- The Bitcoin rainbow chart revealed that BTC was in an accumulation phase.

- Measurements indicate that investors have already started buying BTC.

Like most cryptocurrencies, Bitcoin [BTC]Being the leader of the group, it has turned bullish over the past 24 hours as well. So, let’s evaluate some of the key metrics of Bitcoin to understand whether this is the right time for investors to buy Bitcoin.

Should you buy Bitcoin?

Coin Market Cap Data Bitcoin price has reportedly risen slightly over the past 24 hours. At the time of writing, it was trading at $61,107 with a market cap of over $1.20 trillion.

IntoTheBlock, a company that provides analytics and measurement services, recently published tweet Highlight a key metric.

The tweet talked about Bitcoin’s MVRV ratio and stated that when the metric drops below 1, it opens up an opportunity for investors to accumulate.

Likewise, when the current market cap ratio exceeds 3, it becomes a good opportunity for investors to sell. At the time of writing, Bitcoin’s current market cap ratio is 1.93.

This means that Bitcoin investors should prepare themselves because a buying opportunity may arise soon.

Source: IntoTheBlock

Root, a well-known crypto analyst, posted, tweet He mentioned another important metric for Bitcoin. The tweet used the on-chain Bitcoin value map, which indicated that Bitcoin is fairly valued.

Therefore, this also suggests that investors may consider stockpiling the stock.

AMBCrypto then examined the Bitcoin Rainbow Chart to see what this metric might be indicating. According to our analysis, Bitcoin’s price was in an “accumulation” phase, suggesting that this is a good time to accumulate.

Source: Blockchaincenter

A look at what investors are doing

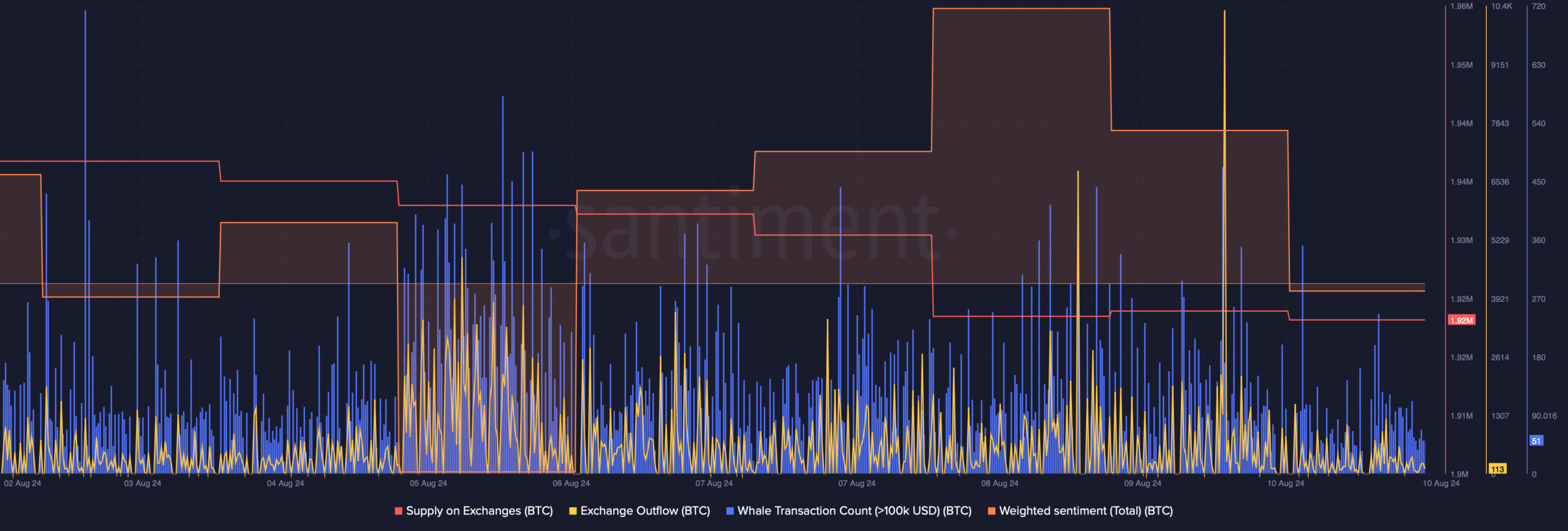

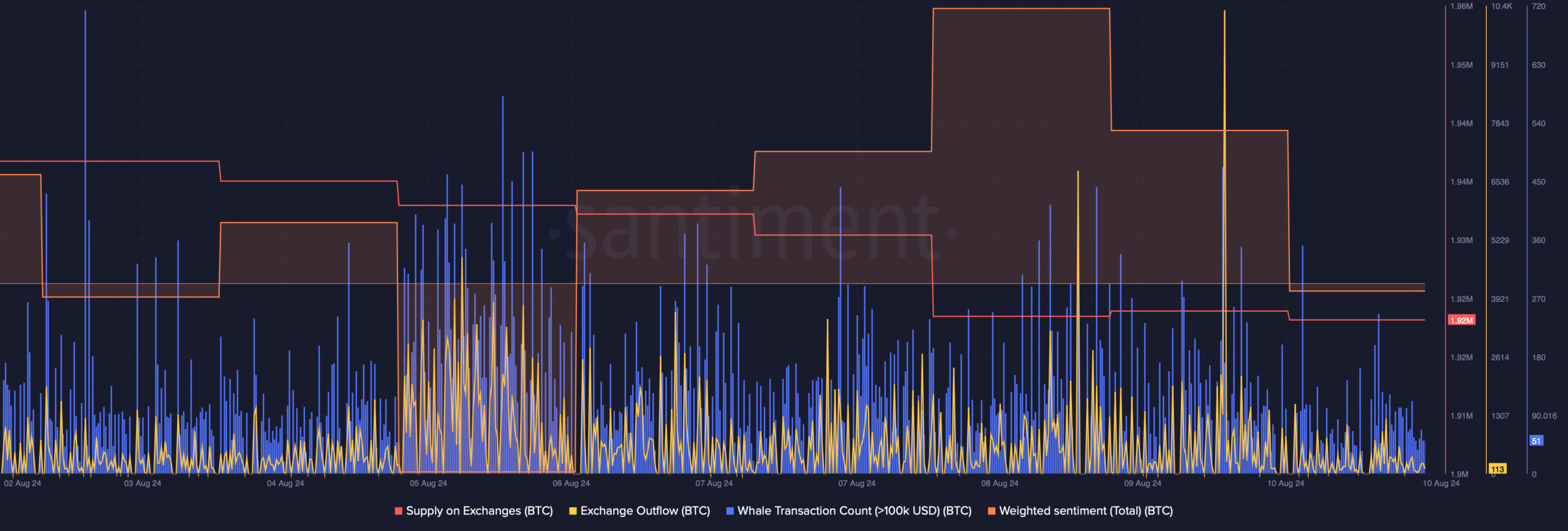

AMBCrypto then examined the on-chain BTC data to see if investors had started piling in. According to our analysis of Santiment charts, the supply of Bitcoin on exchanges was declining, which meant buying pressure was increasing.

The fact that investors are hoarding Bitcoin was proven by the massive spike in its outflows on August 9th.

In addition, big players have also been actively reading BTC as the number of whale transactions has increased.

However, despite investors buying Bitcoin, its sentiment has declined and turned negative. This means that bearish sentiment around the currency has increased.

Source: Santiment

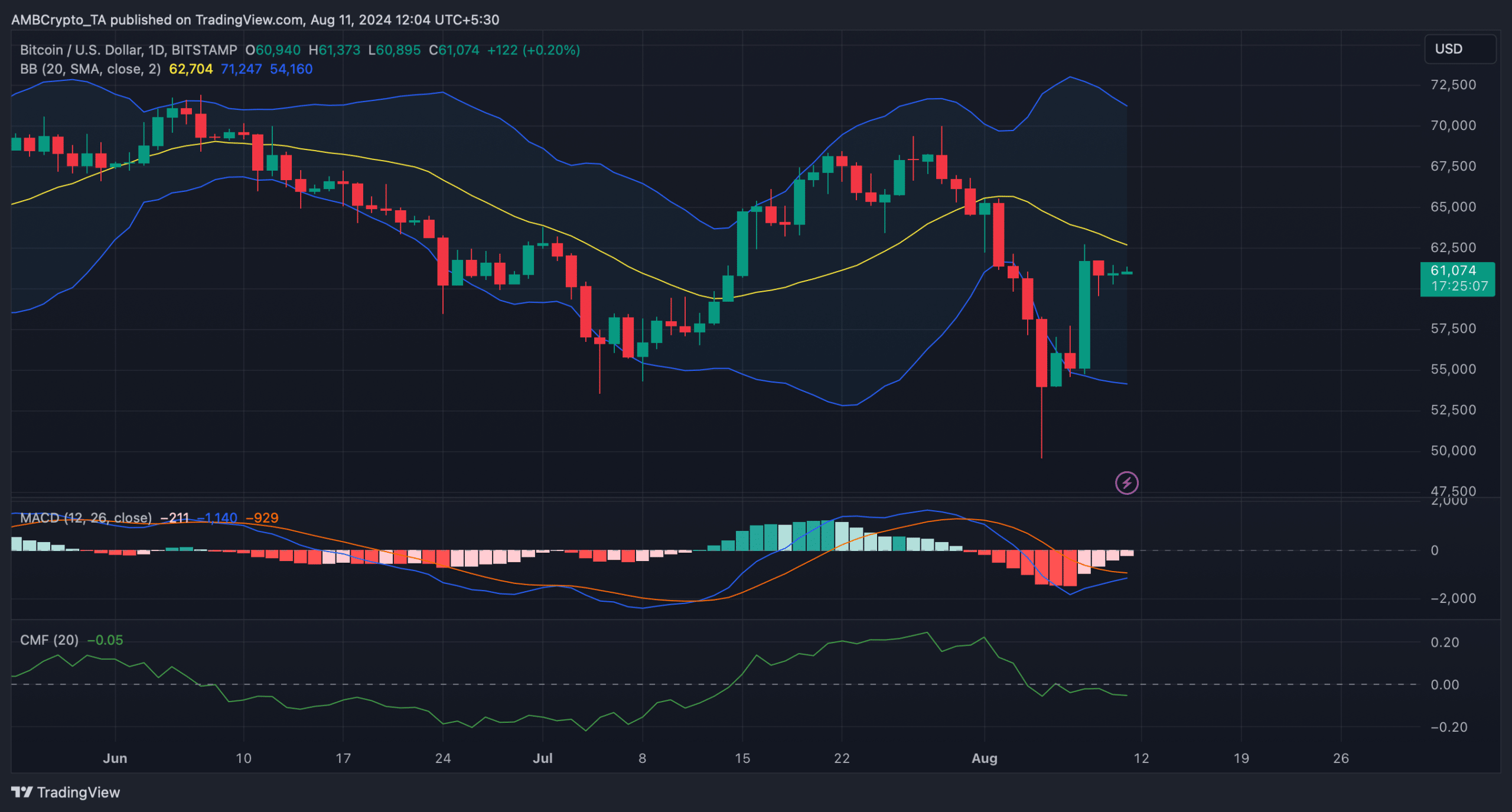

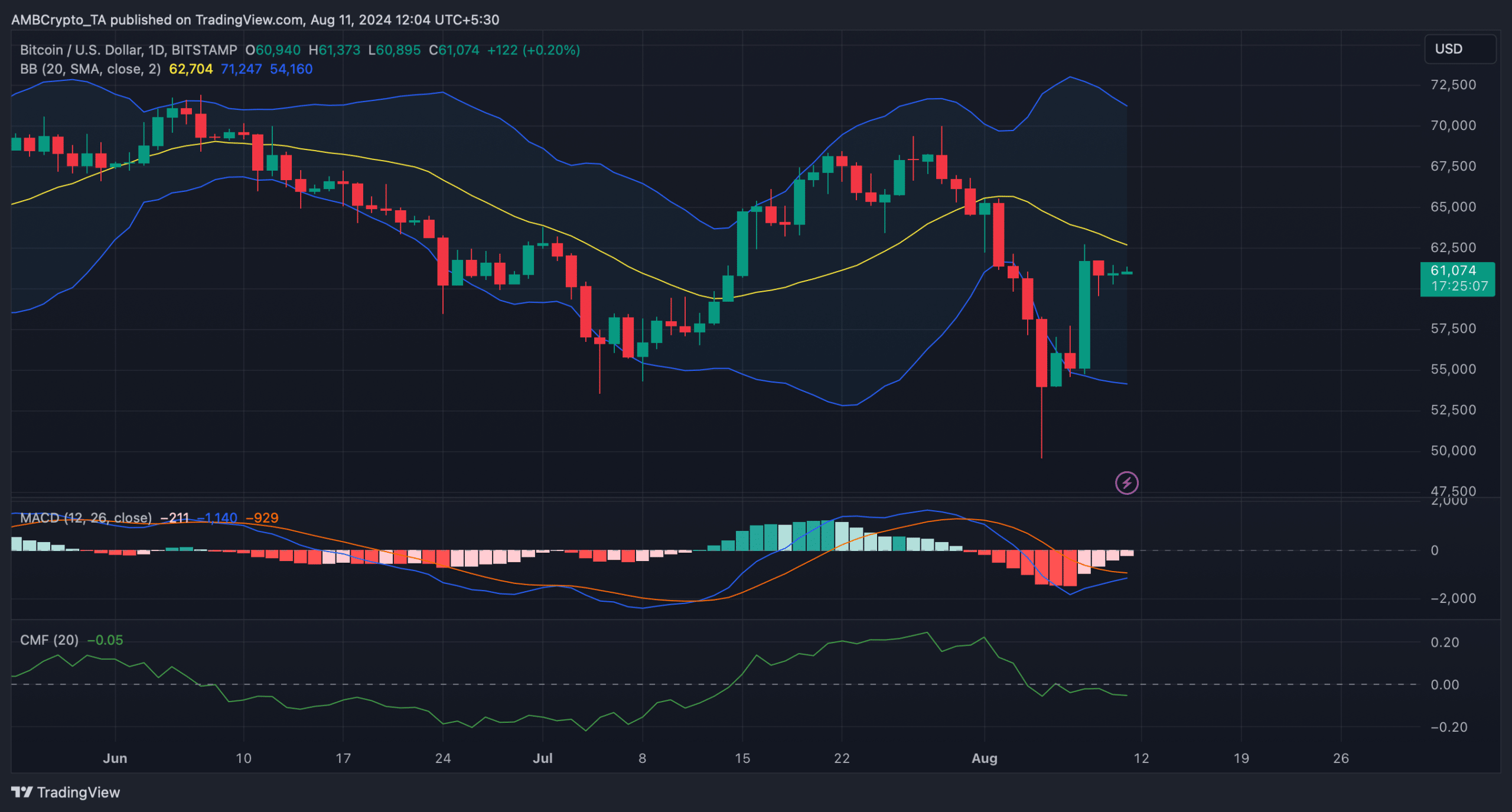

We then planned to take a look at the daily chart of Bitcoin to see if the decline in sentiment is likely to lead to a price drop in the coming days.

Is Your Investment Portfolio Green? Check Bitcoin Profit Calculator

According to our analysis, Bitcoin’s Chaikin Money Flow (CMF) has recorded a sharp decline, indicating a bearish takeover.

At the time of writing, Bitcoin is testing its 20-day simple moving average (SMA) as indicated by the Bollinger Bands indicators. Notably, the MACD has shown the possibility of a bullish crossover, which could allow Bitcoin to successfully surpass the 20-day SMA.

Source: TradingView

“Typical beer advocate. Future teen idol. Unapologetic tv practitioner. Music trailblazer.”

More Stories

JPMorgan expects the Fed to cut its benchmark interest rate by 100 basis points this year

NVDA Shares Drop After Earnings Beat Estimates

Shares of AI chip giant Nvidia fall despite record $30 billion in sales