- USDT and USDC surge by nearly $3 billion amid crypto market slowdown

- Tether’s USDT has recorded $1.5 billion in deposits while Circle’s USDC has recorded $820 million in deposits.

Despite the positive performance that preceded it, the largest cryptocurrency market crashed on Monday. The start of the week saw all cryptocurrencies decline amid the global stock market crash. However, stablecoins defied all market odds throughout the week.

In fact, the stablecoin sector has seen growth in market cap and supply, led by USDT and USDC.

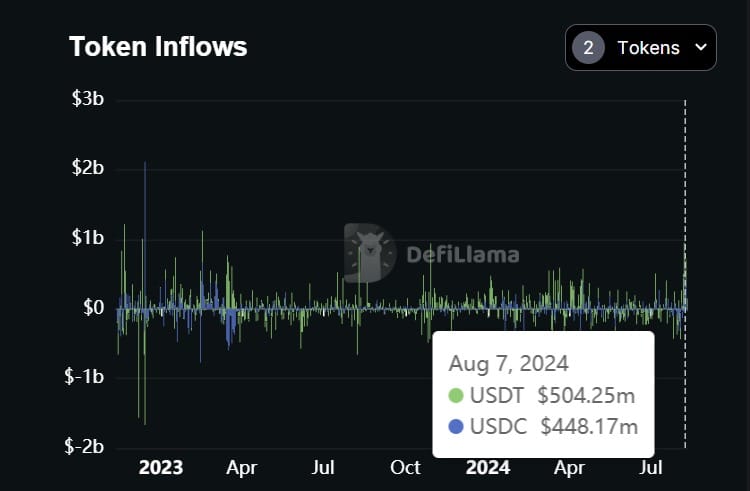

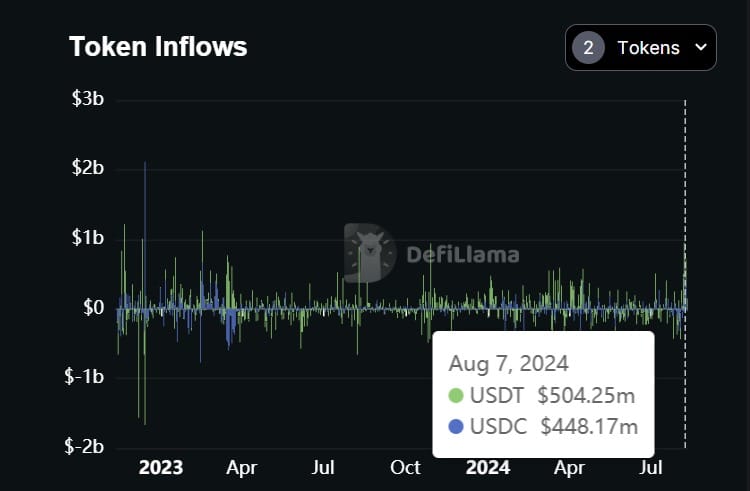

USDT and USDC supply hits $3 billion in a week

Source:X

Over the past week, the supply of Tether’s USDT and Circle’s USDC has skyrocketed to $3 billion. As the crypto markets have been in a steady decline, the increased supply has signaled a greater need to buy the dip. As a result, most investors have been quick to buy the dip as crypto prices have fallen.

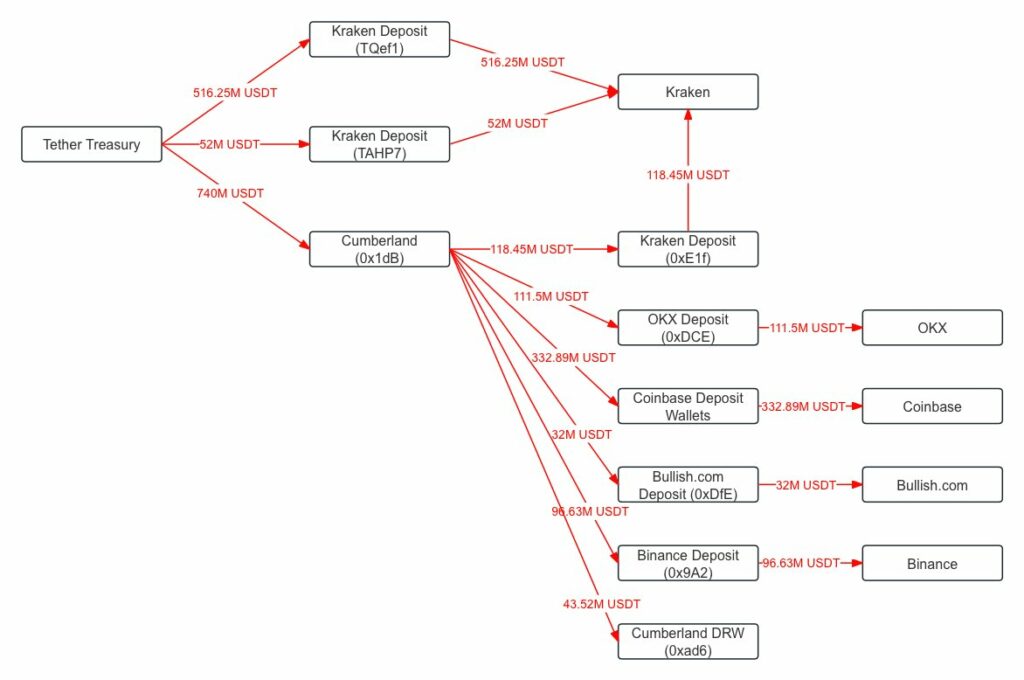

According to data shared on X by Lookonchain, Tether has moved $1.3 billion to exchanges and market caps since Monday’s crash. Look on Chain male,

“1.3 billion USDT have been transferred from Tether’s treasury to exchanges since the market crash on August 5.”

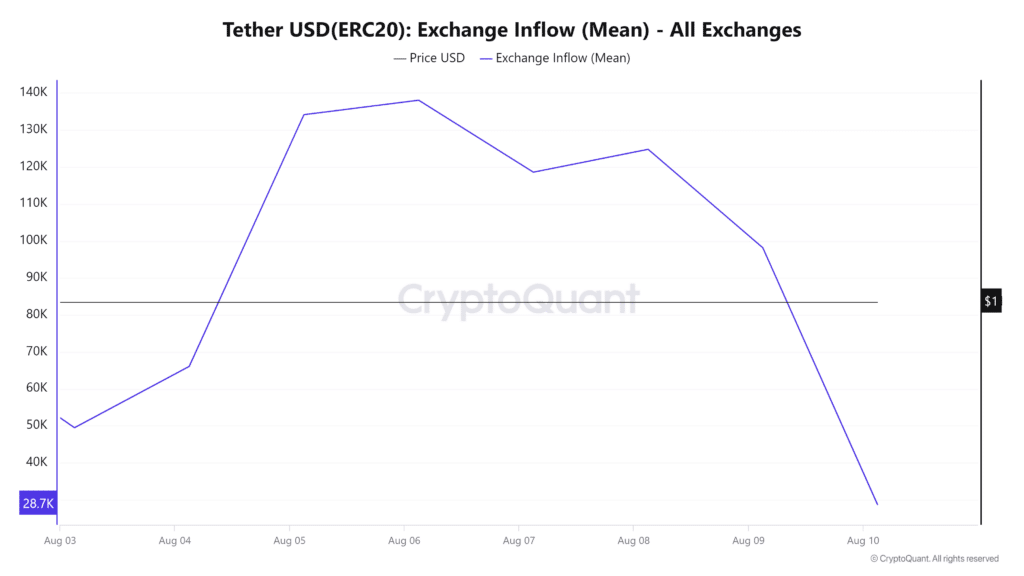

Stablecoin prices have surged since the start of the crypto market crash, which was triggered by traders’ transfers to exchanges. In fact, Cryptoquant data revealed that USDT inflows to exchanges surged by 181% between August 3 and August 6 during the market crash.

Source: CryptoQuant

Similarly, data from defiLlama indicated that Binance recorded a massive growth in USDT deposits to reach $1.5 billion.

Additionally, USDC deposits on Binance reached a record high of $820 million in just 3 days.

Source: Devilama

Simply put, the data shows that the recent market decline presented a buying opportunity with all stakeholders turning into net buyers.

The impact of the increased buying pressure became apparent 48 hours later when markets began to recover with significant gains across the board.

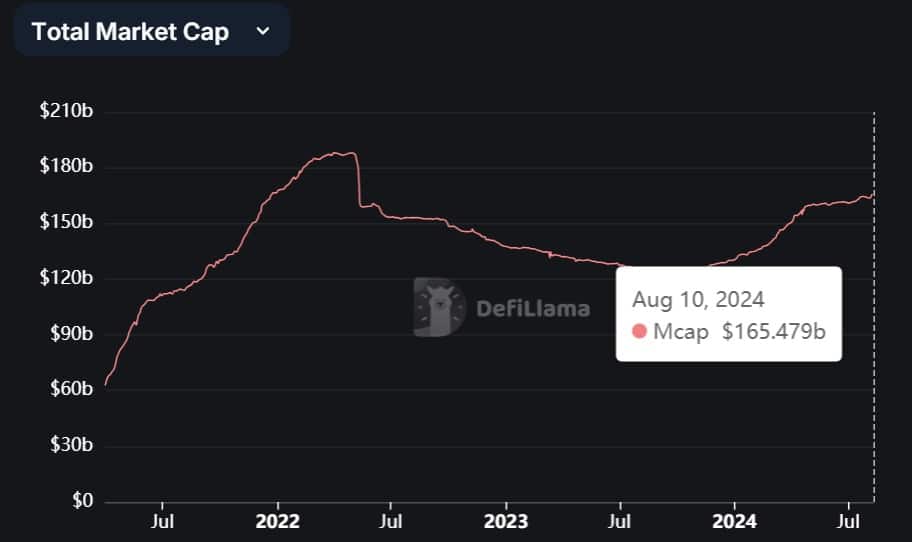

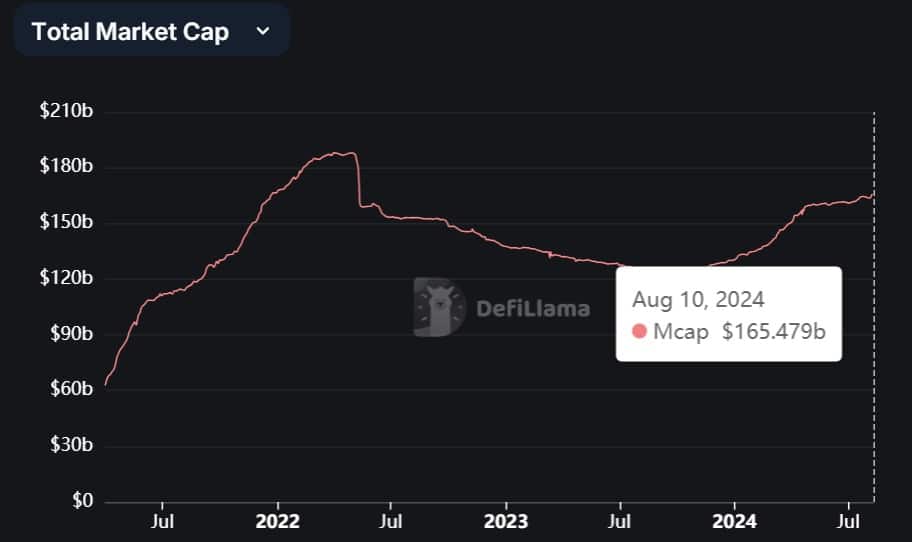

Market value growth reaches record level

Market cap has also surged as supply has grown during the market downturn. Tether’s USDT market cap has grown to a record high of $115.4 billion after seeing sustained growth over the past three months. Similarly, USDC has maintained its growth since Circle’s compliance with MICA. Over the past week, USDC increased its numbers by $1.6 billion to $34.48 billion.

Now, the USDC pair has reached its highest yearly level since the SVB collapse in 2023.

Other cryptocurrency analysts have also noticed this increase, with David Alexander sharing his analysis on X, saying,

“Interesting moves in USDC this week as the total circulating supply increased by $1.56B (4.8%) after seeing a sharp decline ahead of broader market headwinds. Most of these inflows occurred on Ethereum ($1.34B) and Solana ($356M).”

Source: Devilama

Over the past year, stablecoins have seen steady growth from $124.6 billion on August 10, 2023 to $165.4 billion at the time of publishing this article. This can also be seen as a sign of increased adoption, interest, and usage, which translates into growth for USDT and USDC.

“Typical beer advocate. Future teen idol. Unapologetic tv practitioner. Music trailblazer.”

More Stories

JPMorgan expects the Fed to cut its benchmark interest rate by 100 basis points this year

NVDA Shares Drop After Earnings Beat Estimates

Shares of AI chip giant Nvidia fall despite record $30 billion in sales