.3% on Monday, as the stock continues to form a cup bottom at 118.29 overbought. Monday’s weakness could be the beginning of a potential trade that would provide a lower entry point.

Chubb is trading just below the buy point of the 216.10 cup handle on Monday after slight losses in the session. 5% buy zone would reach 226.91.

Join IBD experts as they analyze the leading stocks of the current stock market rally on IBD Live

Tesla stock

Tesla stock It rose slightly on Monday, but remained below the 50- and 200-day moving average lines. Shares are down nearly 55% from their 52-week high.

Last week, the stock hit its lowest level since November 23, 2020, and reached a 52-week low of 166.19.

Dow Jones leaders: Apple and Microsoft

within Dow Jones stockApple shares sold off 2.6% on Monday, falling below the 50-day support level. Apple iPhone Pro production may drop by 6 million units due to civil unrest and Covid restrictions in China, according to reports. The stock is more than 20% off its 52-week high.

Bloomberg reported that disruptions at Foxconn’s Zhengzhou factory could result in a shortage of 6 million units in 2022 iPhone Pro production. That number could rise if Covid restrictions are extended a few more weeks, according to sources. The vast majority of iPhone 14 Pro and Pro Max smartphones are manufactured by the Zhengzhou factory.

Microsoft slid 2.3 percent on Monday, declining for the second straight session. Stocks continue to hold above the 50-day line. The software giant is still about 30% off its 52-week high.

Be sure to follow Scott Lehtonen on Twitter at @employee Learn more about developing stocks and the Dow Jones Industrial Average.

You may also like:

Top growth stocks to buy and monitor

Learn how to time the market with IBD’s ETF market strategy

Find the best long-term investments with IBD’s long-term leaders

MarketSmith: Research, charts, data and training in one place

How to Find Growth Stocks: Why the IBD Tool Simplifies Your Search for Top Stocks

“Typical beer advocate. Future teen idol. Unapologetic tv practitioner. Music trailblazer.”

More Stories

JPMorgan expects the Fed to cut its benchmark interest rate by 100 basis points this year

NVDA Shares Drop After Earnings Beat Estimates

Shares of AI chip giant Nvidia fall despite record $30 billion in sales