Getty Images

Getty ImagesWhen the owner of 7-Eleven announced this week that it Received a purchase offer From a Canadian competitor, it sent shockwaves through Japan.

Never before has a foreign company bought a Japanese company of this size.

Historically, Japanese companies have been more inclined to buy foreign companies.

7-Eleven is the world’s largest grocery store chain, with 85,000 outlets in 20 countries and territories.

It has been particularly successful at selling itself as a quick, cheap, and delicious meal option, and in places where it is already abundant, such as Japan and Thailand.

“We have more stores than McDonald’s or Starbucks,” Seven & I Holdings chief executive Ryoichi Isaka told BBC News before the company received the takeover offer.

About a quarter of these 85,000 stores are in Japan, while about 10,000 are in the United States.

big player

By comparison, Quebec-based Alimentation Couche-Tard, which operates Circle K, has nearly 17,000 stores in 31 countries and territories. More than half of its outlets are in North America.

The deal valued Seven & i at more than $30bn (£23bn) before news of the IPO emerged.

7-Eleven shares jumped more than 20% on Monday, before giving up some of those gains the next day.

Analysts point to the weakness of the Japanese yen against the US dollar and other major currencies as helping to make Seven & i’s prices more affordable.

Along with the weaker yen, the Japanese government’s efforts to encourage mergers and acquisitions appear to be paying off, said Manoj Jain of Hong Kong-based hedge fund Maso Capital.

However, the proposal is still at a preliminary stage, and given the size of any potential deal it could face scrutiny from competition authorities.

Getty Images

Getty Images7-Eleven has been keen to capitalize on the popularity of the foods it sells — a wide variety, including rice balls, sandwiches, cooked noodles, fried chicken and dumplings.

While in most parts of the world, retail stores are where people can get a piece of chocolate or a bag of chips in an emergency, stores like 7-Eleven in Japan are very popular with visitors looking for gourmet treats.

7-Eleven’s dishes have been making waves on social media in Asia.

Visiting a 7-Eleven has been promoted as one of the best things to do in Thailand, with the store’s cheese and ham sandwiches becoming one of the most popular dishes on TikTok.

British singer Ed Sheeran is among the celebrities who have helped raise 7-Eleven’s profile – a video of him trying the snacks from a store in Thailand has gone viral.

Allowed Tik Tok content?

Isaka aims to replicate that success in the US and European markets, where the company has been under pressure from investors to sell some of its businesses and focus on the 7-Eleven brand.

The company has updated its strategy so that more stores can follow the lead of its Japanese stores.

“What we found is that stores that sell fresh food attract a lot more shoppers,” Isaka said.

“We want to grow with quality, not just quantity,” he added. “We want to make sure customers are satisfied and increase sales per store as we grow the number of stores.”

American roots

Seven & i has also been on a shopping spree. In January, it bought more than 200 US stores from petrol station chain Sunoco for about $1bn (£770m).

In April, the company purchased more than 750 stores from a franchisee in Australia.

For much of its century-long history, 7-Eleven has remained an American brand.

The company began in 1927 selling blocks of ice that were used to keep refrigerators cold, and later stocked staples such as eggs, milk and bread.

At that time, the shops were open between 07:00 and 23:00 – hence the name.

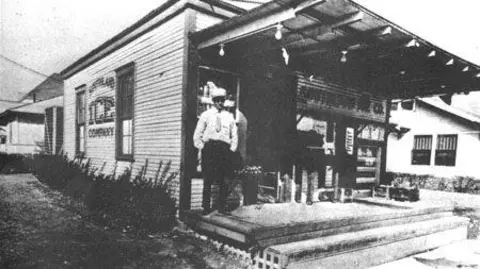

Seven & I Holding Company

Seven & I Holding CompanyAs the business grew, 7-Eleven began offering franchises outside the United States.

In 1974, Japanese retailer Ito Yokado struck a deal to open the country’s first 7-Eleven store. In 1991, the company bought a 70% stake in the chain’s U.S. parent company.

Itō-Yokado’s founder, Masatoshi Ito, who died in 2023 at the age of 98, is often credited with Transforming 7-Eleven into a global empire.

Ito Yokado was renamed Seven & i Holdings in 2005, with the “i” in its name a reference to Ito Yokado and Mr. Ito, who was at the time honorary chairman of the company.

Now, as the company decides whether to remain under Japanese ownership or return to its North American roots, experts are wondering whether more major Japanese companies could become takeover targets.

There is now “a greater willingness on the part of Japanese boards and management teams to accept external capital and be receptive to foreign trends,” Jin said.

He added that it is now possible to encourage more foreign investors to pursue their interest in Japanese companies.

“Typical beer advocate. Future teen idol. Unapologetic tv practitioner. Music trailblazer.”

More Stories

JPMorgan expects the Fed to cut its benchmark interest rate by 100 basis points this year

NVDA Shares Drop After Earnings Beat Estimates

Shares of AI chip giant Nvidia fall despite record $30 billion in sales