Posted: 3:57 AM PDT, April 25, 2024Tammy Slaton Proud to show her progress. the 1000 lb sisters The star took...

Astronomers celebrated the 34th anniversary of the Hubble Space Telescope by snapping an image of the Little Dumbbell Nebula, 3,400...

Jesse Rogers, ESPN staff writerApril 25, 2024 at 07:00 AM ETCloseJesse joined ESPN Chicago in September 2009 and covers MLB...

Game development is, in some ways, easier than ever before. Between the ease of use of engines like RPG Maker...

WASHINGTON (AP) — When Pres Joe Biden Show his status during a Campaign stop at a public golf course And...

One hundred Class 5 students of Ingres College recently participated in a play in English titled “King Arthur – Quest...

the Arsenal The lottery jackpot continues to grow after no one matched all six numbers drawn Monday night.Get your tickets...

Rich Polk/NBC via Getty Images Video footage of an accident that occurred on the set of an Eddie Murphy movie...

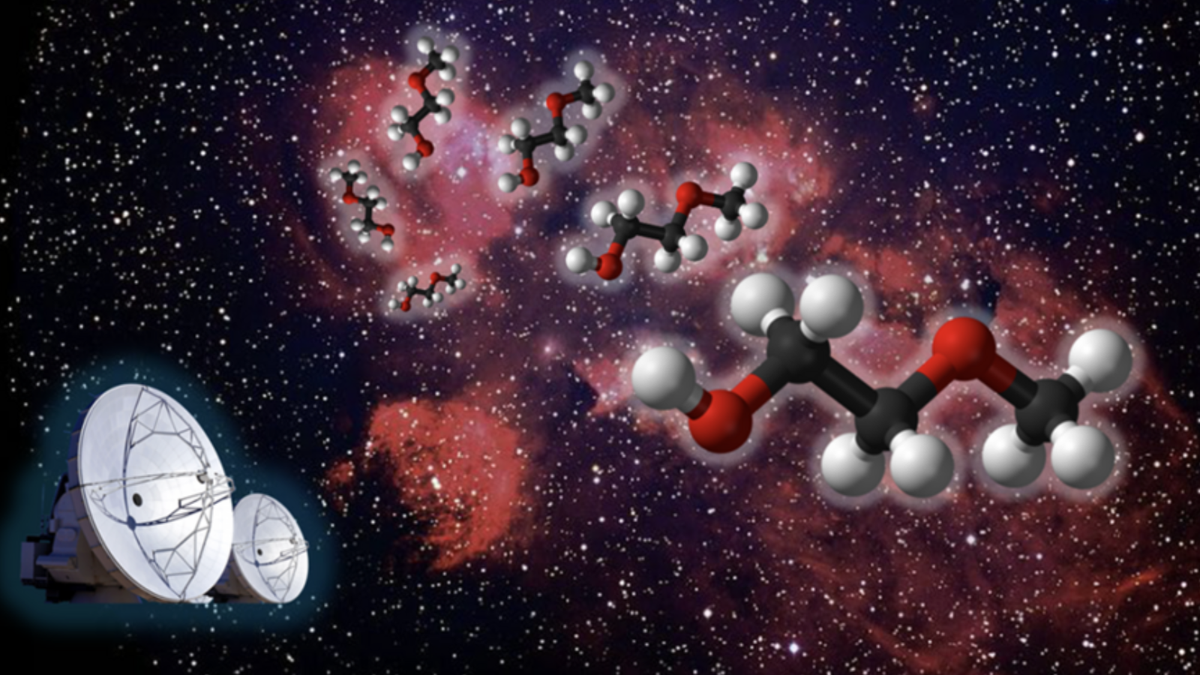

Scientists have discovered a hitherto unknown space particle while examining a region relatively close to condensed star birth, a cosmic...

It's good that Wednesday's press conference began with prayer.The Chicago Bears will likely need some divine intervention to pull off...