- MATIC’s price has fallen by more than 7% in the past 24 hours

- Metrics indicated a further decline in its price soon

Matic It has greatly disappointed its investors with its recent price action. However, while the bears dominated the altcoin price on the charts, Polygon’s performance in the DeFi space looked commendable. Hence, the question – can the latter help initiate a trend reversal for MATIC?

Polygon’s latest setback

Coin Market Cap Data It revealed that the price of MATIC has fallen by more than 5% in the past seven days. However, things quickly became worse as the altcoin lost another 7% of its value in the last 24 hours alone. At the time of writing, MATIC is trading at $0.6622 with a market capitalization of over $6.5 billion, making it the 18th largest cryptocurrency.

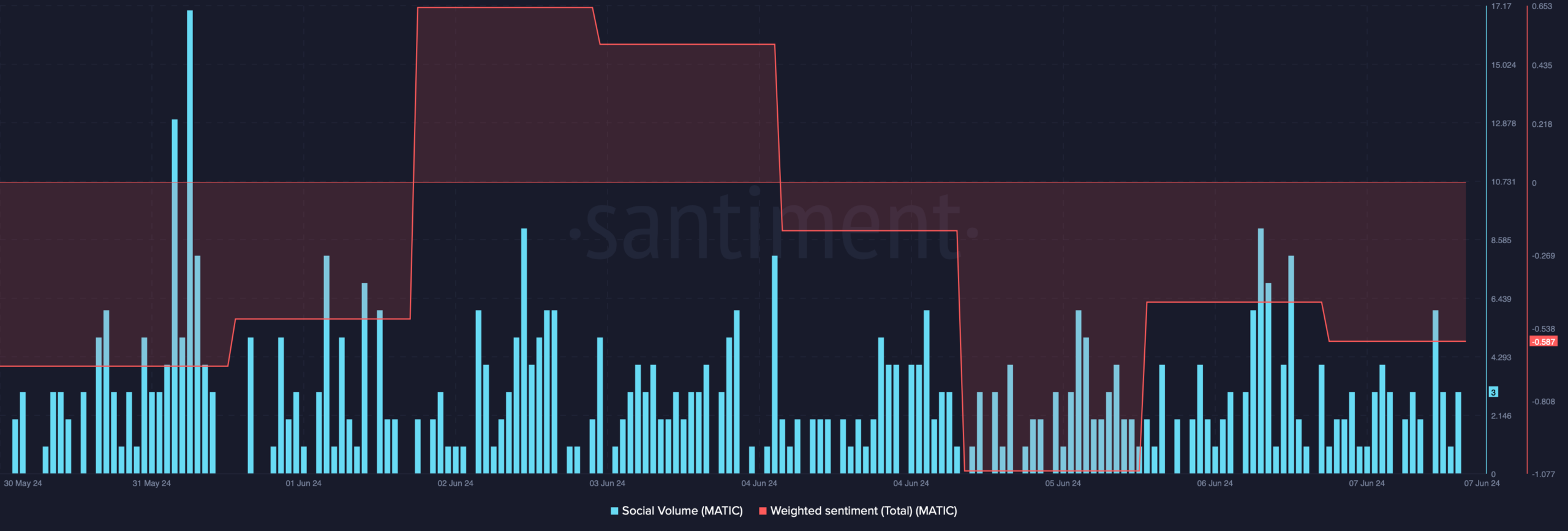

The price drop also had an impact on the token’s social metrics. For example, her social size has decreased, reflecting her declining popularity. Its weighted sentiment also remained in negative territory – a sign that bearish sentiment has retained its dominance in the market.

Source: Santiment

The worst news is that while the price of the token decreased, its trading volume increased. This legitimized the decline in prices and indicated that the chances of the trend continuing are high.

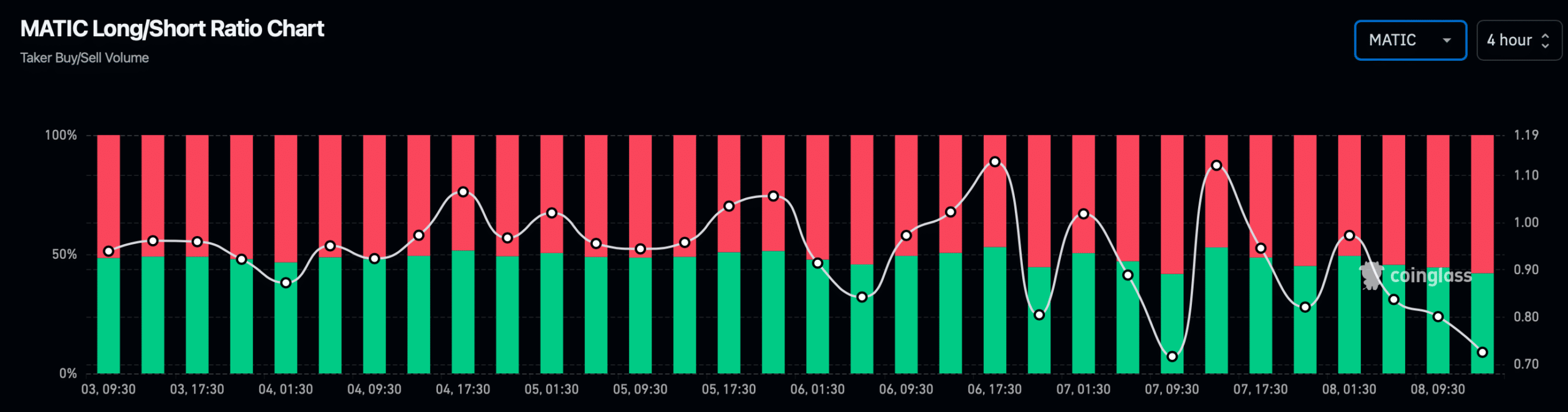

Furthermore, AMBCrypto’s look at Coinglass data revealed that the altcoin’s buy/sell ratio declined over the past four hours. A low ratio is a sign of bearish sentiment, as there is greater interest in selling or shorting assets.

Source: Coinglas

The good part is…

While the price of the token fell, Polygon participated tweet Highlighting blockchain performance in the DeFi space. Accordingly, Polygon PoS, zkEVM, and CDK have emerged as the top options for DeFi creators, providing developers with scalable networks and tools to build financial solutions.

Aave was the largest DeFi protocol on Polygon by total value with $460 million locked. The Azuro Protocol has been introduced to EVM chains that support forecasting application ecosystems. In just 14 months on Polygon, Azuro now has over 25 live apps, $300M in volume, and over $3.2M in revenue.

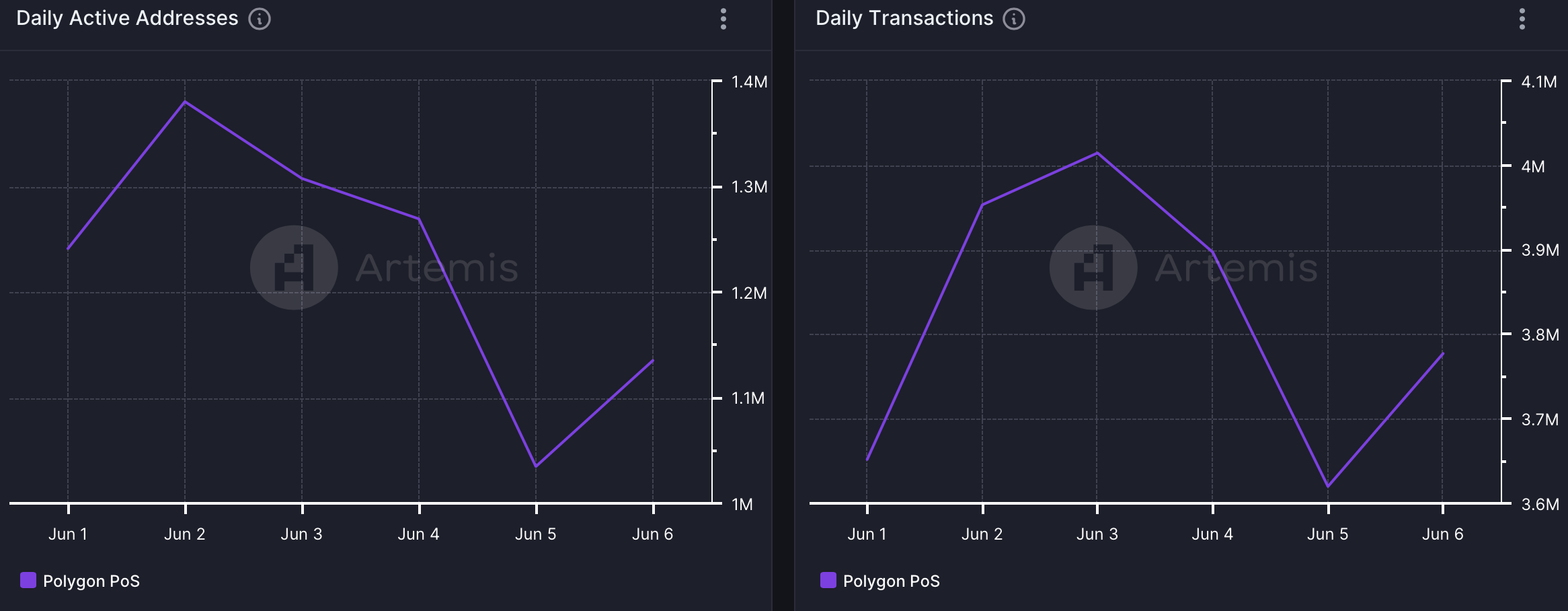

However, despite having such strong pillars in the DeFi space, Polygon network activity declined last week.

Realistic or not, here it is Market cap of MATIC in terms of ETH

Finally, AMBCrypto’s analysis of Artemis data revealed that MATIC’s daily active addresses also decreased. Thanks to this, daily blockchain transactions have decreased over the past seven days.

Source: Artemis

What this means is that while Polygon DeFi’s performance has been praiseworthy, if not perfect, it is not yet enough to drive MATIC’s value into bullish territory on its own. Therefore, the altcoin market trend is likely to continue for the time being.

“Typical beer advocate. Future teen idol. Unapologetic tv practitioner. Music trailblazer.”

More Stories

JPMorgan expects the Fed to cut its benchmark interest rate by 100 basis points this year

NVDA Shares Drop After Earnings Beat Estimates

Shares of AI chip giant Nvidia fall despite record $30 billion in sales