- ETH burn rate drops to record lows amid decline in Ethereum network activity.

- In contrast, its Ethereum competitor Solana has seen its DeFi token value quadruple so far this year.

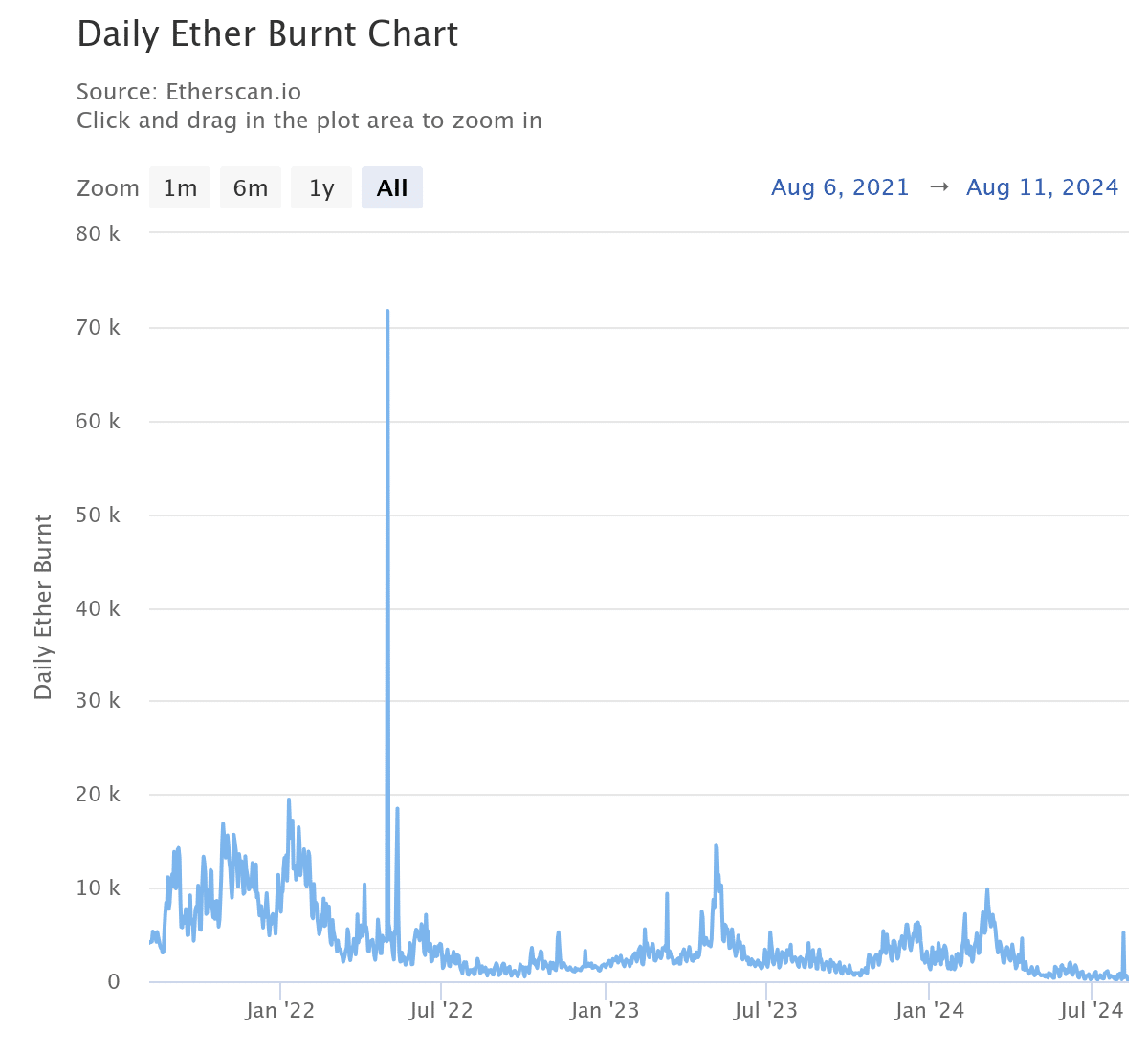

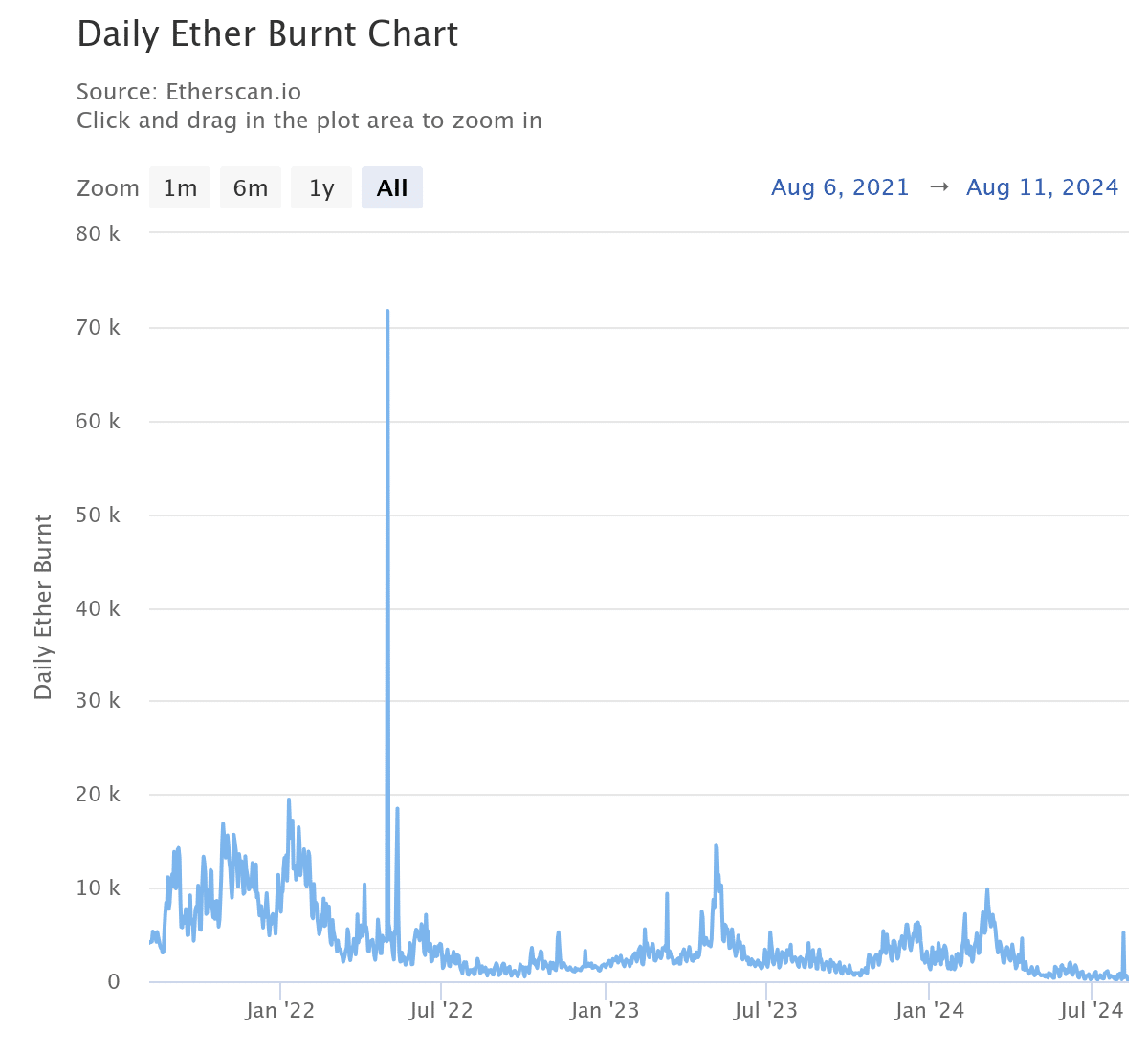

Ethereum [ETH] The burn rate dropped to record lows after 121 ETH tokens were burned on August 10, the lowest level since the EIP-1559 upgrade was implemented.

Decreasing burn rate, as shown in Etherscan, This comes as the network continues to lose its dominance in the decentralized finance (DeFi) market.

Ethereum activity down

Ethereum still holds a huge share of the DeFi market, with a total value locked of $47 billion according to Defilma.

However, competing networks like Tron [TRX] And Solana [SOL] Telecom companies have started to eat into their market share, causing a massive 17% drop in TVL since August 1.

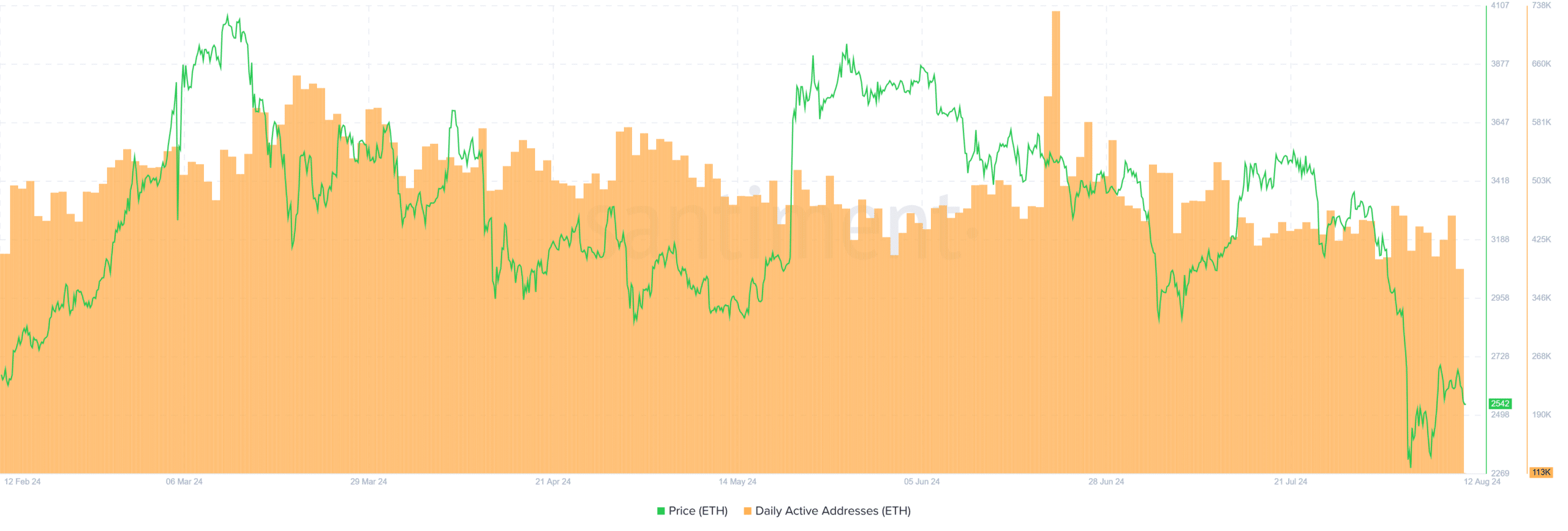

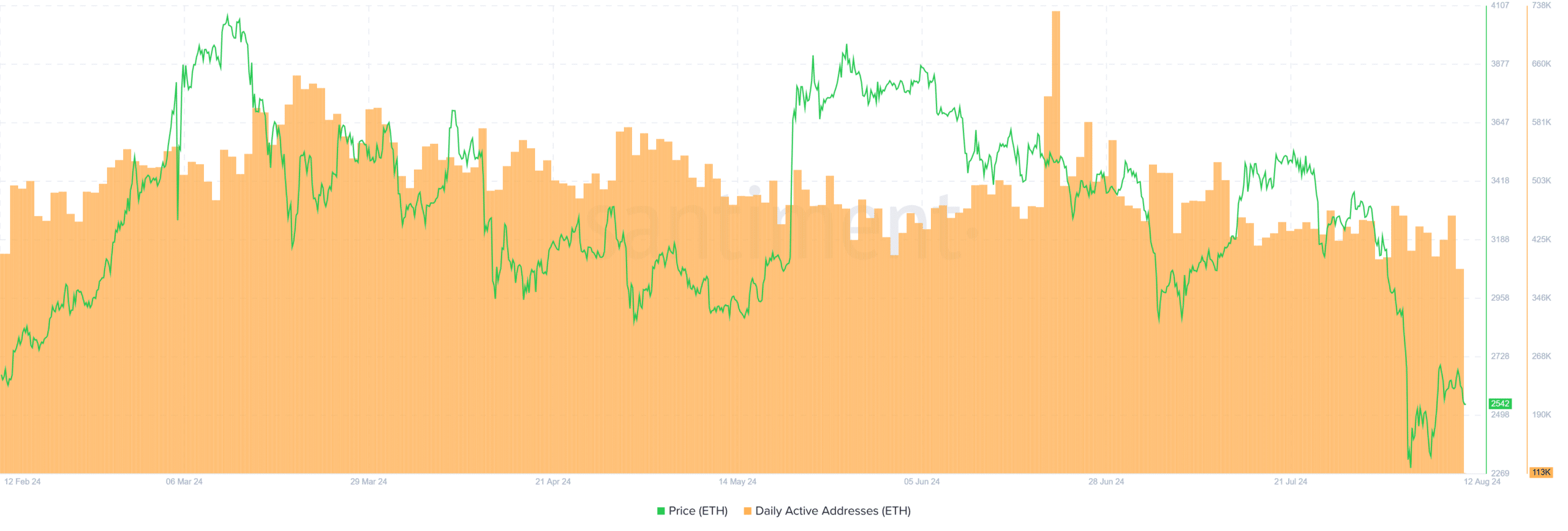

The decline in DeFi activity has also led to a decrease in the number of daily active addresses.

According to AMBCrypto’s look at Santiment data, daily active Ethereum addresses dropped from 731,000 on July 22 to around 386,000 on August 11.

Source: Santiment

The decrease in TVL and user activity leads to a decrease in the number of transactions, which hinders the collection and burning of gas fees. This has led to the Ethereum burn rate falling to its lowest level in years.

Source: Etherscan

AMBCrypto’s Look at Ultrasonic Money Data It also showed that in the past seven days, 3,885 ETH tokens were burned while 18,000 tokens were issued.

Consequently, Ethereum became inflationary, with a net total of 14,206 ETH entering the circulating supply.

Is ETH losing to SOL?

While Ethereum struggles with low network activity, its main competitor, SolanaIt recorded a significant increase in DeFi TVL.

Solana’s total assets were $4.72 billion at the time of publication, a nearly four-fold increase from $1.4 billion on January 1.

Solana has also outperformed ETH in terms of price. While Ethereum has gained 39% over the past year, Solana has seen a staggering 487% increase.

ETH is trading at $2,581 at the time of writing after falling 13% in the past two weeks.

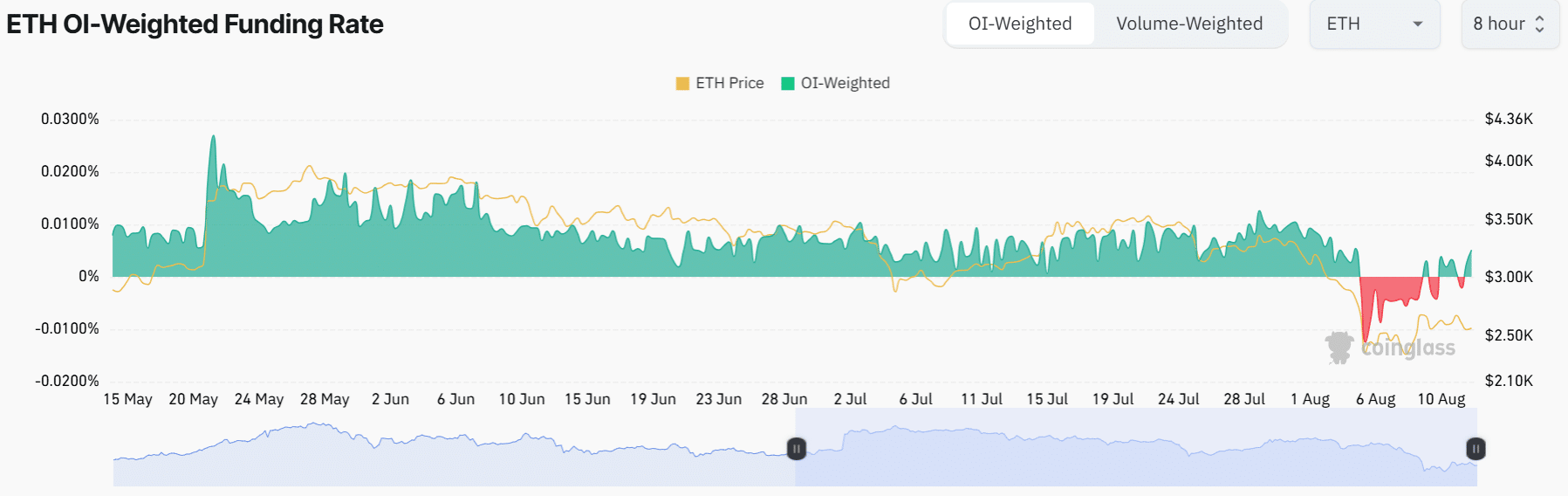

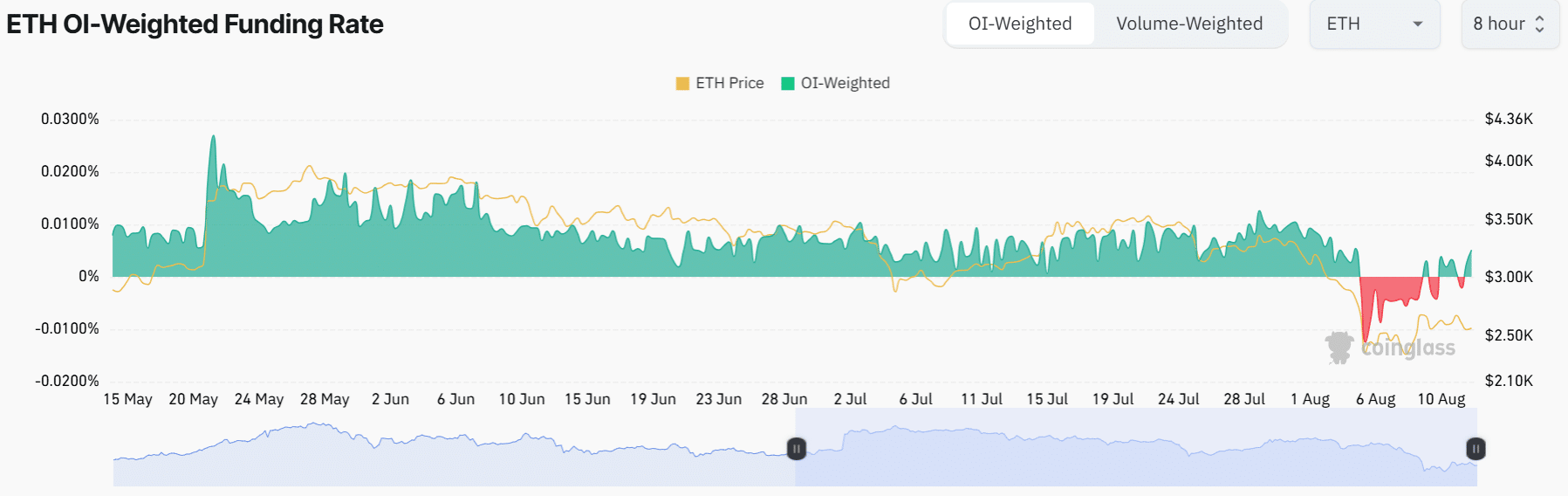

However, traders were betting on a positive price move, as the Ethereum funding rate turned from negative to positive at the time of writing.

This indicated that more traders were taking long-term positions, indicating a shift to bullish sentiment.

Source: Coinglass

The demand for spot ether supported by exchange-traded funds (ETFs) is also a catalyst for further gains.

Read about Ethereum [ETH] Price forecast 2024-2025

Since July 23, Wall Street giants BlackRock and Fidelity have bought $761 million and $282 million worth of ether respectively for their exchange-traded funds, according to Soso Value.

Ethereum also saw its highest inflows last week at $155 million, according to a recent report from Quinchers.

“Typical beer advocate. Future teen idol. Unapologetic tv practitioner. Music trailblazer.”

More Stories

JPMorgan expects the Fed to cut its benchmark interest rate by 100 basis points this year

NVDA Shares Drop After Earnings Beat Estimates

Shares of AI chip giant Nvidia fall despite record $30 billion in sales