Raising interest rates appears to be more effective in Canada than in the United States in slowing the economy and reducing inflation.

Written by Wolf Richter for WOLF STREET.

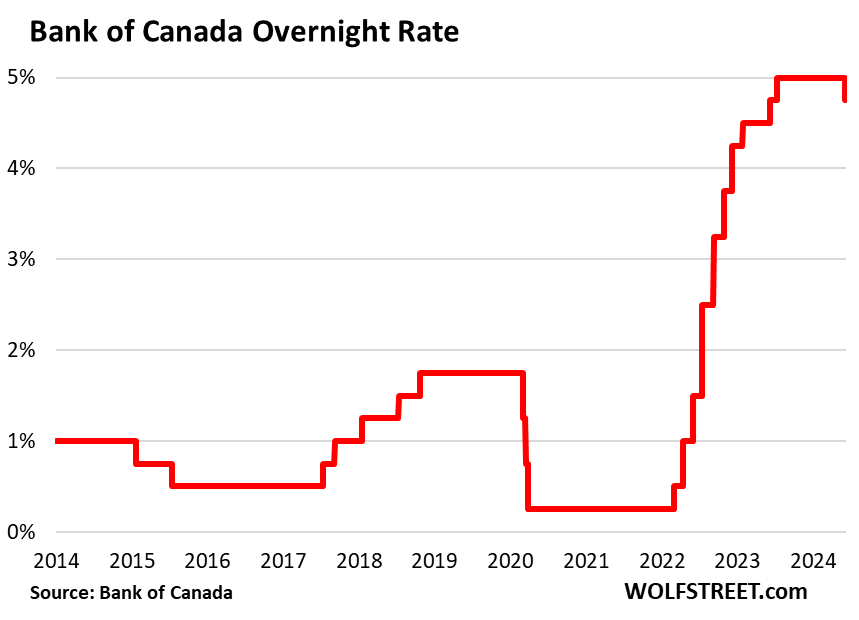

“With continued evidence that core inflation is declining,” the Bank of Canada said today that “monetary policy no longer needs to be as restrictive,” cutting interest rates by 25 basis points, as was widely expected.

QT will continue, the statement said. The Bank of Canada has already offloaded 64% of the securities it added during the pandemic.

The target for the overnight interest rate was reduced to 4.75%. The bank interest rate is 5.0%, and the deposit interest rate is 4.75%.

“The latest data has increased our confidence that inflation will continue to move towards the 2% target,” he said in a statement today.

Employment “is growing at a slower pace than the working-age population,” the statement said, referring to the huge wave of immigrants that has flooded the labor market. He added, “Wage pressures still exist but appear to be gradually easing.”

Due to the huge wave of migrants, per capita GDP has declined six over the past seven quarters (the exception being a slight rise in the first quarter of 2023), with economic growth stalling in the second half of last year and being very slow in the first quarter. From 2023. The remaining quarters to keep up with population growth.

“However, shelter price inflation remains high,” the statement said. So this is it. If it wasn’t for rent. Rents went up because this huge wave of immigrants needed rental housing, and no one was ready for that.

“Risks to inflation expectations remain,” the Bank of Canada said. It “closely monitors the development of core inflation and remains particularly focused on the balance between demand and supply in the economy, inflation expectations, wage growth, and corporate pricing behavior.”

Two IFs for further reductionsBank of Canada: “If inflation continues to decline (#1 IF), and our confidence that inflation continues to grow sustainably towards the 2% target (#2 IF), it is reasonable to expect further cuts in our policy interest rate.” Governor Tiff Macklem said at the press conference.

He identified four risks to low inflation expectations:

“We do not want monetary policy to be too restrictive to bring inflation back on target. But if we cut interest rates too quickly, we could jeopardize the progress we have made. Further progress in lowering inflation is likely to be uneven and risks remain.” .

“We have come a long way in fighting inflation. Our confidence that inflation will continue to approach the 2% target has increased over recent months,” he added.

He said that “indicators of core inflation increasingly point to a sustainable easing” of inflation. He cited these four standards:

- “CPI inflation fell from 3.4% in December to 2.7% in April

- “Our preferred measures of core inflation have fallen from around 3.5% last December to around 2.75% in April.”

- “3-month core inflation rates slowed from around 3.5% in December to less than 2% in March and April

- “The proportion of CPI components increasing faster than 3% is now approaching its historical average, indicating that price increases are no longer unusually broad.”

“All of this means that restrictive monetary policy is easing price pressures,” Macklem added. “With more and more continuing evidence of declining inflation, monetary policy no longer needs to be as restrictive. In other words, it is appropriate to lower our interest rates.”

Why higher rates may be more effective in Canada than in the United States.

There has been a lot of discussion about why raising interest rates appears to be more effective in Canada than in the United States in slowing the economy and lowering inflation.

Part of the reason may be how mortgages are regulated in Canada. Prevailing mortgage rates in Canada are either variable-rate mortgages whose rates are adjusted to suit existing borrowers as rates rise, or fixed-rate mortgages whose rates are fixed for shorter periods such as two or five years, and borrowers face renewals at much higher rates. Higher rates. Therefore, it is existing borrowers who face higher mortgage payments on homes they have lived in for years, which hinders spending on other things, thus slowing demand growth.

In the United States, under the typical 30-year mortgage system, only new borrowers face higher mortgage interest rates, and existing borrowers with 3% mortgages laugh all the way to the bank.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate that very much. Click on the beer and iced tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Register here.

“Typical beer advocate. Future teen idol. Unapologetic tv practitioner. Music trailblazer.”

More Stories

JPMorgan expects the Fed to cut its benchmark interest rate by 100 basis points this year

NVDA Shares Drop After Earnings Beat Estimates

Shares of AI chip giant Nvidia fall despite record $30 billion in sales