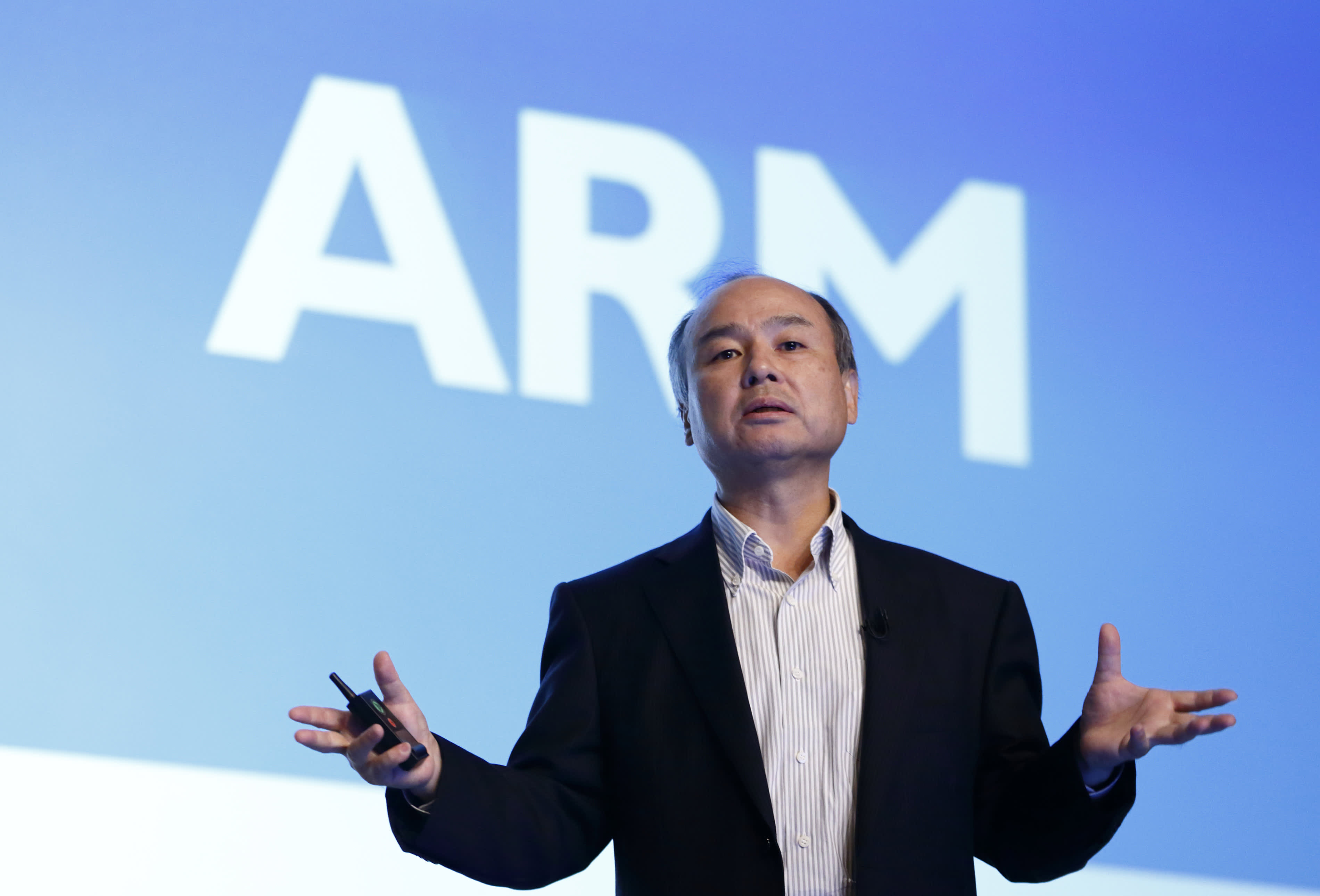

Billionaire Masayoshi Son, Chairman and CEO of SoftBank Group Corp. , speaks in front of a monitor displaying the ARM Holdings logo during a press conference in Tokyo on July 28, 2016.

Tomohiro Ohsumi | bloomberg | Getty Images

Arm said Saturday that SoftBank Group Corp.’s chip maker Arm has applied to regulators confidentially to list on the US stock market, paving the way for the year’s largest initial public offering.

The filing of the IPO shows that SoftBank is pushing ahead with the blockbuster offering despite adverse market conditions, after saying in March that it plans to list Arm on the US stock market.

U.S. IPOs, excluding listings of SPAs, have fallen about 22% to a total of just $2.35 billion since the start of the year, according to Dealogic, as stock market volatility and economic uncertainty dampened many IPO ambitions. .

People familiar with the matter said Arm plans to sell its shares on the Nasdaq later this year, as it seeks to raise between $8 billion and $10 billion. In a statement confirming an earlier Reuters report on the planned initial public offering, Arm said the size and price range of the offering had yet to be determined.

The sources warned that the exact timing and size of the IPO are subject to market conditions and asked not to be identified because it is a matter of confidentiality.

SoftBank and Arm declined to comment.

There are signs that the IPO market is starting to thaw. Johnson & Johnson is preparing to list consumer health firm Kenvue in New York next week, hoping to raise about $3.5 billion.

SoftBank has been targeting a listing for Arm since its $40 billion sale of the chip designer to Nvidia collapsed last year over objections from US and European antitrust regulators.

Since then, Arm’s business has outperformed the broader chip industry thanks to its focus on data center servers and PC hardware that generate higher royalty payments. The company said sales were up 28% in its most recent quarter.

Arm’s IPO is expected to boost the fortunes of SoftBank, which is struggling to turn around its giant Vision Fund, which has been hit by losses due to lower valuations of many of its holdings in tech startups.

Earlier this year, Arm rejected a campaign by the British government to list its shares in London and said it would continue to float on a US stock exchange.

Arm’s IPO preparations are being led by Goldman Sachs, JPMorgan Chase & Co, Barclays and Mizuho Financial Group.

“Typical beer advocate. Future teen idol. Unapologetic tv practitioner. Music trailblazer.”

More Stories

JPMorgan expects the Fed to cut its benchmark interest rate by 100 basis points this year

NVDA Shares Drop After Earnings Beat Estimates

Shares of AI chip giant Nvidia fall despite record $30 billion in sales