The Detroit Three automakers are showing signs of moving toward union demands less than a week from the expiration date of existing contracts, UAW President Sean Fine said Friday.

His comments came hours after Stellantis NV, the maker of Jeep, presented its first economic counterproposal to union demands from last month that included a 14.5% wage increase. Fain also shared that Ford Motor Co. She made updates to her proposal, including introducing a cost-of-living wage adjustment, a shorter progression for higher wages and capping the use of temporary employees.

“I want to be clear: This is a movement,” Fine said during a Facebook Live broadcast. “We’ve gone from 9% to 14.5% at Stellantis. And that’s happening because we’re putting pressure on.

“But I want to be clear about something else too. A 14.5% increase over four years is woefully inadequate. It does not offset inflation, it does not offset decades of low wages, and it does not reverse that.” “The tremendous profits we have made for this company.”

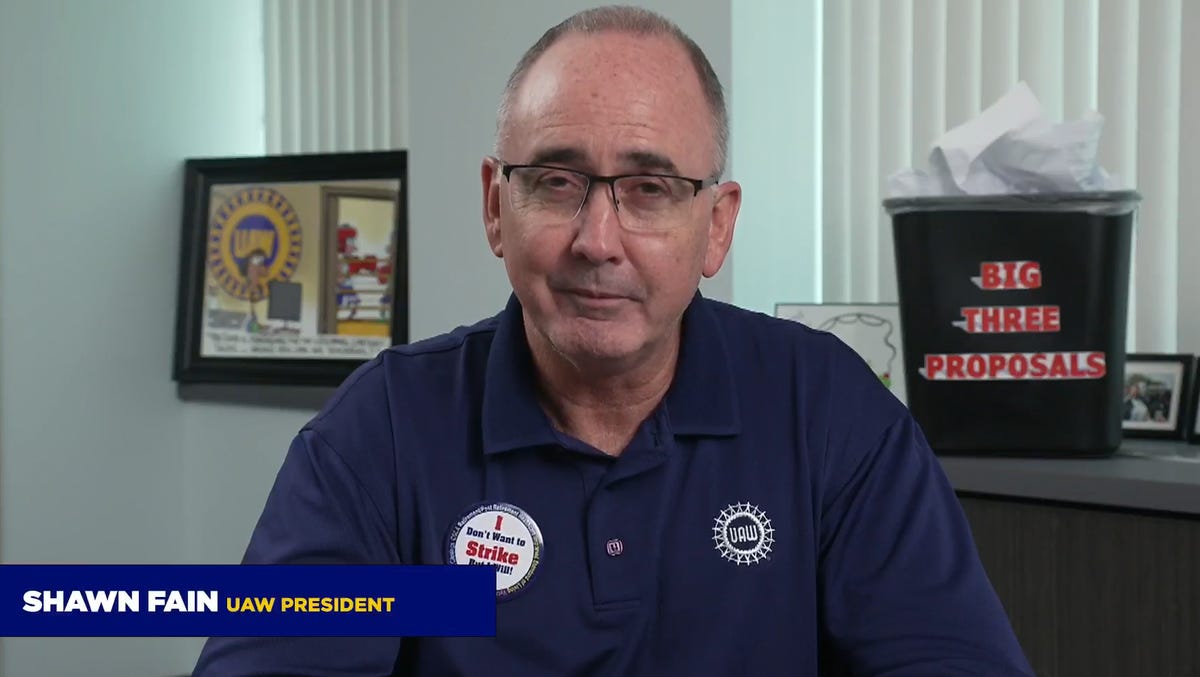

During his speech, Fine shook his head while wearing an “I don’t want to punch, but I will” button in front of an entire office trash can labeled “The Big Three Proposals.”

Stellantis’ pay increases are higher than the pay increases offered by its crosstown competitors. Last week, Ford Motor Co. offered a 9% pay increase, and General Motors on Thursday proposed a 10% increase. However, it is still a far cry from the 46% UAW increase I requested (40% without doubling).

Unlike GM and Ford counters, Stellantis does not include additional lump sum payments as part of its wage proposal. There are about 145,000 UAW members in Detroit 3, including about 43,000 in Stellantis.

Stellantis’ proposal would raise the maximum wage for production operators to about $36.37 an hour by the end of the new agreement, up from the current $31.77. Stellantis declined to provide details on when the increases would occur.

A post from the union also said that for salaried workers represented by the UAW, the proposal only offers lump sum payments and no wage increases.

“This is a responsible and strong proposition that allows us to continue to provide quality jobs for our employees today and into the next generation here in the United States,” Mark Stewart, Stellantis North America chief operating officer, said in an email to employees. Friday. “It also protects the company’s future ability to continue to compete globally in an industry that is rapidly transitioning to electric vehicles.”

Meanwhile, “COLA is back,” Fine said, announcing that Ford’s latest offer includes a cost-of-living wage adjustment. However, he also called the formula “grossly inadequate,” saying it would not provide any increases for 10 of the past 13 years, and is expected to add no increases over the next four years.

Ford’s original proposal included lump sum bonuses with an initial first-year payment of $6,000. Another $6,000 would have been distributed throughout the term of the contract. By incorporating an inflation adjustment into workers’ wages instead, the benefits have the potential to multiply.

The offers from Stellantis and GM looked similar to Ford’s first offer. Stellantis proposed a single payment of $6,000 for inflation protection in the first year and $4,500 in inflation protection payments over the last three years of the decade. GM offered an initial payment of $6,000 and another $5,000 over the life of the contract.

Ford also moved at the UAW’s request for a shorter timeline for advancement to the higher pay. Its latest proposal suggests five years instead of the current previous years. Its offer before that was six years ago – the same offer offered by General Motors and Stellantis. The union wants workers to receive top pay after only 90 days, as was the case until the mid-1990s.

At the same time, the companies rejected the union’s demand that all workers receive a pension and health care upon retirement.

The three companies proposed increasing the starting wage for temporary and additional employees to $20 an hour, up from $15.78 an hour at Stellantis. Ford’s latest bid includes an 8% cap for temporary employees, but Fine was critical that none of the proposals create a path for temporary employees to full-time jobs.

The union has also demanded more paid holidays, the right to strike in the event of a factory closure, and what it calls a Working Family Protection Program that would effectively restore what was known as a job bank where laid-off workers would get jobs. Paid to do community service.

Fine described an offer from Ford saying it would “unilaterally” allow the company to outsource work at any time. The Dearborn automaker also included two weeks of paternity leave; The company currently only offers maternity leave to hourly employees. Stellantis and GM have offered to make Juneteenth a paid holiday.

In a statement released earlier Friday, Ford spokeswoman Jessica Enoch said Blue Oval remains “committed to creating an opportunity for every UAW worker to build an outstanding career and become a permanent Ford employee with good middle-class wages and benefits.”

In a statement, GM spokesman David Parnas said: “Our offer was developed taking into account everything in our environment, including competitor offerings and what is important to our team members. It includes outstanding pay improvements that far exceed the 2019 agreement. We still have work to do.” We have to do it, but we will continue to bargain in good faith with the UAW and work toward an outcome that recognizes the vital role of our team members in GM’s success.

Marek Masters, a professor of management at Wayne State University, said the results still show there is a huge gap between the two parties that they must bridge in the coming days to avoid business disruption.

“They are still very far apart,” he said. “They will need an unexpected breakthrough to avoid a strike.”

On the surface, Linda Jackson, 36, of Detroit, a team leader at Stellantis’ Jefferson subsidiary, said a 14.5% pay increase for those making more than $37 an hour would be a positive outcome if combined with a cost-of-living wage adjustment. Northern Assembly Plant in Detroit and a 13-year UAW member. But given the employer’s proposal in late July that suggested workers share a greater portion of health care costs, she wants to see a more complete picture.

“The 14.5% increase doesn’t mean anything if we can’t see what you’re trying to get rid of,” she said.

She also wants to see workers like her get a pension like the workers before her, and for additional workers to have job security.

“I kind of feel like they got something together because of the unfair practice charge that the UAW laid on them. Like, ‘Hey, we offered them something.’ There wasn’t a lot of substance.”

With less than a week before the 11:59 p.m. expiration date Thursday, Stellantis is the last of the three Detroit automakers to submit its proposal after the UAW submitted its claim last month. Last week, the UAW filed unfair labor practices charges against Stellantis and GM with the National Labor Relations Board, because it has not yet received an economic counterproposal from those companies.

Fine said this week that the union would strike any companies it does not have a tentative agreement with by the time the current contract expires. He confirmed in the live broadcast that the union could strike the three if necessary.

The cost of this may be significant. Estimates from East Lansing-based Anderson Economic Group, a consulting firm that also deals with automakers, suggest that a 10-day strike at all three companies could represent a total loss of $5.6 billion to the economy.

CEO Patrick Anderson called a potential UAW strike by all three Detroit automakers a “very risky” proposition for the union. But with less than a week to go before the deadline, he wrote in a memo on Friday that the group believes a strike is likely against at least one of the companies.

“The difference between automakers and unions on wages is a gap that can be closed,” he wrote. “Differences related to non-wage demands are a gap, not a gap.” He believes non-wage demands, such as cost-of-living adjustment restoration and defined-benefit retirement plans, “increase the contract risk that creates a level of bankruptcy risk for automakers when a downturn occurs in the future.”

Tenth: @Brenna C. Noble

X: @JGrzelewski

“Typical beer advocate. Future teen idol. Unapologetic tv practitioner. Music trailblazer.”

More Stories

JPMorgan expects the Fed to cut its benchmark interest rate by 100 basis points this year

NVDA Shares Drop After Earnings Beat Estimates

Shares of AI chip giant Nvidia fall despite record $30 billion in sales