- SHIB price is up 7.56% since rejecting the $0.00001270 support level in the last 24 hours.

- The metrics and market signals suggest that we are likely to see further upside.

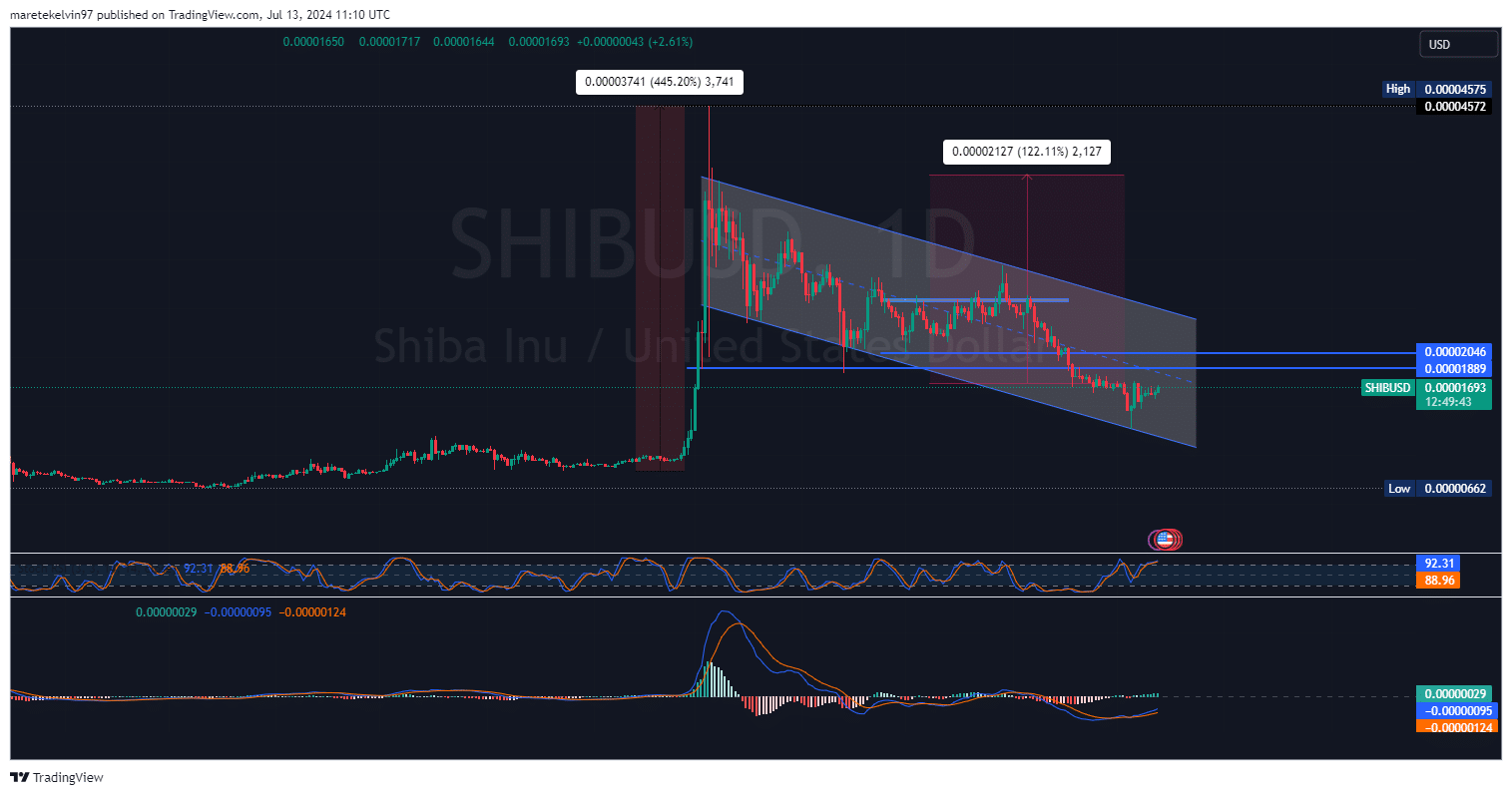

Shiba Inu [SHIB] SHIB price has seen a strong surge recently. SHIB price rejected the bullish flag support level at around $0.00001270. Since rejecting this support on July 5, SHIB price has surged a massive 31% to its current price.

At the time of writing, Shiba Inu’s price is up 7.56% in the past 24 hours, approaching its local highs from last week. CoinMarketCap pegs its price at $0.00001698 with a market cap of $10 billion.

Source: Tradingview

This increasing bullish momentum suggests that buyers are confidently entering the market. However, SHIB stock needs to close above the weekly high to confirm a long-term uptrend.

Metrics paint a positive picture for SHIB

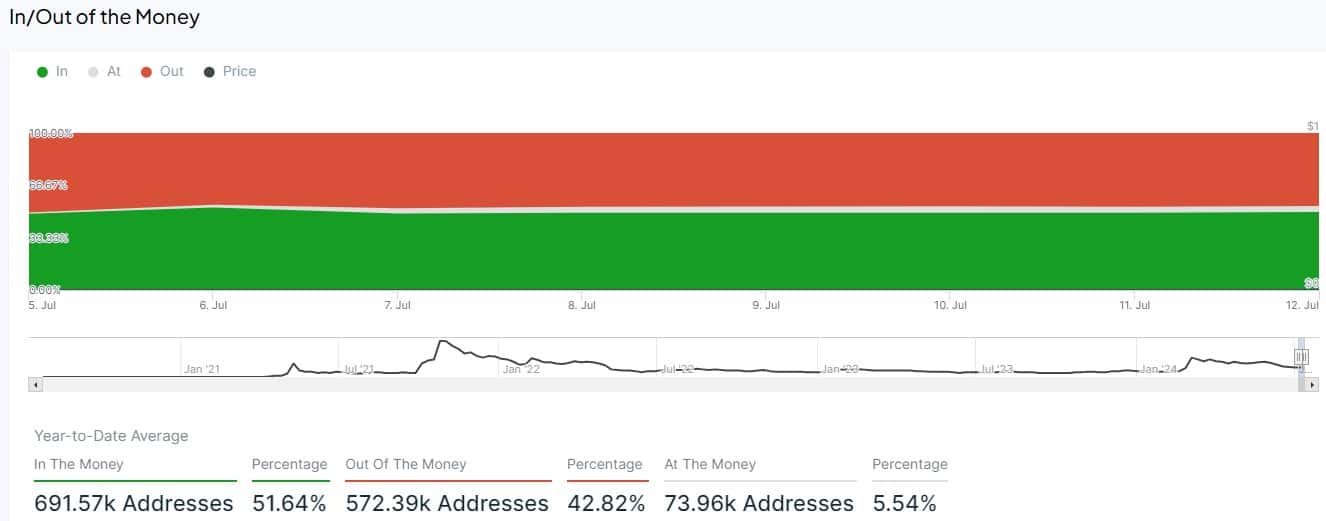

AMBCrypto’s analysis of IntoTheBlock data points to several positive metrics for SHIB investors. 49% of holders are “in the money” at the current price, while only 47% are “out of the money.”

This relatively balanced position reduces the risk of mass profit taking that could disrupt the upward rally.

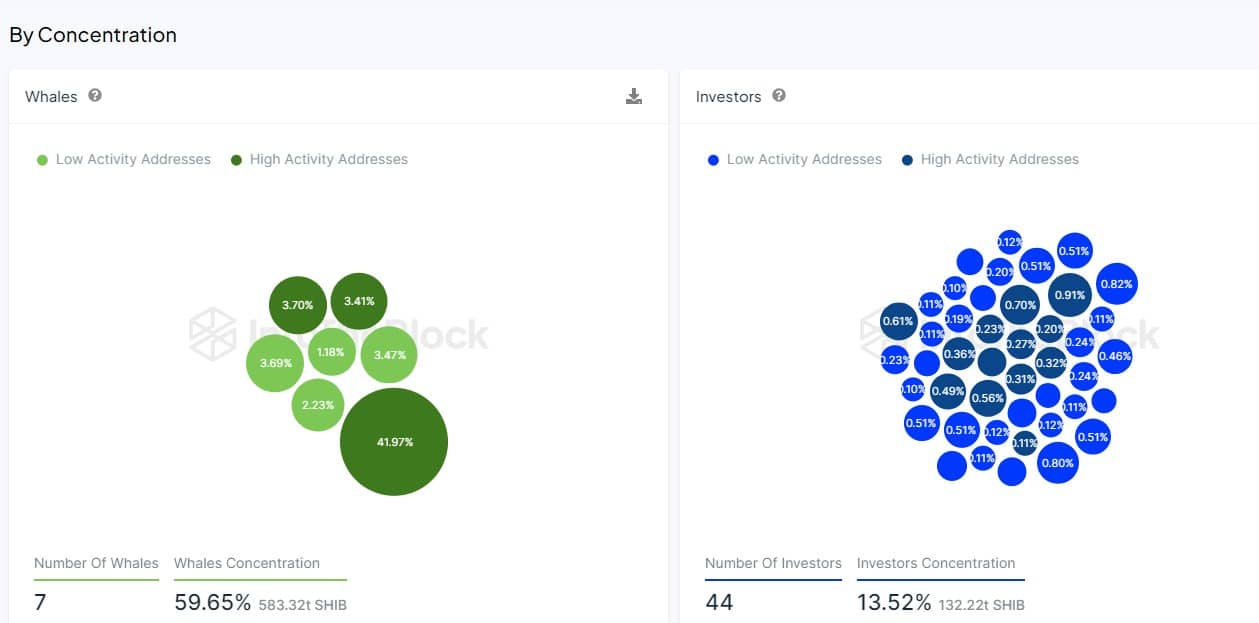

In addition to the above, whales control 73% of SHIB shares. This high concentration can amplify price movements in either direction, depending on the whales’ behavior.

Source: IntoTheBlock

Interestingly, Shiba Inu maintains a strong correlation of 0.84 with Bitcoin. This suggests that it may be linked to any broader crypto market rally led by Bitcoin.

According to our analysis of IntotheBlock growth data, In the Money is 2.11% bullish while Network Growth remains neutral at 0.19%. The supply-demand volume imbalance indicates a strong upside of 82.02%, indicating aggressive buying pressure.

Investor sentiment and token distribution

We further analyzed IntoTheBlock’s concentration data to see how SHIB can reach market distribution. The composition of SHIB holders indicates a “wait and see” investor base, with 77% of addresses holding the coin for more than 12 months.

This long-term expectation may stabilize prices and reduce selling pressure during periods of upside.

The distribution of tokens between whales and retail investors shows an interesting distribution. While only seven whale addresses control 59.65% of SHIB tokens, there are 44 active investor addresses holding 13.52%.

This combination of large shareholders and a growing retail base could drive volatility and sustained interest.

Source: IntoTheBlock

Is your investment portfolio green? Check out the SHIB profit calculator

Recent price increases and indicators point to a bullish signal for SHIB stock. However, investors should remain cautious given its historical volatility and dependence on broader market sentiment.

If SHIB can maintain its momentum and break above a key weekly high, we could see this uptrend continue.

“Typical beer advocate. Future teen idol. Unapologetic tv practitioner. Music trailblazer.”

More Stories

JPMorgan expects the Fed to cut its benchmark interest rate by 100 basis points this year

NVDA Shares Drop After Earnings Beat Estimates

Shares of AI chip giant Nvidia fall despite record $30 billion in sales