- The funding rate has indicated a bullish signal, however, the Coinbase Premium indicator may resist the upside.

- Bitcoin may have reached a local peak, so its rise to a new high may be delayed.

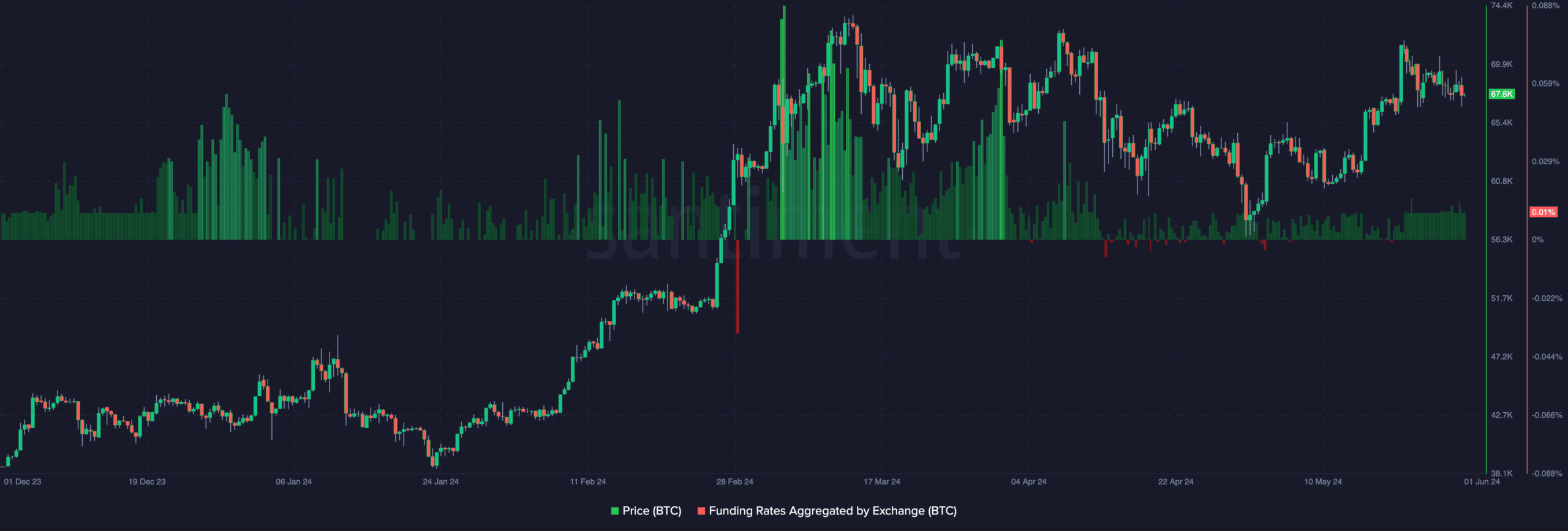

Bitcoin [BTC] AMBCrypto confirmed that the funding rate has been low since mid-May. Although this means lower investor expectations, it could be beneficial for Bitcoin price.

The financing rate is the cost of holding an open contract in the market. When the reading is positive, it means that the trading price is trading significantly higher than the indicator value

Low optimism and high BTC prices?

On the other hand, a negative financing rate indicates that the spot rate is higher than the contract price. At the time of writing, Bitcoin’s funding rate was 0.01%.

But although positive, this was a Read less Compared to what it was a few weeks ago. From a trading perspective, the low funding rate combined with the falling price indicated that potential buyers were holding back on Bitcoin’s movements.

Source: Santiment

However, it also means that spot traders are becoming aggressive. If this continues, Bitcoin could return to the $70,000 level within a short period.

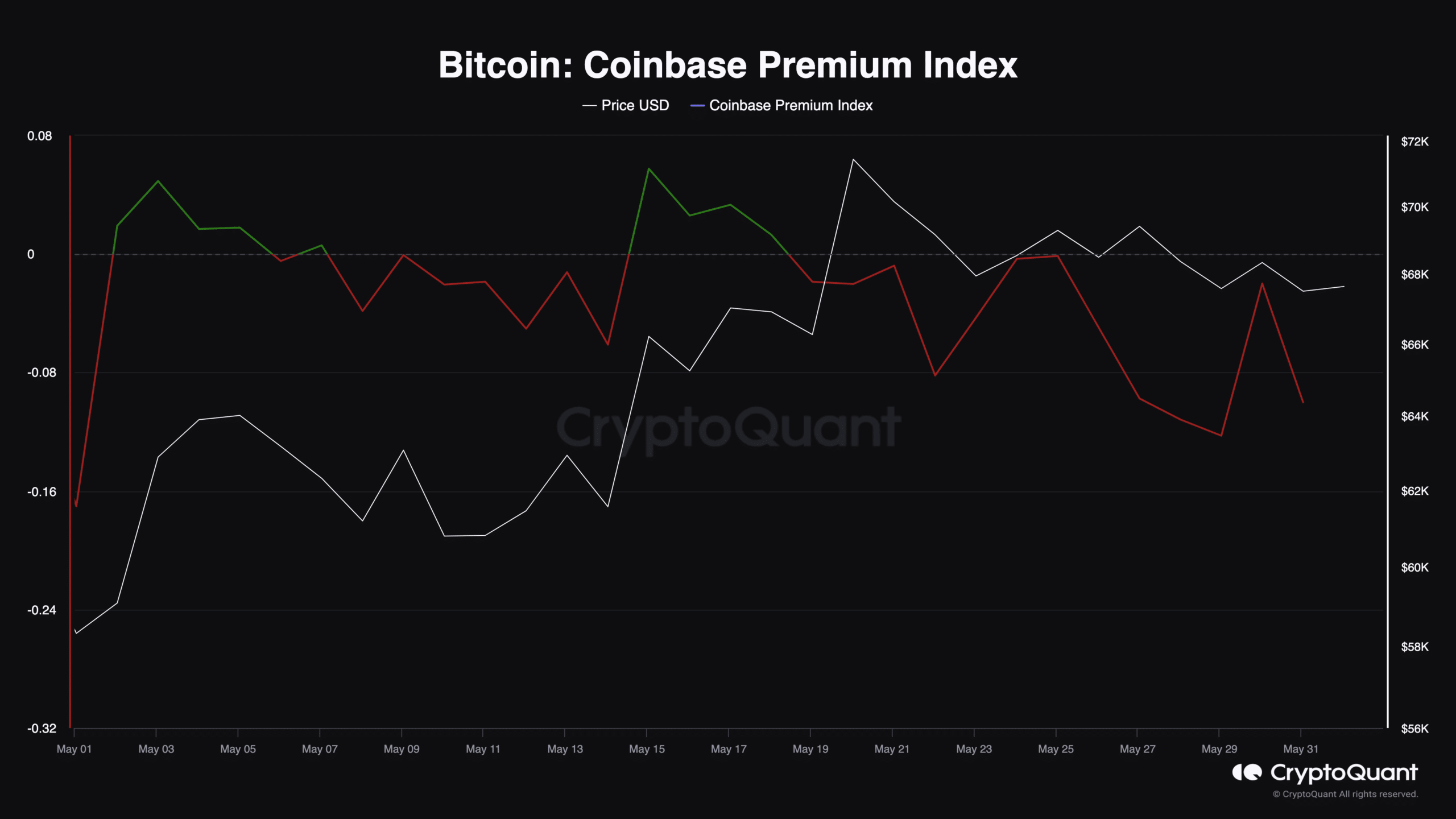

But recovery may not be quick. This is due to the Coinbase Premium index status. The index is the difference between the price of BTC on the Coinbase exchange and the value on other exchanges.

If the index value is high, it means that US investors are buying a lot of Bitcoin, thus putting good pressure on the price. However, A drop The measure indicates an increase in Bitcoin sales by investors in the country.

As of this writing, the Coinbase Premium Index is -0.10, indicating that selling pressure was intense. From the chart below, AMBCrypto notes that this decline was one of the reasons why Bitcoin continues to be rejected.

Source: Cryptoquant

Bearish forces are still at work

However, if the reading increases, it could lead to a BTC breakout. Analyst TraderOasis also agreed with this in his analysis on CryptoQuant, Pointing which,

“As a result, when the price reaches the daily gap, the increase in the Coinbase Premium Index will be our signal.”

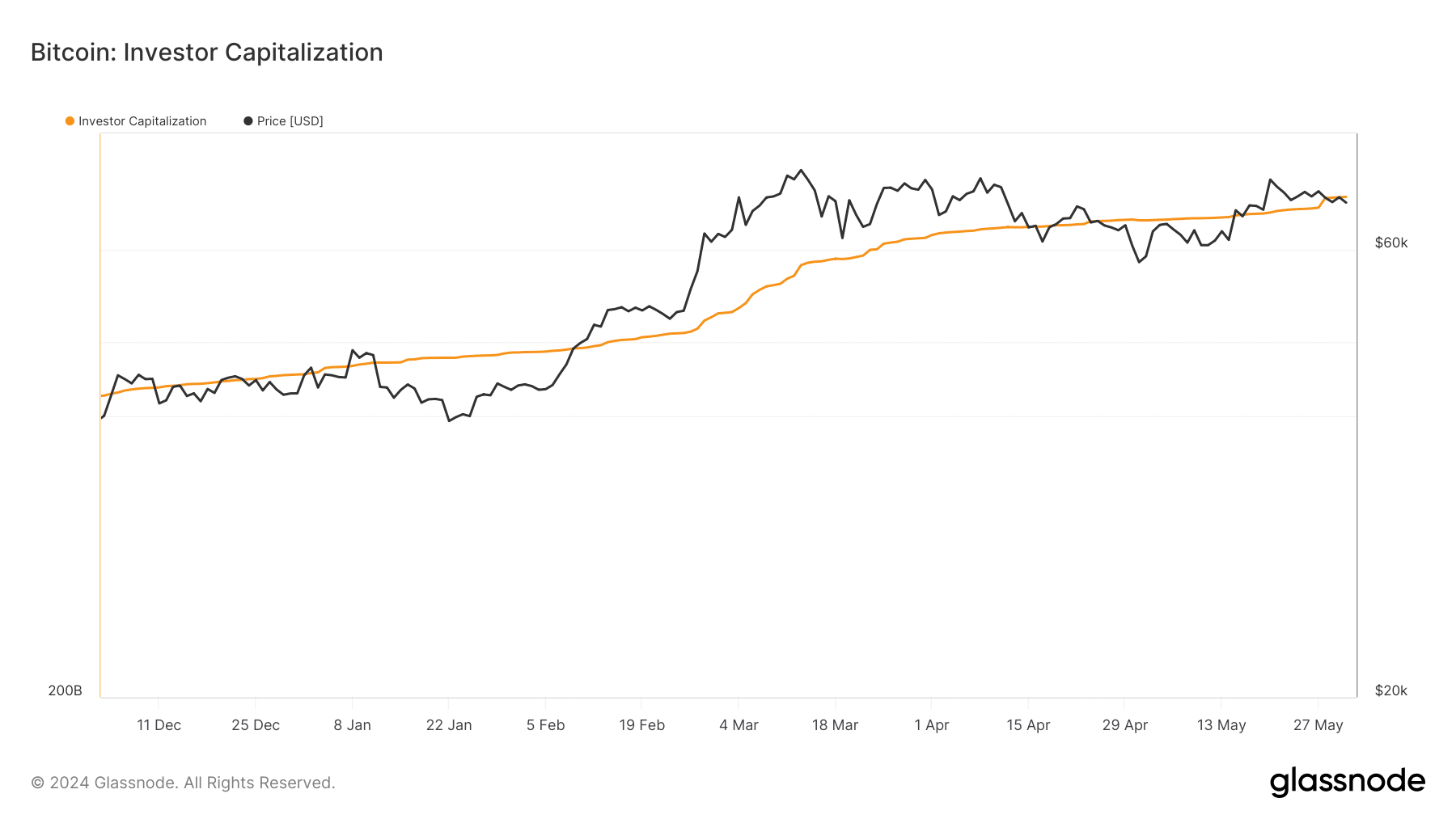

Furthermore, AMBCryto has vetted the investor capital provided by Glassnode. Investor capital can see if BTC is close to the bottom or has reached a local top.

At the time of writing, the scale was around The same place Such as the price of Bitcoin, indicating that the currency was in a critical area. If the gauge rises above Bitcoin, it signals a local top and forces a correction.

Conversely, if Bitcoin price jumps much higher than it, the value could rise, and it may retest $70,000.

Source: Glassnode

Is your wallet green? Check out our Bitcoin Profit Calculator

However, volatility around Bitcoin remained low at press time. This indicates that the price may continue to fluctuate in a narrow range for some time.

Going forward, there is a possibility that the above metrics will turn positive. If this is the case, the coin price may attempt to surpass its all-time high before the end of June.

“Typical beer advocate. Future teen idol. Unapologetic tv practitioner. Music trailblazer.”

More Stories

JPMorgan expects the Fed to cut its benchmark interest rate by 100 basis points this year

NVDA Shares Drop After Earnings Beat Estimates

Shares of AI chip giant Nvidia fall despite record $30 billion in sales