- The significant decline indicates a decline in interest in Solana-based meme coins.

- SOL price may test lower support levels around $145.90 if interest continues to decline.

Daily trading volume of decentralized exchanges on Solana [SOL] He fell. As of May 26, AMBCrypto’s analysis of the Artemis dashboard showed volume at $984 million.

Three days earlier, the number was more than $1.5 billion. This decline was in contrast to the blockchain record in April. At that time, Solana’s live trading volume reached a record high of $60 billion, raised every month.

Considering the Last fall As May comes to a close, it is possible that the total volume for the month will be lower. The previous rise can be linked to the memecoin craze on the network.

No meme coins and no party

Therefore, this decrease may mean that engagement with memecoins launched on Solana is no longer as high as it was. In addition, the development appears to put SOL, the ecosystem’s native token, in an awkward position.

At press time, SOL was priced at $161.49. A few days ago, the value approached $190. If DEX volume continues to decline, SOL may follow as well.

This is because the demand for cryptocurrency is relatively linked to the circulation of memcoin. For those unfamiliar, while some memecoin may allow exchange with USDC, most require SOL.

Source: Artemis

As such, if buying of memecoins decreases, SOL bids will likely decrease. Apart from this, other metrics can also predict the next direction of Solana price, and AMBCrypto has looked into them.

SOL has become weak

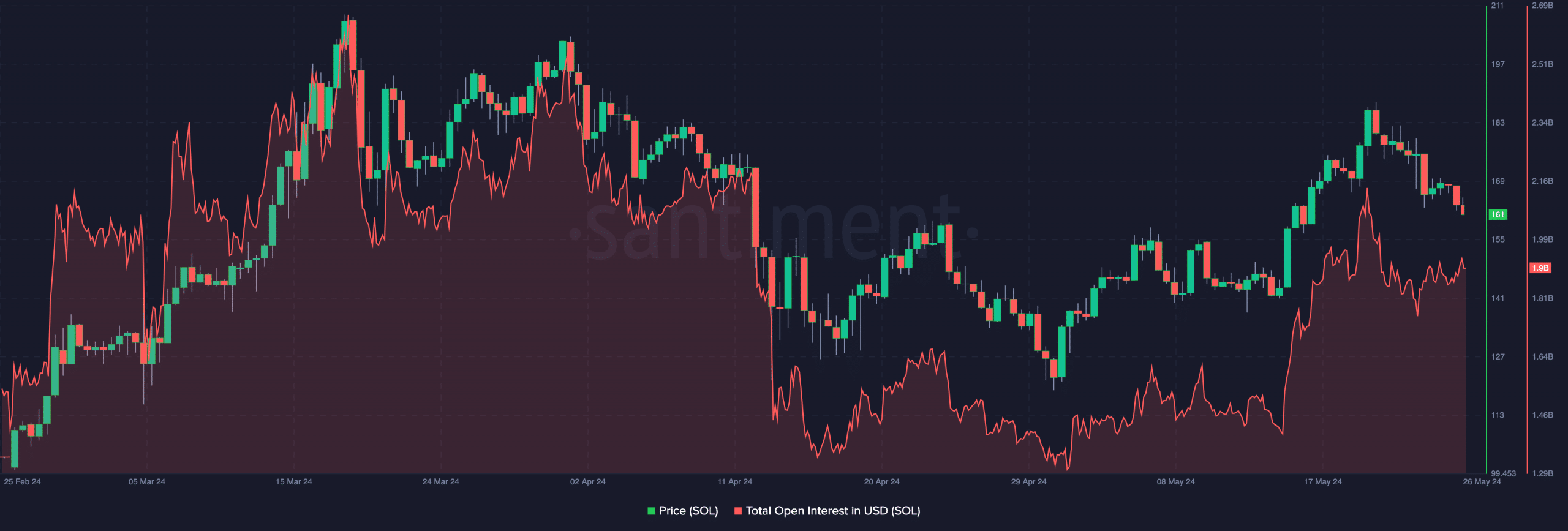

One of the other indicators we analyzed was Solana’s open interest (OI). According to data from Santiment, OI fell to $1.90 billion. As of May 20, this value was approximately $2.20 billion.

OI is the value of all open positions in the contract. If it increases, it means that net positions are increasing and more money is coming into the market. In this case, the increase serves as a bullish signal.

A good example is shown in the chart below where SOL price rose to $188.45 as OI jumped. However, this decline means that Liquidity withdrawn SOL contracts increased.

Source: Santiment

Therefore, the strength of the potential upside is diminishing. If this continues, the price of SOL may continue to fall, and a move to $145.90 may be possible.

Additionally, AMBCrypto reported that Solana is starting to lag behind other blockchains in terms of activity. Some of the projects that gave Solana a run for its money were Aptos [APT] And it was settled [SUI].

Realistic or not, here’s APT’s market cap in terms of SOL

However, it is still uncertain whether these projects will be able to stand the test of time by consistently surpassing Solana’s transactions.

If this happens, Solana may lose a portion of its market value as well as its price. If not, he may return to his winning ways.

“Typical beer advocate. Future teen idol. Unapologetic tv practitioner. Music trailblazer.”

More Stories

JPMorgan expects the Fed to cut its benchmark interest rate by 100 basis points this year

NVDA Shares Drop After Earnings Beat Estimates

Shares of AI chip giant Nvidia fall despite record $30 billion in sales