(Bloomberg) — AI-driven gains could push Microsoft to join Apple in the elite stock class with a market capitalization of more than $3 trillion.

Most Read from Bloomberg

That’s according to analysts at Morgan Stanley, whose new $415 price tag for the software giant means a valuation of around $3.1 trillion. Analysts led by Keith Weiss named Microsoft their top pick among large-cap software companies, and said it was the best place in the sector to capitalize on the growth of artificial intelligence.

“Generative AI looks to expand the range of business processes that can be largely automated by software,” Weiss wrote in a note. “Microsoft is the best at software to monetize this expansion.”

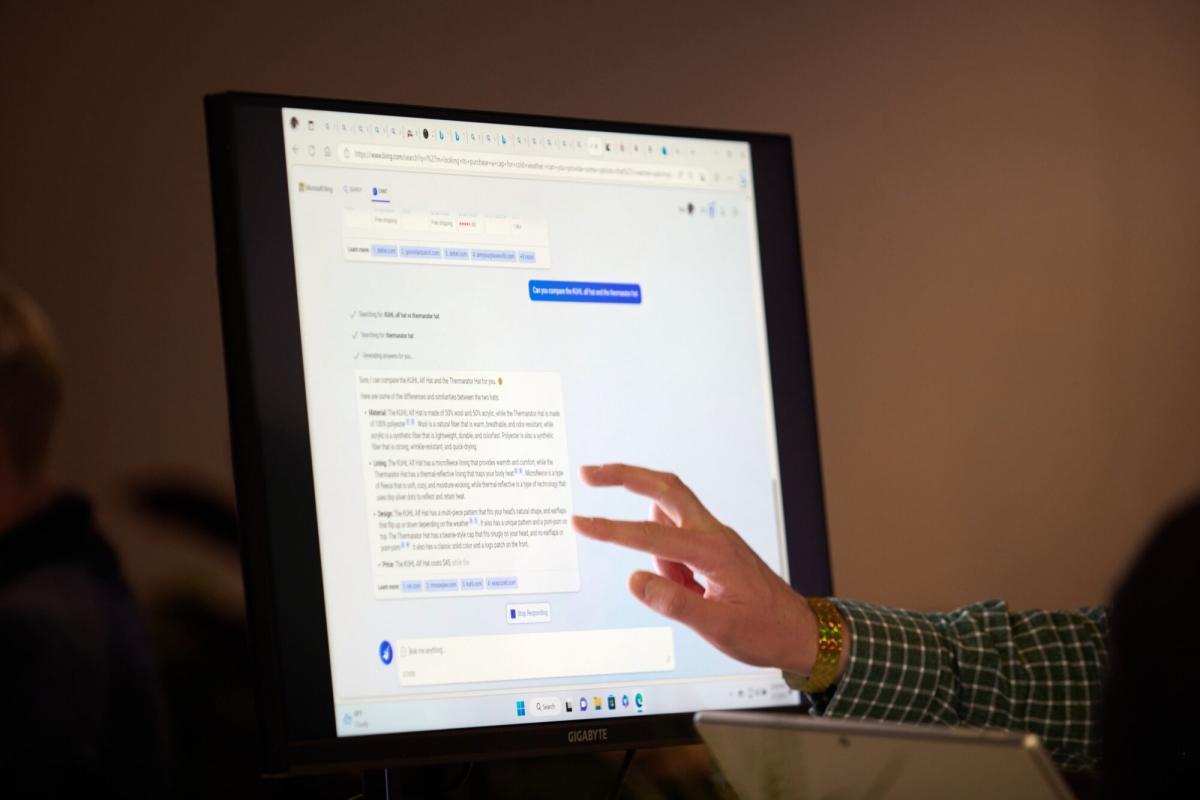

The market frenzy for all things AI has supercharged Microsoft stock this year. Startup OpenAI Inc. , which is backed by Microsoft, generated a lot of excitement amid the viral success of its ChatGPT tool. Microsoft is now looking to overhaul its entire suite of Office applications — including Excel, PowerPoint, Outlook, and Word — with OpenAI technology.

Even though share prices are up 42% this year, the valuation is “still reasonable,” according to Weiss. He wrote that the so-called price-to-earnings ratio per share, or the price-to-earnings multiple divided by the expected percentage growth in earnings, “remains in line with historical averages, despite the unprecedented centralization of artificial intelligence.” The price-earnings-growth ratio is a metric often used by investors interested in growth.

Weiss raised his price target from $335 to $415. This is the second highest rate among analysts tracked by Bloomberg after Redburn’s $450 target. Morgan Stanley has rated Microsoft overweight since early 2016, and the stock has gained more than 500% in that period.

The rest of Wall Street is also massively bullish on the stock – with 52 analysts rating it a Buy or Equivalent. However, only three of them have price targets that suggest Microsoft will reach the historic $3 trillion market capitalization mark by next year, according to data compiled by Bloomberg. Microsoft shares rose 0.9 percent on Thursday.

Apple made history on Wall Street last month as the first company with a market capitalization of more than $3 trillion.

— With assistance from James Coon and Katrina Lewis.

(Updates the market closing price in the fifth and seventh paragraphs.)

Most Read from Bloomberg Businessweek

© 2023 Bloomberg LP

“Typical beer advocate. Future teen idol. Unapologetic tv practitioner. Music trailblazer.”

More Stories

JPMorgan expects the Fed to cut its benchmark interest rate by 100 basis points this year

NVDA Shares Drop After Earnings Beat Estimates

Shares of AI chip giant Nvidia fall despite record $30 billion in sales