- Binance has published its reserves guide which shows signs of positive growth.

- The social volume and sentiment around the BNB token has dropped significantly over the past few days.

Binance [BNB] Binance has been through a series of legal battles and regulatory scrutiny over the past year. Despite the difficulties Binance has faced, the overall outlook for the exchange has remained positive.

The proof is in the candy

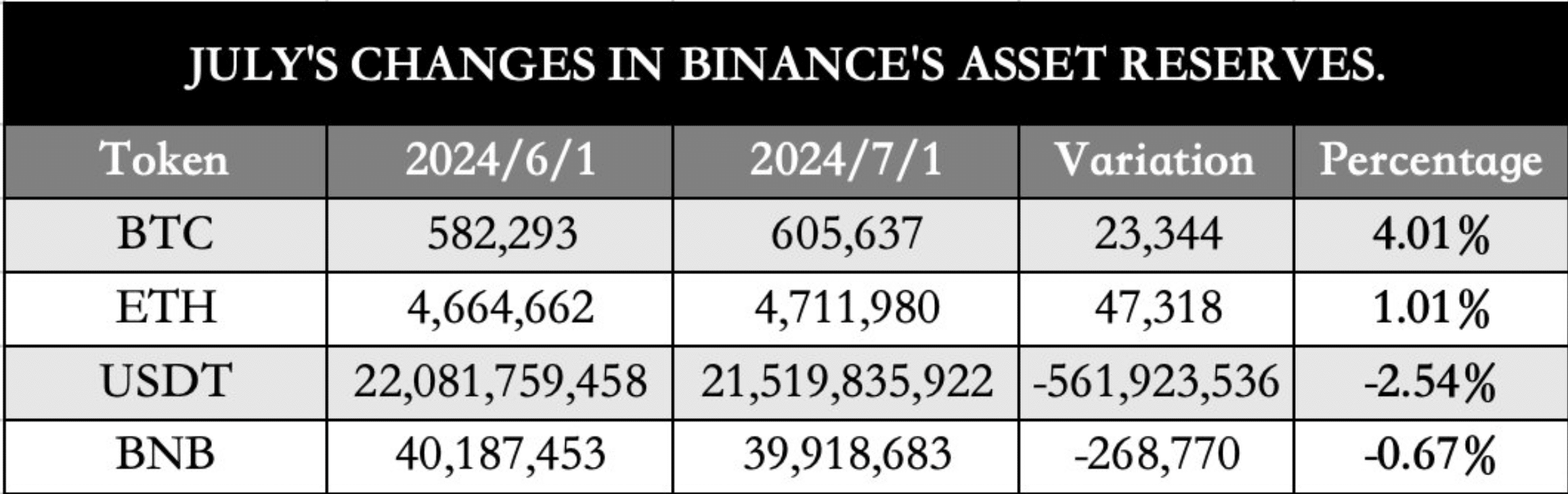

Binance has released its latest cryptocurrency reserves report, the 20th in a row. The report details the cryptocurrency holdings held by its users, providing transparency into the exchange’s financial health.

Looking at the breakdown of user assets, we see a positive trend in Bitcoin holdings. User assets of Bitcoin reached 605,637, reflecting a 4.01% increase compared to June 1.

Ethereum holdings also showed a slight increase of 1.01%, with Ethereum user assets reaching 4.711 million.

However, there was a decline in Tether (USDT) holdings. USDT user assets fell to 21.51 billion, which is a 2.54% decrease from the previous month.

Issuing proof-of-reserves reports on a regular basis builds trust with users by demonstrating the solvency and safe storage of their assets. This transparency can attract new users and encourage existing users to hold larger amounts of cryptocurrency on the platform.

Source: Binance

Problems abroad

However, there were some issues that Binance faced that could cause problems for the exchange.

Olubukola Akinwumi, Deputy Governor of the Central Bank of Nigeria (CBN), has raised serious allegations against Binance.

Local media reports claimed that Akinwumi accused the cryptocurrency exchange of conducting financial transactions normally reserved for banks and licensed institutions.

Akinwumi’s testimony did not stop at the money laundering allegations, but specifically pointed out that Binance allows users in Nigeria to conduct transactions while hiding behind pseudonyms.

According to Akinwumi, this is in direct violation of the Central Bank of Nigeria’s rules. The central bank requires all parties involved in financial transactions to disclose their true identities.

Other concerns have been raised about Binance’s peer-to-peer (P2P) platform. The platform facilitates direct transactions between users. Akinwumi highlighted that these transactions involve the conversion of Nigeria’s fiat currency, the naira.

Read information about Binance coin [BNB] Price forecast 2024-2025

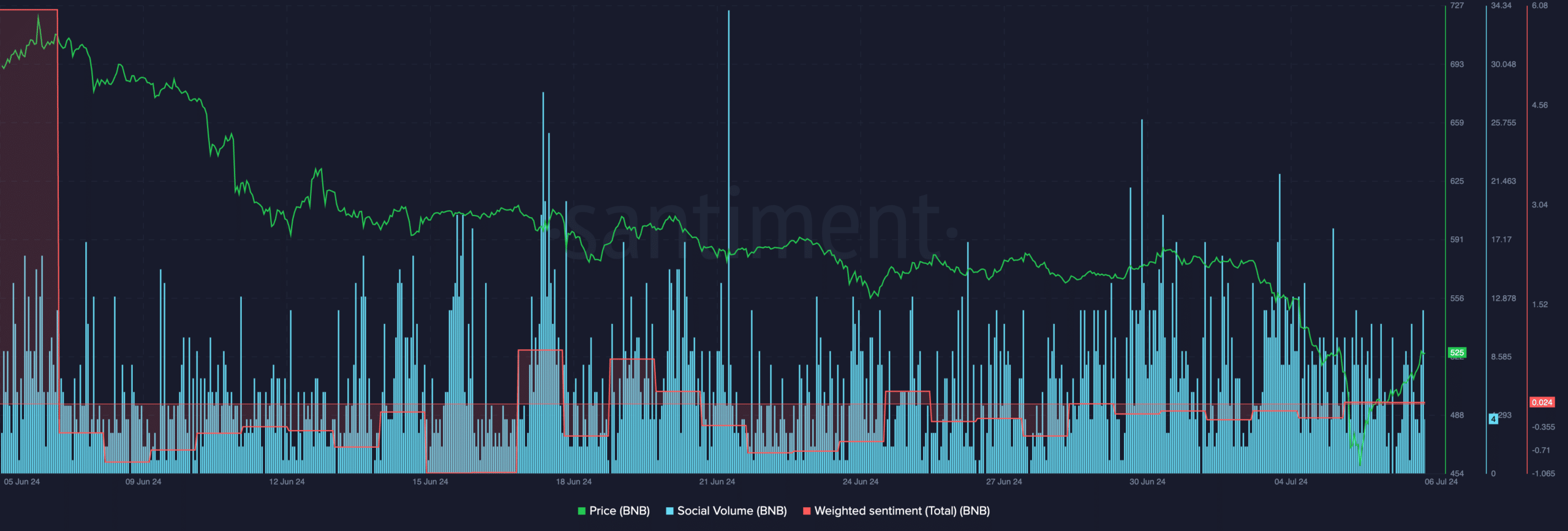

These factors could tarnish the image and reputation of Binance, which could have a negative impact on BNB. At the time of writing, BNB was trading at $509.71 and has fallen by 0.73% in the last 24 hours.

The volume of social engagement around the token has increased, but the weighted sentiment has decreased, indicating an increasing number of negative comments about the BNB token.

Source: Santiment

“Typical beer advocate. Future teen idol. Unapologetic tv practitioner. Music trailblazer.”

More Stories

JPMorgan expects the Fed to cut its benchmark interest rate by 100 basis points this year

NVDA Shares Drop After Earnings Beat Estimates

Shares of AI chip giant Nvidia fall despite record $30 billion in sales