Washington CNN — House Speaker Mike Johnson announced on Wednesday that he is sticking to his plan to introduce a...

French Morning readers regularly submit to us their problems related to moving abroad. Twice a month, Vie d'Expat tries to...

DETROIT (AP) — Tesla is asking shareholders to take back a $56 billion pay package CEO Elon Musk Which was...

He watches: Ariana Grande's story Ariana Grande is proud of Nona. On Tuesday, the singer shared a photo on Instagram...

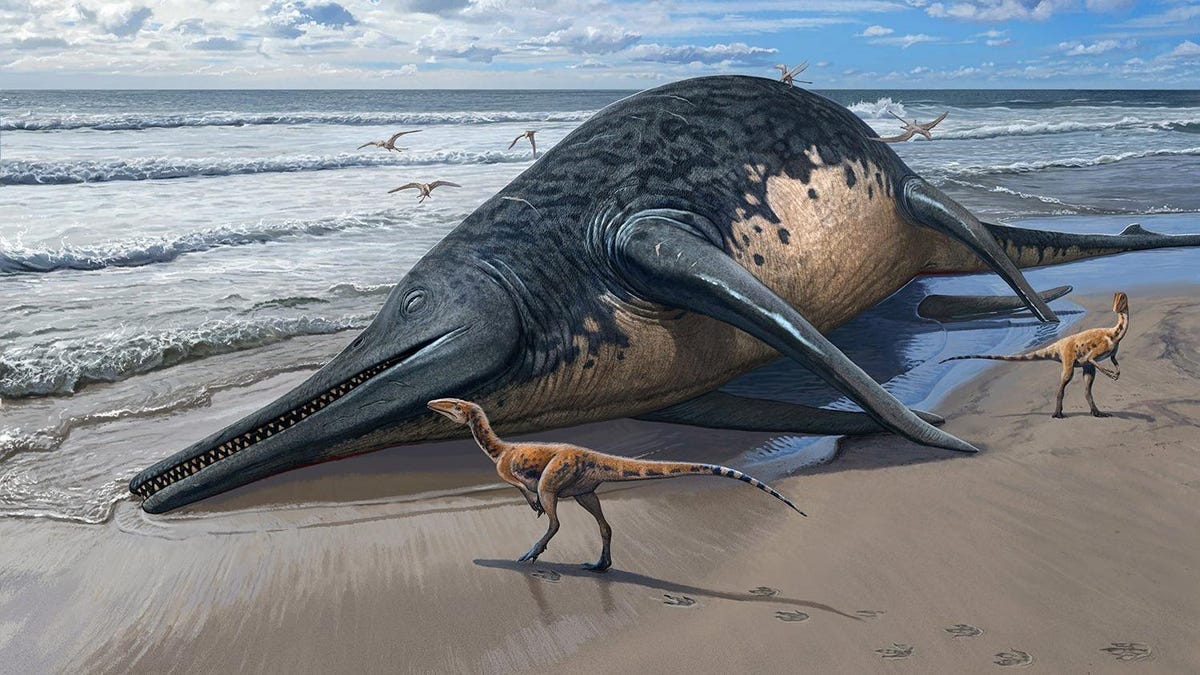

A jawbone found in Somerset, England, may belong to the largest marine reptile known to date, the massive ichthyosaur that...

Written by Shams Charania, Alex Andreev, and William GuilloryNew Orleans Pelicans star Zion Williamson will miss Friday's game against the...

Google is expected to introduce the new Pixel 8A at its I/O developers conference next month. This will likely be...

Record rainfall levels have brought cities in the UAE and Oman to a standstill, with at least 19 people killed...

Supervised by Léopold N'Guessan and Céline Oble-Morisset, English teachers at Gérard-Philipe de Chauvigny College, as well as Rémy Fournier, Élise...

Waterslide on Savannah, a 274-foot luxury hybrid yacht.Courtesy of Northrop & JohnsonA version of this article first appeared in CNBC's...

/cdn.vox-cdn.com/uploads/chorus_asset/file/24643387/DSC04630_processed.jpg)