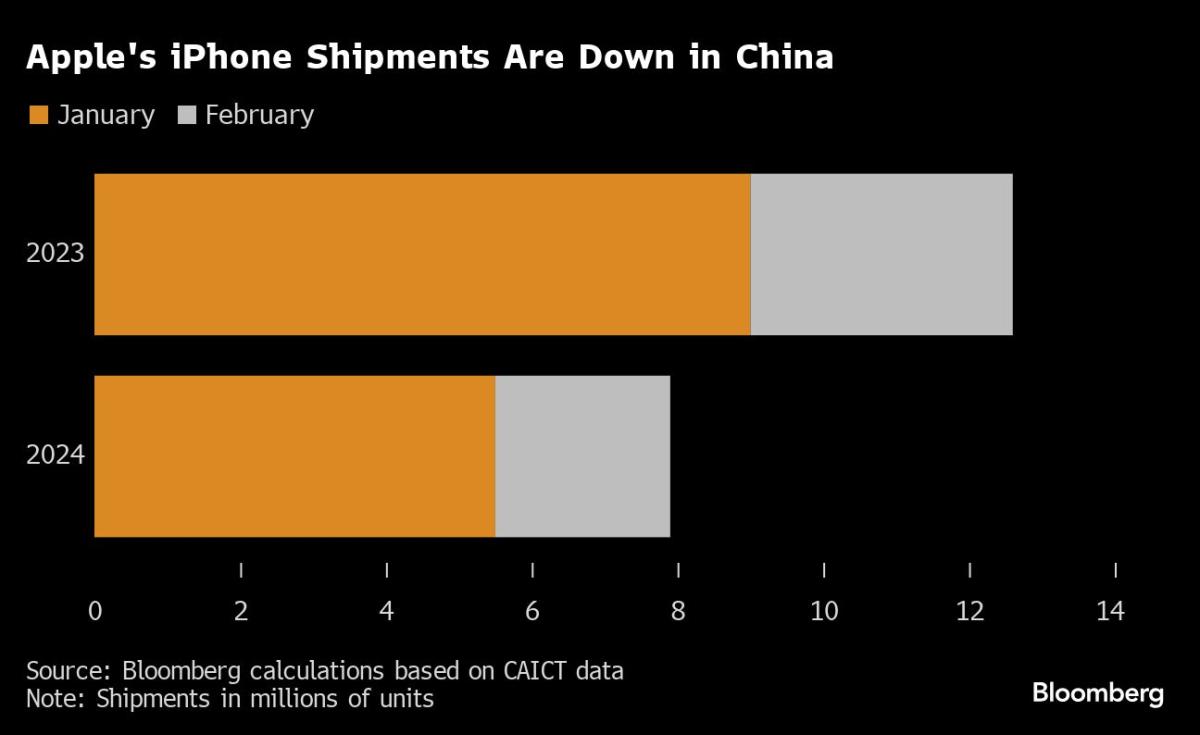

(Bloomberg) — Apple Inc.'s iPhone shipments fell 10% more than expected in the March quarter, reflecting weak sales in China despite a recovery in the broader smartphone industry.

Most read from Bloomberg

The company shipped 50.1 million iPhones in the first three months, according to preliminary numbers from IDC, lagging the average analyst estimate compiled by Bloomberg of 51.7 million units for the period.

The Cupertino, California-based company has been struggling to maintain sales in the world's largest smartphone market since the latest generation of iPhones debuted in September. The resurgence of Huawei Technologies Co., more domestic competition and Beijing's ban on foreign devices in the workplace have all weighed on sales.

This stagnation is particularly evident against the backdrop of the mobile phone market in general recording its best growth in years. Smartphone makers shipped 289.4 million phones in the period, representing a 7.8% increase from last year's lows, when many manufacturers were grappling with a glut of unsold devices. Samsung Electronics Co. 1 in the March quarter, while budget-focused brand Transsion increased its shipments by 85% and Xiaomi Corp rebounded to close the gap with second-place Apple.

“The smartphone market is emerging from the turmoil of the past two years stronger and changed,” said Nabila Popal, research director at IDC. “While both major players saw negative growth in the first quarter, Samsung appears to be in a stronger position overall than in recent quarters.”

Leading Apple supplier Hon Hai Precision Industry Co. and Murata Manufacturing Co. and LG Innotek Co., Ltd. and TDK Corp., in early Asian trading on Monday, amid widespread selling due to fears of escalating conflict in the Middle East.

During the pandemic, Apple's iPhone has shown the most resilience as consumers have pulled back on smartphone purchases from most of its Android-powered rivals. This inventory buildup has led to aggressive pricing by Chinese competitors like Xiaomi, which took months to exhaust their excess supply and are now starting to ramp up shipments back up. Huawei's surprise return to prominence last year — with its made-in-China chip and HarmonyOS operating system in the Mate 60 series — has eroded Apple's premium market share in China since August.

“Increasing competition in China accounts for a large part of Apple's decline in the first quarter,” Bhopal said. Elsewhere, a number of regions started the year with excess stock of iPhones after heavy shipments in the final months of 2023, she added.

IDC researchers found that average selling prices for cell phones are rising, as consumers increasingly choose premium models that they intend to keep longer. Apple, which consistently maintains the highest ASP in the industry, has led the way in this, with consumers showing a clear preference for its higher-end models. However, this year the company resorted to unusual discounts to stimulate sales, with some retail partners in China taking up to $180 off the regular price.

In March, Apple opened a new large store in the center of the financial center Shanghai, with CEO Tim Cook in attendance. China hosts the company's largest retail network outside the United States and accounts for nearly a fifth of sales, which are still driven by the iPhone. However, many of the attendees who spoke to Bloomberg at the Shanghai store launch had gotten their iPhones more than two years ago. While Apple fans said they intend to stay within the Apple ecosystem, some said they are also considering foldable device options from competitors or the Huawei Mate 60's successor.

What does Bloomberg Intelligence say?

–With assistance from Jessica Sui.

(Updates with stock reactions and comments)

Most read from Bloomberg Businessweek

©2024 Bloomberg L.P

“Analyst. Web buff. Wannabe beer trailblazer. Certified music expert. Zombie lover. Explorer. Pop culture fanatic.”

More Stories

It certainly looks like the PS5 Pro will be announced in the next few weeks.

Leaks reveal the alleged PS5 Pro name and design

Apple introduces AI-powered object removal in photos with latest iOS update