-

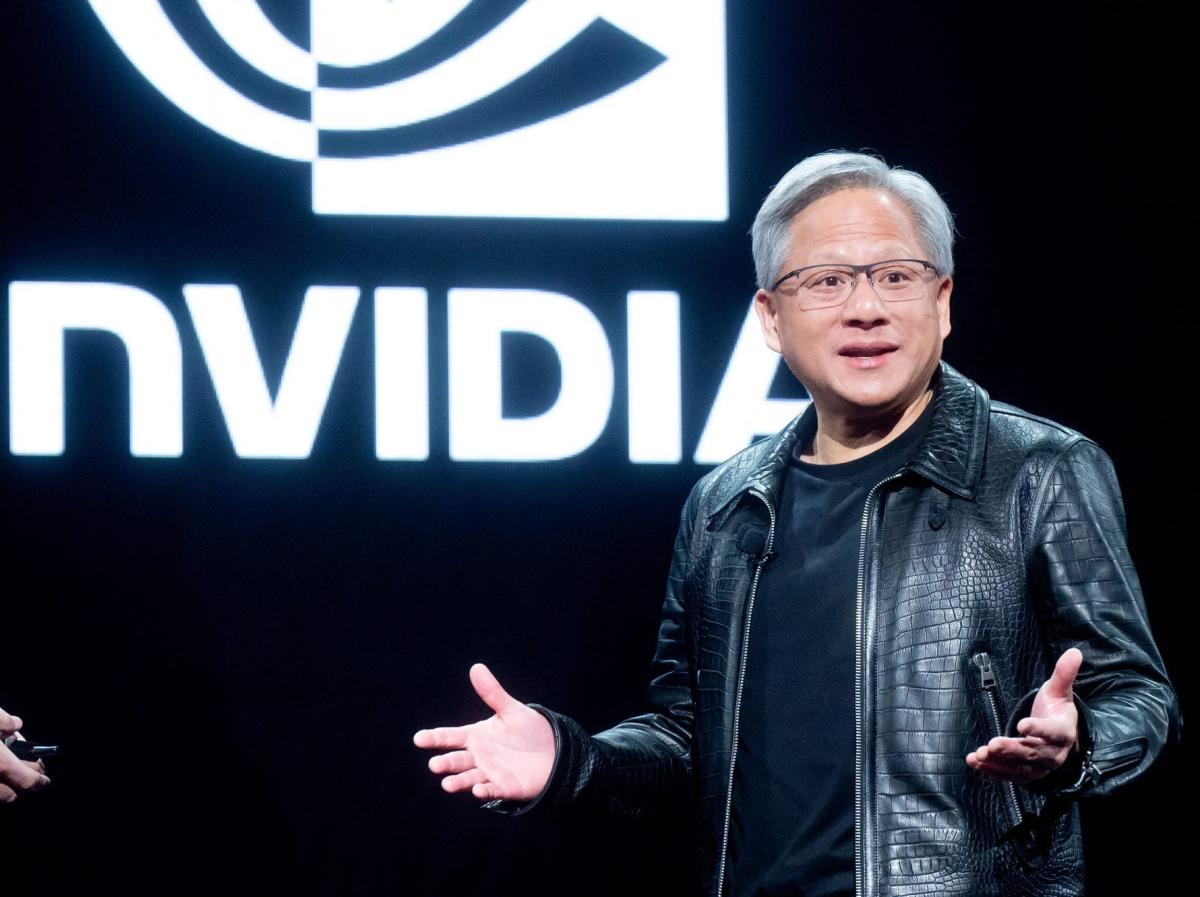

Nvidia stock doesn't look expensive even at its $2 trillion valuation, according to Bank of America.

-

The bank increased its price target for Nvidia to $1,100 ahead of the “AI Woodstock” event, implying a 24% upside.

-

Nvidia is trading at a lower P/E ratio than it was in November 2022, BofA said.

Even at a $2.2 trillion valuation, Nvidia Inventory is still inexpensive, American bank he said in a note on Wednesday.

The bank reiterated its 'buy' rating and raised its price target to $1,100 from $925, representing a potential upside of 24% from current levels.

“Despite the year-to-date outperformance, NVDA's valuation and ownership are attractive compared to its semi/IT peers,” said Vivek Arya, Bank of America analyst.

Nvidia shares are up 80% year to date It has risen 287% over the past year as demand for its AI-enabled graphics cards remains insatiable.

But amid the incredible success of Nvidia's core business, the company's stock is still trading at lower valuations than when ChatGPT first launched in 2022.

“NVDA is down today at 37x NTM PE versus 44x PE when ChatGPT launched in November 2022,” Arya said, adding that the stock is trading well within the historical forward price-to-earnings range of 26x to 69x.

Meanwhile, while most investors own Nvidia stock, they are still underweight the stock relative to its market weight. Standard & Poor's 500.

“Valuation and ownership levels continue to indicate there is room for upside,” Arya said. “Our latest ownership analysis indicates that although NVDA is widely held (67% of funds in our survey), its relative weight (concentration of ownership in NVDA versus concentration in the SPX) is lower than that of its large-cap IT peers (1.01 x versus 1.13x peers) although “nearly 9x faster growth potential,” Arya said.

A further rise in Nvidia stock could come from its “AI Woodstock” event on March 18, when it hosts the GPU Tech conference and is set to unveil the successor to its hugely popular H100 chip.

“We expect GTC to showcase: 1) the growing impact of genetic AI and digital twins across a wide range of end markets, 2) the opportunity to re-engineer approximately $1-$2 trillion of global computing infrastructure with accelerators, resulting in a $250 US – $500 billion annual market (vs. $250 billion previously) over the next 3-5 years, 3) Modernization of pipelines via accelerators (B100, N100), Ethernet switches, DPU, and Edge AI.”

Read the original article on Interested in trade

“Typical beer advocate. Future teen idol. Unapologetic tv practitioner. Music trailblazer.”

More Stories

JPMorgan expects the Fed to cut its benchmark interest rate by 100 basis points this year

NVDA Shares Drop After Earnings Beat Estimates

Shares of AI chip giant Nvidia fall despite record $30 billion in sales