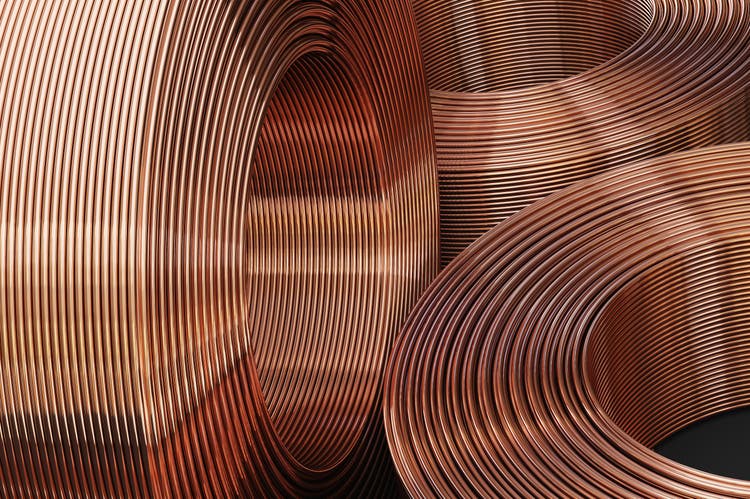

SimoneN/iStock via Getty Images

Hedge fund manager Pierre Andurand, one of the world’s most famous commodities traders, believes that the rise in copper prices still has much further to go and could be close to… Four times as much as $40,000 per metric ton For the next few years, the show struggles to keep up Increasing request.

The French fund manager said: Financial Times On Friday, he believed demand for copper, which is set to play an essential role in the global energy transition, will outstrip supply in the second half of this decade, causing prices to rise 28% year-to-date to an all-time high of $11,104.50. per metric meter. tons earlier this week.

“We are moving towards doubling the growth in demand for copper due to global electrification, including electric cars, solar panels and wind farms, but also military use and data centers,” Andurand said. foot.

Andurand also has a bullish view on other commodities, including aluminium, which he believes will continue to rise in price for similar reasons as copper, where it could be replaced by the red metal, but he no longer expects a significant rise in crude oil prices. the prices.

“Geopolitical risks such as Russia and Gaza did not have an impact on supplies, so I think this is the reason why oil prices are relatively stable, and I expect them to remain that way,” he said.

US copper futures fell this week for the first time after an eight-week winning streak, with the May COMEX contract (HG1:COM) falling. -5.5% For the week to $4.7785/MMBtu.

Also, May COMEX gold (XAUUSD:CUR) trading ended. -3.3% to $2,332.50 an ounce this week, Comex May Silver (XAGUSD:CUR) closed. -2.3% To $30,330 per ounce.

ETFs: (NYSEARCA:CPER),(NYSEARCA:COPX), (OTC:JJCTF), (GLD), (GDX), (GDXJ), (IAU), (NUGT), (PHYS), (GLDM), (AAAU), (SGOL), (BAR), (OUNZ ), (SLV), (PSLV), (SIVR), (SIL), (SILJ)

Macquarie analysts say global demand for copper is growing This is offset by slower demand growth in ChinaWhich in turn changes investor sentiment towards copper.

“Given current fundamental indicators, this move appears to be overdone and the risk of a sharp correction is very high, if not already underway,” the company says.

More about copper and copper miners

“Typical beer advocate. Future teen idol. Unapologetic tv practitioner. Music trailblazer.”

More Stories

JPMorgan expects the Fed to cut its benchmark interest rate by 100 basis points this year

NVDA Shares Drop After Earnings Beat Estimates

Shares of AI chip giant Nvidia fall despite record $30 billion in sales