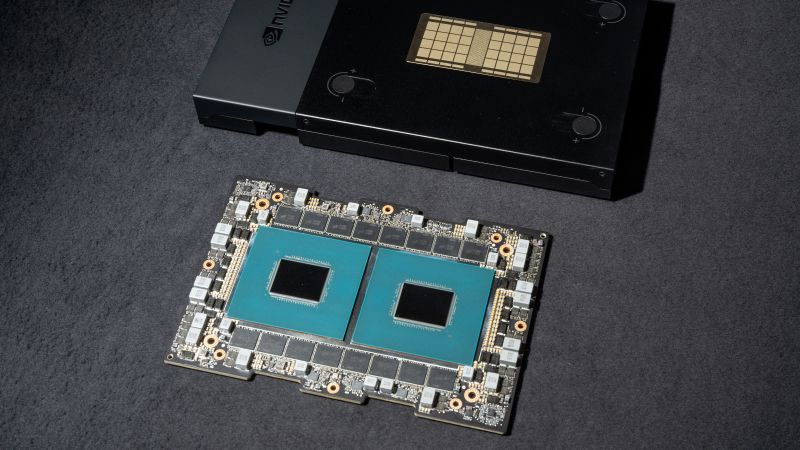

Marlena Sloss/Bloomberg/Getty Images

An Nvidia Grace CPU Superchip, lower part and Grace-Grace module are arranged at the company's headquarters in Santa Clara, California, US, on Monday, June 5, 2023.

New York

CNN

—

Last year was a banner year for AI, and no company benefited from the trend quite like chipmaker Nvidia.

Earnings released Wednesday show that Nvidia's profits grew to nearly $12.3 billion in the three months ended Jan. 28 — up from $1.4 billion in the same quarter last year, an increase of 769% year-over-year and stronger growth than Wall Street analysts expected. . is expected. This result helped raise the company's profits for the full year by more than 580% over the previous year.

Nvidia also posted fourth-quarter revenue gains of 265% year-over-year, also exceeding analyst expectations, as the company continues to ride the wave of massive investment in artificial intelligence.

“Demand is increasing worldwide across companies, industries and countries,” CEO Jensen Huang said at a press conference. statement Wednesday. In a call with analysts following the report, Huang compared the widespread adoption of AI technology to the beginning of a new industrial revolution.

Nvidia is Crucial to the burgeoning AI space. The US chipmaker is unrivaled in producing processors that power artificial intelligence systems, including generative AI, the buzzy new technology that can create text, images and other media.

Nvidia accounts for about 70% of AI semiconductor sales, even as Meta, Amazon, IBM and Microsoft start producing some of their own chips, according to Dan Morgan, a vice president at Synovus Trust Company.

Sales from the company's core data center business grew 409% year over year to reach a record $18.4 billion in the fourth quarter, thanks to partnerships with infrastructure giants like Google, Amazon and Cisco.

But the company's rise in share price over the past year – shares grew about 230% in 2023 – means Nvidia is now hugely important to the broader market too. In a note on Tuesday, Goldman Sachs analysts described Nvidia as “the hottest stock on the planet.” It was Nvidia Best performing stocks in the S&P 500 In 2023.

Nvidia shares jumped nearly 7% in after-hours trading after Wednesday's report.

But some shareholders worry that the explosive growth cannot continue forever. And the American restrictions introduced last year on Exporting advanced artificial intelligence chips to Chinawhich affected products such as Nvidia's H800 and A800 chips, threatens to stifle access to a huge and fast-growing market.

The company admitted that data center sales to China “fell significantly” in the January quarter due to restrictions, although other regions nonetheless contributed to strong growth in the unit.

“However, if Nvidia does not find a long-term workaround for the limitations, they may start to spill over into future growth,” Morgan said in an email comment ahead of Wednesday's report.

Nvidia executives said on the earnings call that the company has already begun shipping replacement chips to China that do not violate the restrictions. China represented a mid-single-digit percentage of total data center business in the fourth quarter and is expected to remain in a similar range in the current quarter, Chief Financial Officer Colette Kress said.

Despite China tensions, others on Wall Street believe the company still has plenty of room to run.

“The outlook for Nvidia is positive, as AI chip competition from Intel, AMD, Meta, and Microsoft may be months away while demand for Nvidia chips grows,” Gadjo Sevilla, a senior analyst at Insider Intelligence, said in a note earlier this week.

For now, the company says demand for its advanced AI chips continues to “exceed supply,” Chris said on a call on Wednesday. “Building and deploying AI solutions has reached almost every industry.”

Ensuring supply meets rising demand could be a challenge for the company as it heads into this year. However, Huang said, “The company's cycle times are improving… Overall, our supplies are increasing very well.”

The company said Wednesday that it expects revenue for the current quarter to reach about $24 billion, which represents a 233% increase from the same quarter last year and exceeds what Wall Street expected.

“Typical beer advocate. Future teen idol. Unapologetic tv practitioner. Music trailblazer.”

More Stories

JPMorgan expects the Fed to cut its benchmark interest rate by 100 basis points this year

NVDA Shares Drop After Earnings Beat Estimates

Shares of AI chip giant Nvidia fall despite record $30 billion in sales