- Ethereum lags behind Bitcoin in demand from institutional investors

- Ethereum still maintains a strong lead against Bitcoin in one key area

Ethereum ETFs may have brought some excitement to the market, but the buzz they generated was nowhere near what we saw with Bitcoin. This finding is consistent with the push by political elites for Bitcoin.

While the observation confirms how Bitcoin is overtaking Ethereum, could the latter also have a liquidity disadvantage? In fact, a recent study showed that Bitcoin is outperforming Ethereum. QCP Analysis A recent report suggests that Ethereum may be marginalized from the overall capital markets as the market continues to favor Bitcoin.

Since both Bitcoin and Ethereum are available as Spot ETF assets, comparing performance may provide a clearer picture of the differences in performance.

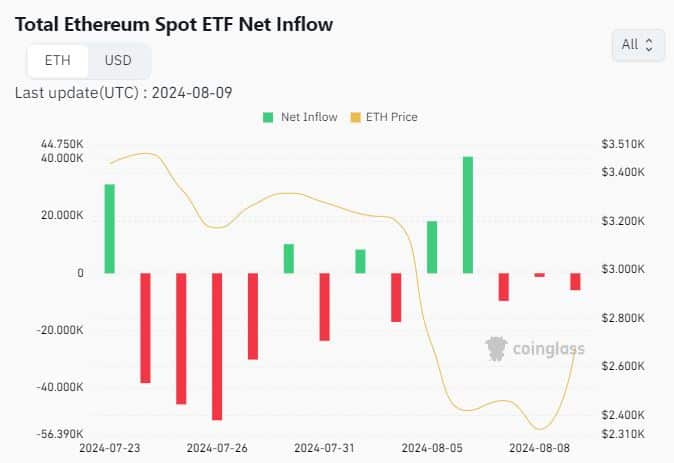

Net Inflows to Bitcoin ETFs Bitcoin inflows have averaged around 300,000 BTC over the past two weeks, according to Coinglass. Meanwhile, net inflows to Ethereum spot ETFs totaled -114,350 ETH.

Source: Coinglass

The data revealed stronger demand for Bitcoin, compared to ETH in the spot ETF sector.

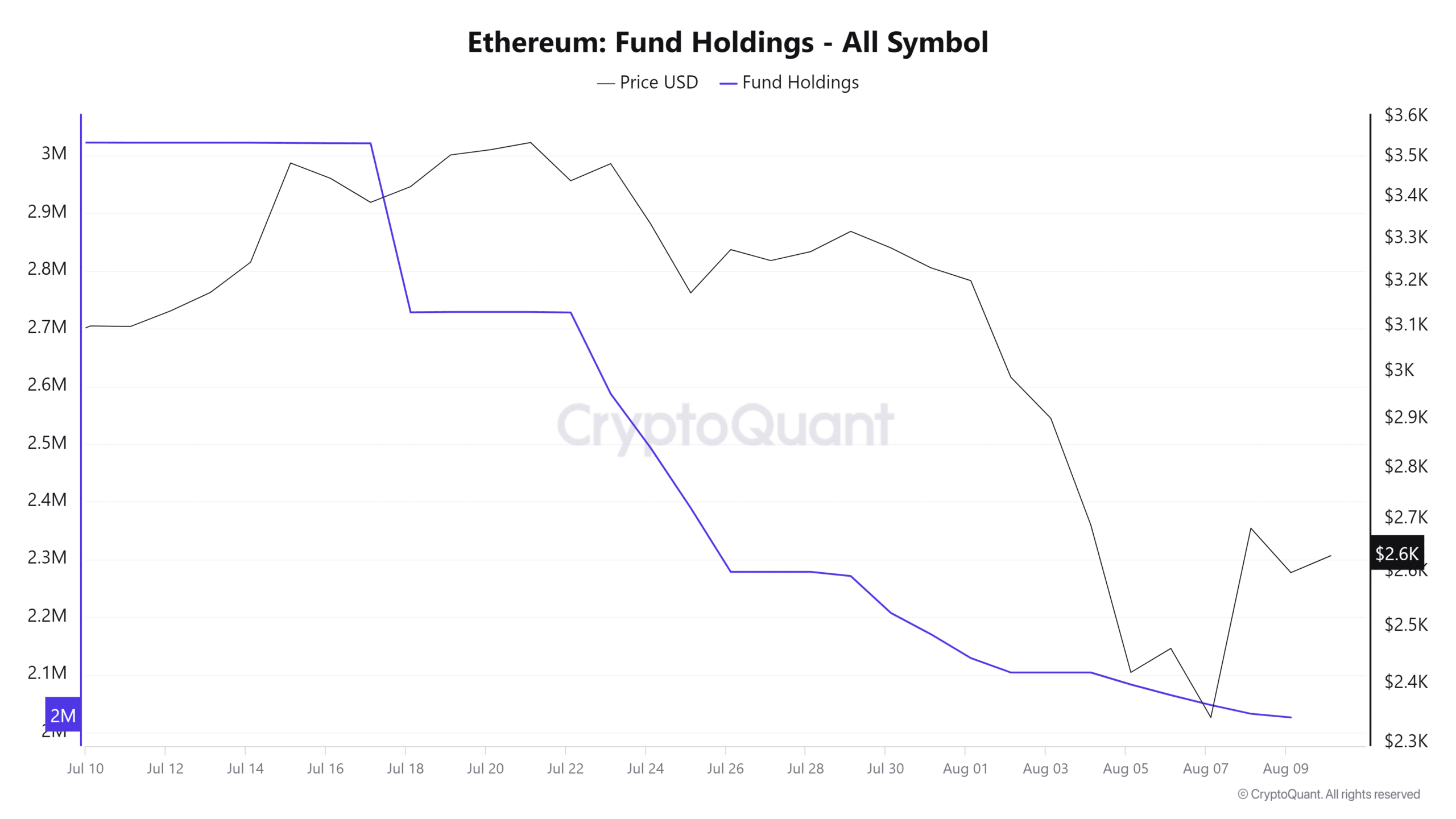

Our assessment also revealed the same regarding the funds’ holdings. According to CryptoQuant, the funds’ ETH holdings amounted to 2,026,328.5 ETH, worth $5.32 billion at the ETH price at the time of publication.

Source: CryptoQuant

Here, it is also worth noting that ETH fund holdings were still on a downward trajectory at the time of writing, despite the market recovery.

Meanwhile, Bitcoin funds’ holdings stood at 280,951.35 BTC, which is worth $17.07 billion at the time of writing — just over 3 times ETH. This is despite Bitcoin funds’ holdings also declining over the past four weeks.

Fair comparison?

The data indicated that Bitcoin is the most preferred in the capital markets, compared to Ethereum.

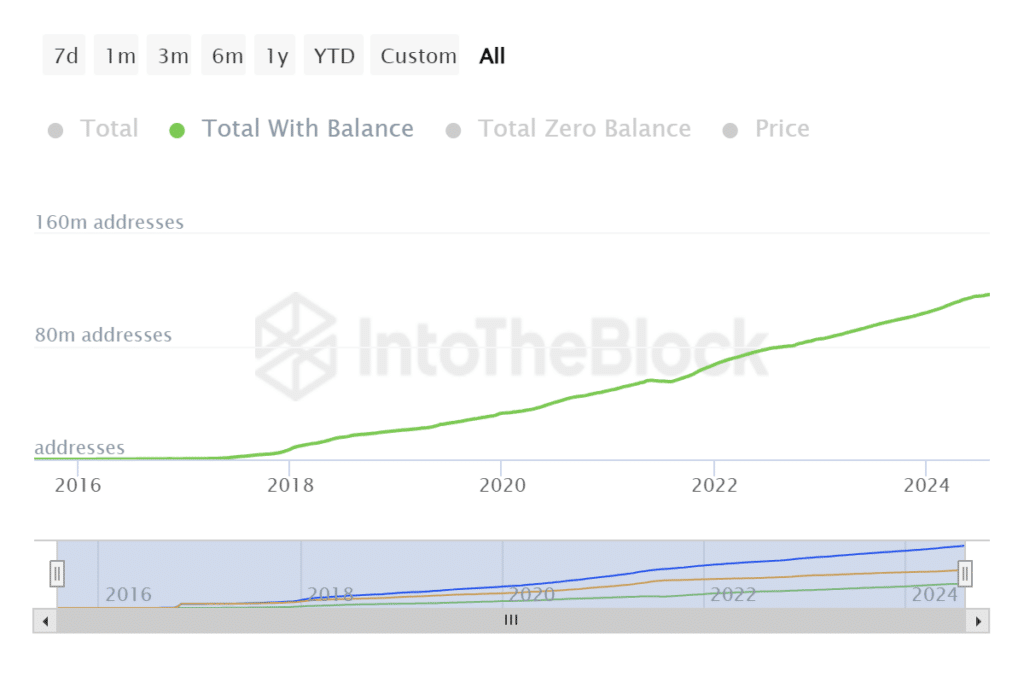

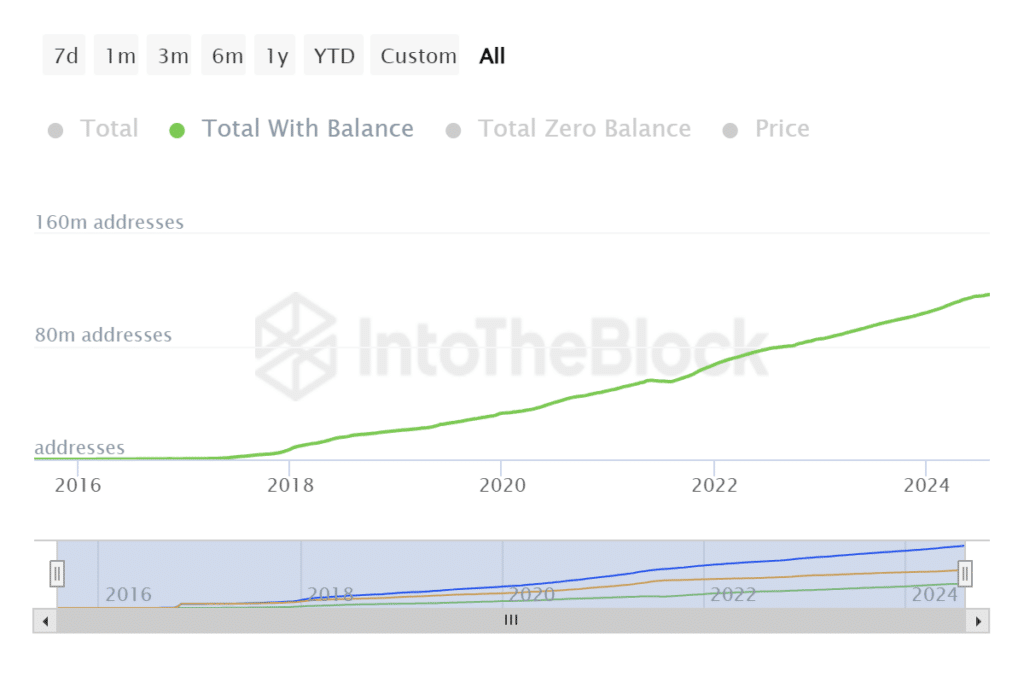

This may explain why Bitcoin has more funds than Ethereum. However, Ethereum also wins in other key areas. For example, it has a much higher total address count with a balance of 116.97 million.

Source: IntoTheBlock

By comparison, Bitcoin had “only” 52.67 million total addresses with balances — less than half of Ethereum’s total addresses.

This highlights one of Ethereum’s strengths as an expanding ecosystem, and is perhaps one of the biggest reasons why Ethereum recently received spot ETF approvals.

Bitcoin’s early lead over Ethereum certainly provides a clear advantage. However, Ethereum also presents an opportunity that institutional investors are beginning to seize. Moreover, Ethereum ETFs have only been around for a few weeks, while Bitcoin ETFs have been around for months.

The remaining months of 2024 are expected to provide a clearer picture of how Ethereum will perform in the overall capital market. However, the results confirm that Ethereum is at a slight disadvantage compared to Bitcoin in terms of securing institutional liquidity.

This may also explain the differences between the price action of BTC and ETH.

“Typical beer advocate. Future teen idol. Unapologetic tv practitioner. Music trailblazer.”

More Stories

JPMorgan expects the Fed to cut its benchmark interest rate by 100 basis points this year

NVDA Shares Drop After Earnings Beat Estimates

Shares of AI chip giant Nvidia fall despite record $30 billion in sales